ECI Telecom demos 100 Gigabit over 4,600km

- 4,600km optical transmission over submarine cable

- The Tera Santa Consortium, chaired by ECI, will show a 400 Gigabit/ 1 Terabit transceiver prototype in the summer

- 100 Gigabit direct-detection module on hold as the company eyes new technology developments

"When we started the project it was not clear whether the market would go for 400 Gig or 1 Terabit. Now it seems that the market will start with 400 Gig."

"When we started the project it was not clear whether the market would go for 400 Gig or 1 Terabit. Now it seems that the market will start with 400 Gig."

Jimmy Mizrahi, ECI Telecom

ECI Telecom has transmitted a 100 Gigabit signal over 4,600km without signal regeneration. Using Bezeq International's submarine cable between Israel and Italy, ECI sent the 100 Gigabit-per-second (Gbps) signal alongside live traffic. The Apollo optimised multi-layer transport (OMLT) platform was used, featuring a 5x7-inch MSA 100Gbps coherent module with soft-decision, forward error correction (SD-FEC).

"We set a target for the expected [optical] performance with our [module] partner and it was developed accordingly," says Jimmy Mizrahi, head of the optical networking line of business at ECI Telecom. "The [100Gbps] transceiver has superior performance; we have heard that from operators that have tested the module's capabilities and performance."

One geography that ECI serves is the former Soviet Union which has large-span networks and regions of older fibre.

Tera Santa Consortium

ECI used the Bezeq trial to also perform tests as part of the Tera Santa Consortium project involving Israeli optical companies and universities. The project is developing a transponder capable of 400 Gigabit and 1 Terabit rates. The project is funded by seven participating firms and the Israeli Government.

"When we started the project it was not clear whether the market would go for 400 Gig or 1 Terabit,” says Mizrahi. “Now it seems that the market will start with 400 Gig."

The Tera Santa Consortium expects to demonstrate a 1 Terabit prototype in August and is looking to extend the project a further three years.

100 Gigabit direct detection

In 2012 ECI announced it was working with chip company, MultiPhy, to develop a 100 Gigabit direct-detection module. The 100 Gigabit direct detection technology uses 4x28Gbps wavelengths and is a cheaper solution than 100Gbps coherent. The technology is aimed at short reach (up to 80km) links used to connect data centres, for example, and for metro applications.

“We have changed our priorities to speed up the [100Gbps] coherent solution,” says Mizrahi. “It [100Gbps direct detection] is still planned but has a lower priority.”

ECI says it is monitoring alternative technologies coming to market in the next year. “We are taking it slowly because we might jump to new technologies,” says Mizrahi. “The line cards will be ready, the decision will be whether to go for new technologies or for direct detection."

Mizrahi would not list the technologies but hinted they may enable cheaper coherent solutions. Such coherent modules would not need SD-FEC to meet the shorter reach, metro requirements. Such a module could also be pluggable, such as the CFP or even the CFP2, and use indium phosphide-based modulators.

“For certain customers pricing will always be the major issue,” says Mizrahi. “If you have a solution at half the price, they will take it.”

Cisco Systems' intelligent light

Network optimisation continues to exercise operators and content service providers as their requirements evolve with the growth of services such as cloud computing. Cisco Systems' announced elastic core architecture aims to tackle networking efficiency and address particular service provider requirements.

“The core [network] needs to be more robust, agile and programmable”

Sultan Dawood, Cisco

“The core [network] needs to be more robust, agile and programmable – especially with the advent of cloud,” says Sultan Dawood, senior manager, service provider marketing at Cisco. “As service providers look at next-generation infrastructure, convergence of IP and optical is going to have a big play.”

Cisco's elastic core architecture combines several developments. One is the integration of Cisco's 100 Gigabit-per-second (Gbps) dense wavelength division multiplexing (DWDM) coherent transponder, first introduced on its ROADM platform, onto its router to enable IP-over-DWDM.

This is part of what Cisco calls nLight – intelligent light - which itself has three components: its 100Gbps coherent ASIC hardware, the nLight control plane and nLight colourless and contentionless ROADMs. “As packet and optical networks converge, intelligence between the layers is needed,” says Dawood. “Today how the ROADM and the router communicate is limited."

There is the GMPLS [Generalized Multi-Protocol Label Switching] layer working at the IP layer, and WSON [Wavelength Switched Optical Layer] working at the optical layer. These two protocols are doing control plane functions at each of their respective layers. "What nLight is doing is communicating between these two layers [using existing parameters] and providing the interaction," says Dawood.

Ron Kline, principal analyst for network infrastructure at Ovum, describes nLight more generally as Cisco’s strategy for software-defined networking: "Interworking control planes to share info across platforms and add the dynamic capabilities."

The second component of Cisco's announcement is an upgrade of its carrier-grade services engine, from 20Gbps to 80Gbps, that fits within Cisco's CSR-3 core router and will be available from May 2013. The services engine enables such services as IPv6 and 'cloud routing' - network positioning which determines the most suitable resource for a customer’s request based on the content’s location and the data centre's loading.

Cisco has also added anti distributed denial of service (anti-DDoS) software to counter cyber threats. “We have licensed software that we have put into our CRS-3 so that with our VPN services we can provide threat mitigation and scrub any traffic liable to hurt our customers,” says Dawood.

nLight

According to Cisco, several issues need to be addressed between the IP and optical layers. For example, how the router and the optical infrastructure exchange information like circuit ID, path identifiers and real-time information in order to avoid the manual intervention used currently.

“With this intelligent data that is extracted due to these layers communicating, I can now make better, faster decisions that result in rapid service provisioning and service delivery,” says Dawood.

Cisco cites as an example a financial customer requesting a low-latency path. In this case, the optical network comes back through this nLight extraction process and highlights the most appropriate path. That path has a circuit ID that is assigned to the customer. If the customer then comes back to request a second identical circuit, the network can make use of the existing intelligence to deliver a similar-specification circuit.

Such a framework avoids lengthy, manual interactions between the IP and transport departments of an operator required when setting up an IP VPN, for example. By exchanging data between layers, service providers can understand and improve their network topology in real-time, and be more dynamic in how they shift resources and do capacity planning in their network.

Service providers can also improve their protection and restoration schemes and also how they configure and provision services. Such capabilities will enable operators to be more efficient in the introduction and delivery of cloud and mobile services.

Total cost of ownership

Market research firm ACG Research has done a total cost of ownership (TCO) analysis of Cisco's elastic core architecture. It claims using nLight achieves up to a halving of the TCO of the optical and packet core networks in designs using protected wavelengths. It also avoids a 10% overestimation of required capacity.

Meanwhile, ACG claims an 18-month payback and 156% return on investment from a CRS CGSE service module with its anti‐DDoS service, and a 24% TCO savings from demand engineering with the improved placement of routes and cloud service workload location.

Cisco says its designed framework architecture is being promoted in the Internet Engineering Task Force (IETF). The company is also liaising with the International Telecommunication Union (ITU) and the Optical Internetworking Forum (OIF) where relevant.

60-second interview with .... Dell'Oro's Jimmy Yu

"For the year, it is going to be a fivefold growth rate [for 100 Gig transport]."

Jimmy Yu, Dell'Oro

Q: That fact that the market is down 5 percent on a year ago. Why is this?

A: There are a few factors. First, the macro-economy in Europe continues to get worse; that causes a slowdown.

A second factor is that in North America there was a decline in the second quarter, which is pretty unusual. Part of it, we think, might be that operators have caught up with a lot of the spending to increase broadband, after adding [to the network] for a couple of good years.

The third issue is that the China market has had a really slow start. And while there has been talk about the Chinese market softening, it seems that the CapEx [capital expenditure] is there for a strong second half.

What categories does Dell'Oro include when it talks about optical transport?

There are two main pieces: WDM [wavelength division multiplexing], both metro and long haul, and the multi-service multiplexer used for aggregation. The third piece, which is really small, is optical switching - optical cross-connect used in the core and lately more so in the metro.

According to Dell'Oro, wavelength division multiplexing was up 5 percent in the first half of 2012 compared to the same period a year ago, due to demand for 40 Gig and 100 Gig. What is happening in these two markets?

At 100 Gig we are at an inflection point where demand growth rates are really high. We've got a doubling in demand and shipments quarter-on-quarter [in the second quarter]. For the year, it is going to be a fivefold growth rate.

Also the 40 Gig is still growing. It has been around for a few years so its growth rate is not as strong [as 100 Gig transport] but it is still a significant part of the market.

Has the market settled on particular modulation scheme, especially at 40 Gig?

For 100 Gig the majority [deployed] is coherent. There is one company at least, ADVA Optical Networking, which is coming out with its direct-detection scheme for 100 Gig. This has now been shipping for one quarter. There is a market for the price point and the lower-span link of direct-detection.

For 40 Gig there is still a mix of modulations. Vendors coming out with 100 Gig coherent are also coming out with 40 Gig coherent options. So coherent at 40 Gig is now approaching half of the total market and is happening pretty quickly.

As for [40 Gig] DQPSK [differential quadrature phase-shift keying] modulation, it is probably a little bit more than DPSK [differential phase-shift keying].

You also report a rise in the adoption of optical packet products and that it contributed close to one-third of the optical market revenues in the first half 2012. Why is that?

The optical packet platform is a wider definition than just packet optical transport systems (P-OTS).

One reason why optical packet is growing is that with traditional P-OTS, you have cross-connect and switching capabilities in a WDM system so as you go to higher 40 and 100 Gig wavelengths you want some bandwidth management in that system.

Another thing is that people are trying to make the aggregation layer - the traditional SONET/SDH - more Ethernet friendly and MPLS-TP [multiprotocol label switching, transport profile] is gaining traction.

Combined, we are seeing this optical packet market has grown 12 percent year-on-year in the second quarter whereas the overall market has declined.

Dell'Oro said Huawei has 20 percent market share, which other vendors have double-digit market share?

Besides Huawei, the other vendors with double-digit percentage for the quarter - in order - are ZTE, Alcatel-Lucent and Ciena.

Did you see anything in this latest study that was surprising?

There was nothing in this quarter but I saw it last quarter. The legacy equipment – traditional SONET/SDH – is declining. Most of the market decline for optical is in legacy.

SONET/SDH sales in the second quarter of 2012 declined by 20 percent year-on-year. It is finally happening: the market is shifting away from SONET/SDH.

OFC/NFOEC 2012 industry reflections - Part 1

The recent OFC/NFOEC show, held in Los Angeles, had a strong vendor presence. Gazettabyte spoke with Infinera's Dave Welch, chief strategy officer and executive vice president, about his impressions of the show, capacity challenges facing the industry, and the importance of the company's photonic integrated circuit technology in light of recent competitor announcements.

OFC/NFOEC reflections: Part 1

"I need as much fibre capacity as I can get, but I also need reach"

Dave Welch, Infinera

Dave Welch values shows such as OFC/NFOEC: "I view the show's benefit as everyone getting together in one place and hearing the same chatter." This helps identify areas of consensus and subjects where there is less agreement.

And while there were no significant surprises at the show, it did highlight several shifts in how the network is evolving, he says.

"The first [shift] is the realisation that the layers are going to physically converge; the architectural layers may still exist but they are going to sit within a box as opposed to multiple boxes," says Welch.

The implementation of this started with the convergence of the Optical Transport Network (OTN) and dense wavelength division multiplexing (DWDM) layers, and the efficiencies that brings to the network.

That is a big deal, says Welch.

Optical designers have long been making transponders for optical transport. But now the transponder isn't an element in the integrated OTN-DWDM layer, rather it is the transceiver. "Even that subtlety means quite a bit," say Welch. "It means that my metrics are no longer 'gray optics in, long-haul optics out', it is 'switch-fabric to fibre'."

Infinera has its own OTN-DWDM platform convergence with the DTN-X platform, and the trend was reaffirmed at the show by the likes of Huawei and Ciena, says Welch: "Everyone is talking about that integration."

The second layer integration stage involves multi-protocol label switching (MPLS). Instead of transponder point-to-point technology, what is being considered is a common platform with an optical management layer, an OTN layer and, in future, an MPLS layer.

"The drive for that box is that you can't continue to scale the network in terms of bandwidth, power and cost by taking each layer as a silo and reducing it down," says Welch. "You have to gain benefits across silos for the scaling to keep up with bandwidth and economic demands."

Super-channels

Optical transport has always been about increasing the data rates carried over wavelengths. At 100 Gigabit-per-second (Gbps), however, companies now use one or two wavelengths - carriers - onto which data is encoded. As vendors look to the next generation of line-side optical transport, what follows 100Gbps, the use of multiple carriers - super-channels - will continue and this was another show trend.

Infinera's technology uses a 500Gbps super-channel based on dual polarisation, quadrature phase-shift keying (DP-QPSK). The company's transmit and receive photonic integrated circuit pair comprise 10 wavelengths (two 50Gbps carriers per 50GHz band).

Ciena and Alcatel-Lucent detailed their next-generation ASICs at OFC. These chips, to appear later this year, include higher-order modulation schemes such as 16-QAM (quadrature amplitude modulation) which can be carried over multiple wavelengths. Going from DP-QPSK to 16-QAM doubles the data rate of a carrier from 100Gbps to 200Gbps, using two carriers each at 16-QAM, enables the two vendors to deliver 400Gbps.

"The concept of this all having to sit on one wavelength is going by the wayside," say Welch.

Capacity challenges

"Over the next five years there are some difficult trends we are going to have to deal with, where there aren't technical solutions," says Welch.

The industry is already talking about fibre capacities of 24 Terabit using coherent technology. Greater capacity is also starting to be traded with reach. "A lot of the higher QAM rate coherent doesn't go very far," says Welch. "16-QAM in true applications is probably a 500km technology."

This is new for the industry. In the past a 10Gbps service could be scaled to 800 Gigabit system using 80 DWDM wavelengths. The same applies to 100Gbps which scales to 8 Terabit.

"I'm used to having high-capacity services and I'm used to having 80 of them, maybe 50 of them," says Welch. "When I get to a Terabit service - not that far out - we haven't come up with a technology that allows the fibre plant to go to 50-100 Terabit."

This issue is already leading to fundamental research looking at techniques to boost the capacity of fibre.

PICs

However, in the shorter term, the smarts to enable high-speed transmission and higher capacity over the fibre are coming from the next-generation DSP-ASICs.

Is Infinera's monolithic integration expertise, with its 500 Gigabit PIC, becoming a less important element of system design?

"PICs have a greater differentiation now than they did then," says Welch.

Unlike Infinera's 500Gbps super-channel, the recently announced ASICs use two carriers and 16-QAM to deliver 400Gbps. But the issue is the reach that can be achieved with 16-QAM: "The difference is 16-QAM doesn't satisfy any long-haul applications," says Welch.

Infinera argues that a fairer comparison with its 500Gbps PIC is dual-carrier QPSK, each carrier at 100Gbps. Once the ASIC and optics deliver 400Gbps using 16-QAM, it is no longer a valid comparison because of reach, he says.

Three parameters must be considered here, says Welch: dollars/Gigabit, reach and fibre capacity. "I have to satisfy all three for my application," he says.

Long-haul operators are extremely sensitive to fibre capacity. "I need as much fibre capacity as I can get," he says. "But I also need reach."

In data centre applications, for example, reach is becoming an issue. "For the data centre there are fewer on and off ramps and I need to ship truly massive amounts of data from one end of the country to the other, or one end of Europe to the other."

The lower reach of 16-QAM is suited to the metro but Welch argues that is one segment that doesn't need the highest capacity but rather lower cost. Here 16-QAM does reduce cost by delivering more bandwidth from the same hardware.

Meanwhile, Infinera is working on its next-generation PIC that will deliver a Terabit super-channel using DP-QPSK, says Welch. The PIC and the accompanying next-generation ASIC will likely appear in the next two years.

Such a 1 Terabit PIC will reduce the cost of optics further but it remains to be seen how Infinera will increase the overall fibre capacity beyond its current 80x100Gbps. The integrated PIC will double the 100Gbps wavelengths that will make up the super-channel, increasing the long-haul line card density and benefiting the dollars/ Gigabit and reach metrics.

In part two, ADVA Optical Networking, Ciena, Cisco Systems and market research firm Ovum reflect on OFC/NFOEC. Click here

Dan Sadot on coherent's role in the metro and the data centre

Gazettabyte went to visit Professor Dan Sadot, academic, entrepreneur and founder of chip start-up MultiPhy, to discuss his involvement in start-ups, his research interests and why he believes coherent technology will not only play an important role in the metro but also the data centre.

"Moore's Law is probably the most dangerous enemy of optics"

Professor Dan Sadot

The Ben-Gurion University campus in Beer-Sheba, Israel, is a mixture of brightly lit, sharp-edged glass-fronted buildings and decades-old Palm trees.

The first thing you notice on entering Dan Sadot's office is its tidiness; a paperless desk on which sits a MacBook Air. "For reading maybe the iPad could be better but I prefer a single device on which I can do everything," says Sadot, hinting at a need to be organised, unsurprising given his dual role as CTO of MultiPhy and chairman of Ben-Gurion University's Electrical and Computer Engineering Department.

The department, ranked in the country's top three, is multi-disciplinary. Just within the Electrical and Electronics Department there are eight tracks including signal processing, traditional communications and electro-optics. "That [system-oriented nature] is what gives you a clear advantage compared to experts in just optics," he says.

The same applies to optical companies: there are companies specialising in optics and ASIC companies that are expert in algorithms, but few have both. "Those that do are the giants: [Alcatel-Lucent's] Bell Labs, Nortel, Ciena," says Sadot. "But their business models don't necessarily fit that of start-ups so there is an opportunity here."

MultiPhy

MultiPhy is a fabless start-up that specialises in high-speed digital signal processing-based chips for optical transmission. In particular it is developing 100Gbps ICs for direct detection and coherent.

Sadot cites a rule of thumb that he adheres to religiously: "Everything you can do electronically, do not do optically. And vice versa: do optically only the things you can't do electronically." This is because using optics turns out to be more expensive.

And it is this that MultiPhy wants to exploit by being an ASIC-only company with specialist knowledge of the algorithms required for optical transmission.

"Electronics is catching up," says Sadot. "Moore's Law is probably the most dangerous enemy of optics."

Ben-Gurion University Source: Gazettabyte

Ben-Gurion University Source: Gazettabyte

Direct detection

Not only have developments in electronics made coherent transmission possible but also advances in hardware. For coherent, accurate retrieval of phase information is needed and that was not possible with available hardware until recently. In particular the phase noise of lasers was too high, says Sadot. Now optics is enabling coherent, and the issues that arise with coherent transmission can be solved electronically using DSP.

MultiPhy has entered the market with its MP1100Q chip for 100Gbps direct detection. According to Sadot, 100Gbps is the boundary data rate between direct detection and coherent. Below 100Gbps coherent is not really needed, he says, even though some operators are using the technology for superior long-haul optical transmission performance at 40Gbps.

"Beyond 100 Gig you need the spectral efficiency, you need to do denser [data] constellations so you must have coherent," says Sadot. "You are also much more vulnerable to distortions such as chromatic dispersion and you must have the coherent capability to do that."

But at 100 Gig the two - coherent and direct detection - will co-exist.

MultiPhy's first device runs the maximum likelihood sequence estimation (MLSE) algorithm that is used to counter fibre transmission distortions. "MLSE offers the best possible theoretical solution on a statistical basis without retrieving the exact phase," says Sadot. "That is the maximum you can squeeze out of direct detection."

The MLSE algorithm benefits optical performance by extending the link's reach while allowing lower cost, reduced-bandwidth optical components to be used. MultiPhy claims 4x10Gbps can be used for the transmit and the receive path to implement the 4x28Gbps (100Gbps) design.

Sadot describes MLSE as a safety net in its ability to handle transmitter and/or receiver imperfections. "We have shown that performance is almost identical with a high quality transmitter and a lower quality transmitter; MLSE is an important addition." he says.

Ben-Gurion University Source: Gazettabyte

Ben-Gurion University Source: Gazettabyte

Coherent metro

System vendors such as Ciena and Alcatel-Lucent have recently announced their latest generation coherent ASICs designed to deliver long-haul transmission performance. But this, argues Sadot, is overkill for most applications when ultra-long haul is not needed: metro alone accounts for 75% of all the line side ports.

He also says that the power consumption of long-haul solutions is over 3x what is required for metro: 75W versus the CFP pluggable module's 24W. This means the power available solely for the ASIC would be 15W.

"This is not fine-tuning; you really need to design the [coherent metro ASIC] from scratch," says Sadot. "This is what we are doing."

To achieve this, MultiPhy has developed patents that involve “sub-Nyquist” sampling. This allows the analogue-to-digital converters and the DSP to operate at half the sampling rate, saving power. To use sub-Nyquist sampling, a low-pass anti-aliasing filter is applied but this harms the received signal. Using the filter, sampling at half the rate can occur and using the MLSE algorithm, the effects of the low-pass filtering can be countered. And because of the low pass filtering, reduced bandwidth opto-electronics can be used which reduces cost.

The result is a low power, cost-conscious design suited for metro networks.

Coherent elsewhere

Next-generation PON is also a likely user of coherent technology for such schemes as ultra-dense WDM-PON.

Sadot believes coherent will also find its way into the data centre. "Again you will have to optimise the technology to fit the environment - you will not find an over-design here," he says.

Why would coherent, a technology associated with metro and long-haul, be needed in the data centre?

"Even though there is the 10x10 MSA, eventually you will be limited by spectral efficiency," he says. Although there is a tremendous amount of fibre in the data centre, there will be a need to use this resource to the maximum. "Here it will be all about spectral efficiency, not reach and optical signal-to-noise," says Sadot.

Sadot's start-ups

Sadot had a research posting at the optical communications lab at Stanford University. The inter-disciplinary and systems-oriented nature of the lab was an influence on Sadot when he founded the optical communications lab at Ben-Gurion University around the time of the optical boom. "A pleasant time to come up with ideas," is how he describes that period - 1999-2000.

The lab's research focus is split between optical and signal processing topics. Work there resulted in two start-ups during the optical bubble which Sadot was involved in: Xlight Photonics and TeraCross.

Xlight focused on ultra-fast lasers as part of a tunable transponder. Xlight eventually merged with another Israeli start-up Civcom, which in turn was acquired by Padtek.

The second start-up, TeraCross, looked at scheduling issues to improve throughput in Terabit routers. "The start-up led to a reference design that was plugged into routers in Cisco's Labs in Santa Clara [California]," says Sadot. "It was the first time a scheduler showed the capability to support a one Terabit data stream, and route in a sophisticated, global manner."

But with the downturn of the market, the need for terabit routers disappeared and the company folded.

Sadot's third and latest start-up, MultiPhy, also has its origins in Ben-Gurion's optical communications lab's work on enabling system upgrades without adding to system cost.

MultiPhy started as a PON company looking at how to upgrade GPON and EPON to 10 Gigabit PON without changing the hardware. "The magic was to use previous-generation hardware which introduces distortion as it doesn't really fit this upgrade speed, and then to compensate by signal processing," says Sadot.

After several rounds of venture funding the company shifted its focus from PON, applying the concept to 100 Gigabit optical transmission instead.

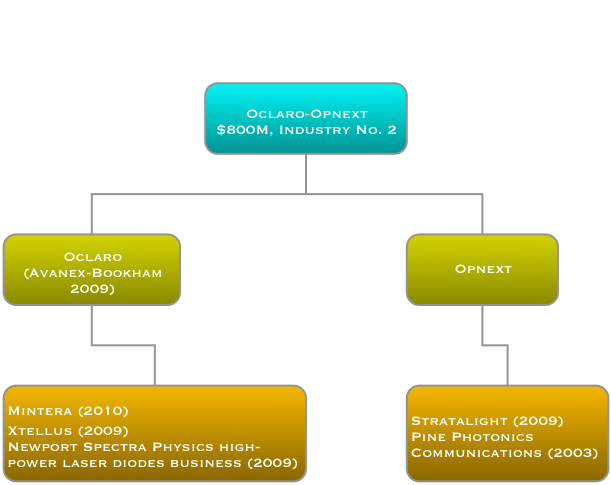

Oclaro-Opnext merger will create second largest optical component company

Oclaro has announced its plan to merge with Opnext. The deal, valued at US $177M, will result in Opnext's shareholders owning 42% of the combined company. The merger of the fifth and sixth largest optical component players, according to Ovum, will create a company with annual revenues of $800M, second only to Finisar. The deal is expected to be completed in the next 3-6 months.

Source: Gazettabyte

Source: Gazettabyte

Other details of the merger include:

- Combining the two companies will save between $35M-45M but will take 18 months to achieve.

- Restructuring and system integration will cost $20M-$30M.

- All five of the new company's fabs will be kept. The fabs are viewed as key assets.

- The new company will continue its use of contract manufacturers in Asia. Oclaro announced a recent deal with Venture, and that included the possibility of an Oclaro-Opnext merger.

- Oclaro's CEO, Alain Couder, will become the CEO of the new company. Harry Bosco, Opnext's CEO, will join the company's board of directors, made up of six Oclaro and four Opnext members.

- In 4Q 2011, Oclaro reported three customers, each accounting for greater than 10% sales: Fujitsu, Infinera and Ciena. Opnext reported 43% of its sales to Cisco Systems and Hitachi in the same period.

Industry scale

The motivation for the merger is to achieve industry scale, says Oclaro. "We have never been shy [of mergers and acquisitions] - we did Avanex and Bookham," says Yves LeMaitre, chief marketing officer for Oclaro. "We believe industry scale allows you to absorb certain fixed costs like fab infrastructure and the sales force." Scale also increases the absolute amount that can be invested in R&D, estimated at 12-13% of its revenues.

"It [the acquisition] is really about building a company that directly competes with Finisar," says Daryl Inniss, practice leader, components at Ovum. "It creates a stronger, vertically integrated company that starts at chips and goes all the way to the line card."

"We will be one of the most vertically integrated suppliers for 100 Gigabit coherent technology"

Mike Chan, Opnext

LightCounting believes the Oclaro-Opnext merger will be a success. Moreover, the market research firm expects further optical component M&As. Since the Oclaro-Opnext was announced, Sumitomo Electric Device Innovations has announced it will acquire Emcore's VCSEL and associated transceiver technology for $17M.

Meanwhile, Morgan Stanley Research is less positive about the merger, believing that the Opnext acquisition carries 'material risk'. It argues that the stated synergies are aggressive and that the integration of the two firms could distract Oclaro and lower its share price.

Products and technology

The deal expands Oclaro's transceiver portfolio, enhancing its offerings in telecom and strengthening its presence in datacom. It also expands the customer base: Opnext supplies Juniper, Google and H-P, new customers for Oclaro.

Common products shared by the two firms are limited, for high-end products the overlap is mainly 100 Gigabit coherent and tunable laser XFPs. LightCounting also points out that the two share some legacy SONET/SDH, WDM and Ethernet products: "Nothing that reduces competition significantly," it says in a research note.

"[With the Avanex-Bookham merger] There was a little bit of overlap in a few areas which we managed," says Oclaro's LeMaitre. "It is even easier in this case."

"We see potential, further down the road, for new very-short-reach optical interfaces"

Yves LeMaitre, Oclaro

Opnext acquired optical transmission subsystem vendor StrataLight in 2009 while Oclaro acquired Mintera in 2010. Both Oclaro and Opnext have used the expertise of the two subsystem vendors to become early market entrants of 100 Gigabit 168-pin multi-source modules.

But Oclaro makes the optical components for the modules - tunable lasers, lithium niobate modulators and integrated coherent transceivers - items that Opnext has to buy for its 100 Gig coherent module, says Ovum's Inniss: "Opnext has built decent gross margins when you consider that a lot of the optics they don't own themselves.” Oclaro's components will be used within Opnext's modules.

"We will be one of the most vertically integrated suppliers for key 100 Gigabit coherent technology moving forward," says Mike Chan, executive vice president of business development and marketing at Opnext.

Opnext stresses that it has its own programmes for integrated photonics. "We have been telling our customers that we have been working on some of these integrated photonics [for 100G coherent]," says Chan. "The StrataLight portion of Opnext also has a lot of work done, and IP created, in the coherent modem area."

Currently both companies' 100 Gigabit modules use NEL's coherent receiver DSP-ASIC. Oclaro has also made an investment in coherent chip start-up, ClariPhy. But for future coherent adaptive-rate designs, the joint company will be able to develop its own coherent chip. "We have the in-house know-how for the coherent modem chip," says Chan.

The merged company is well positioned to address client-side 100 Gigabit-ber-second (Gbps) transceivers. "Here the challenge is to achieve high density and low power [interfaces]," says Chan. Oclaro has VCSEL technology that can be used for very short reach 4x28Gbps arrays. Oclaro says it is the world's leading supplier of VCSELs for a variety of commercial applications and has now shipped over 150M units.

At OFC/NFOEC Opnext demonstrated a 1310nm LISEL (Lens-integrated Surface-Emitting distributed feedback Laser) array operating at 25-40Gbps. The surface-emitting distributed feedback (DFB) laser can also be used for the same 4x28Gbps design, says Chan. "Within the data centre 500m is the sweet-spot," says Chan. "It is not just the physical distance but the link-budget as the signal may have to go through a patch panel." The DFB can be used with multi-mode and single-mode fibre and Opnext believes it can achieve a 1km reach.

Oclaro does not rule out using its VCSEL technology to address such applications as optical engines, connecting racks and for backplanes. "We see potential, further down the road, for new very-short-reach optical interfaces into consumer, backplane, and board-to-board to really expand our addressable market," says LeMaitre

Further mergers

LightCounting argues that the 2011 floods in Thailand have added urgency to industry consolidation, with the Oclaro and Opnext merger being the first of several. Oclaro and Opnext were among the most impacted by the flood with Q4 2011 revenues being down 18% and 38%, respectively, says LightCounting.

Ovum also expects further mergers as companies strengthen their coherent and ROADM technologies.

Inniss believes ROADMs is the next area that Oclaro is likely to strengthen. Oclaro has acquired Xtellus but Ovum says the main ROADM leaders are Finisar, JDS Uniphase and CoAdna. Companies to watch include JDS Uniphase, Fujitsu Optical Components, CoAdna and Sumitomo, says Inniss.

A day after Ovum's and LightCounting's M&A comments, Sumitomo announced the acquisition of Emcore's VCSEL business unit.

100 Gigabit direct detection gains wider backing

More vendors are coming to market with 100 Gigabit direct detection products for metro and private networks.

The emergence of a second de-facto 100 Gigabit standard, a complement to 100 Gigabit coherent, has gained credence with 4x28 Gigabit-per-second (Gbps) direct detection announcements from Finisar and Oclaro, as well as backing from system vendor, ECI Telecom.

"We believe that in some cases operators will prefer to go with this technology instead of coherent"

Shai Stein, CTO, ECI Telecom

ECI Telecom and chip vendor MultiPhy announced at OFC/NFOEC that they have been collaborating to develop a 168-pin MSA, 5x7-inch 100 Gigabit-per-second (Gbps) direct detection module. Finisar and Oclaro used the show held in Los Angeles to announce their market entry with 100Gbps direct detection CFP pluggable optical modules.

Late last year ADVA Optical Networking announced the industry's first 100Gbps direct detection product. At the same time, MultiPhy detailed its MP1100Q receiver chip designed for 100Gbps direct detection.

According to ECI, by having the 168-pin MSA interface, one line card can support a 100Gbps coherent transponder or the 100Gbps direct detection. "This is important as it enables us to fit the technology and price to the needs of end customers," says Shai Stern, CTO of ECI Telecom.

100 Gigabit transmission

Coherent technology has become the de-facto standard for 100Gbps long-haul transmission. Using dense wavelength division multiplexing (DWDM), system vendors can achieve 1,500km and greater reaches using a 50GHz channel.

But coherent designs are relatively costly and 100Gbps direct detection offers a cost-conscious alternative for metro networks and for linking data centres, achieving a reach of up to 800km.

"It [100 Gig direct detection] provides needed performance at an attractive cost, in particular when you are looking at private optical networks," says Per Hansen, vice president of product marketing, optical networks solutions at Oclaro.

Such networks need not be owned by private enterprises, they can belong to operators, says Hansen, but they are typically simple point-to-point connections or 3- to 4-node rings serving enterprises. "Bonding adjacent [4x28Gbps] wavelengths to create a 100Gbps channel that connects efficiently to your [IP] router is very attractive in such networks," says Hansen.

For more complex mesh metro networks, coherent is more attractive. "Simply because of the spectral resources being taken up through the mesh [with 4x28Gbps], and the operational aspect of routeing that," says Hansen.

ECI Telecom says that it has yet to decide whether it will adopt 100Gbps direct detection. But it does see a role for the technology in the metro since the 100Gbps technology works well alongside networks with 10 and 40 Gigabit on-off keying (OOK) channels. "We believe that in some cases operators will prefer to go with this technology instead of coherent," says Stein.

Some operators have chosen to deploy coherent over new overlay networks, to avoid the non-linear transmission effects that result from mixing old and new technologies on the one network. "With this technology, operators can stay with their existing networks yet benefit from 100 Gig high capacity links," says Stein.

Finisar says 100Gbps direct detection is also suited to low-latency applications. "The fact that it is not coherent means it doesn't include a DSP chip, enabling it to be used for low latency applications," says Rafik Ward, vice president of marketing at Finisar.

Implementation

The announced 100Gbps direct detection designs all use 4x28Gbps channels and optical duo-binary (ODB) modulation, although MultiPhy also promotes an 80km point-to-point OOK version (see Table).

Source: Gazettabyte

Source: Gazettabyte

The module input is a 10x10Gbps electrical interface: a CFP interface or the 168-pin line side MSA. A 'gearbox' IC is used to translate between the 10x10Gbps electrical interface and the four 28Gbps channels feeding the optics.

"There are a few suppliers that are offering that [gearbox IC]," says Robert Blum, director of product marketing for Oclaro's photonic components. AppliedMicro recently announced a duplex multiplexer-demultiplexer IC.

MultiPhy's receiver chip has a digital signal processor (DSP) that implements the maximum likelihood sequence estimation (MLSE) algorithm, which is says enables 10 Gig opto-electronics to be used for each channel. The result is a 100Gbps module based on the cost of 4x10Gbps optics. However, over-driving the 10Gbps opto-electronics creates inter-symbol interference, where the energy of a transmitted bit leaks into neighbouring signals. MultiPhy's DSP using MLSE counters the inter-symbol interference.

100G direct detection module showing MultiPhy's MP1100Q chip. Source: MultiPhy

100G direct detection module showing MultiPhy's MP1100Q chip. Source: MultiPhy

Oclaro and Finisar claim that using ODB alone enables the use of lower-speed opto-electronics. "This is irrespective of whether you use MLSE or hard decision," says Blum. "The advantage of using optical duo-binary modulation is that you can use 10G-type optics."

Finisar's Ward points out that by using ODB, the 100Gbps direct-detection module avoids the price/ power penalty associated with a receiver DSP running MLSE to compensate for sub-optimal optical components.

Oclaro, however, has not ruled out using MLSE in future. The company endorsed MultiPhy's MLSE device when the product was first announced but its first 100G transceiver is not using the IC.

Finisar and Oclaro's modules require 200GHz to transmit the 100Gbps signal: 4x50GHz channels, each carrying the 28Gbps signal. "This architecture will enable 2.5x the spectral efficiency of tunable XFPs," says Ward. Using XFPs, ten would be needed for a 100Gbps throughput, each channel requiring 50GHz or 500GHz in total.

MultiPhy claims that it can implement the 100Gbps in a 100GHz channel, 5x the efficiency but still twice the spectrum used for 100Gbps coherent.

Finisar demonstrated its 100Gbps CFP module with SpectraWave, a 1 rack unit (1U) DWDM transport chassis, at OFC/NFOEC. "It provides all the things you need in line to enable a metro Ethernet link: an optical multiplexer and demultiplexer, amplification and dispersion compensation," says Ward. Up to four CFPs can be plugged into the SpectraWave unit.

Operator interest

In a recent survey published by Infonetics Research, operators had yet to show interest in 100Gbps direct detection. Infonetics attributed the finding to the technology still being unavailable and that operators hadn't yet assessed its merits.

"Operators are aware of this technology," says ECI's Stein. "It is true they are waiting to get a proof-of-concept and to test it in their networks and see the value they can get.

"That is why ECI has not yet decided to go for a generally-available product: we will deliver to potential customers, get their feedback and then take a decision regarding a commercial product," says Stein.

However MultiPhy claims that this is the first technology that enables 100Gbps in a pluggable module to achieve a reach beyond 40km. That fact coupled with the technology's unmatched cost-performance is what is getting the interest. "Every time you show a potential user some way they can save on cost, they are interested," says Neal Neslusan, vice president of sales and marketing at MultiPhy.

Direct detection roadmap

Recent announcements by Cisco Systems, Ciena, Alcatel-Lucent and Huawei highlight how the system vendors will use advanced modulation and super-channels to evolve coherent to speeds beyond 100Gbps. Does direct detection have a similar roadmap?

"I don't think that this on-off keying technology is coming instead of coherent," says Stein. "Once we move to super-channel and the spectral densities it can achieve, coherent technology is a must and will be used." But for 40Gbps and 100Gbps, what ECI calls intermediate rates, direct detection extends the life of OOK and existing network infrastructure.

ECI and MultiPhy are members of the Tera Santa Consortium developing 1 Terabit coherent technology, and MultiPhy stresses that as well as its direct detection DSP chips, it is also developing coherent ICs.

Further reading: 100 Gigabit: The coming metro opportunity

Latest coherent ASICs set the bar for the optical industry

Feature: Beyond 100G - Part 3

Alcatel-Lucent has detailed its next-generation coherent ASIC that supports multiple modulation schemes and allow signals to scale to 400 Gigabit-per-second (Gbps).

The announcement follows Ciena's WaveLogic 3 coherent chipset that also trades capacity and reach by changing the modulation scheme.

"They [Ciena and Alcatel-Lucent] have set the bar for the rest of the industry," says Ron Kline, principal analyst for Ovum’s network infrastructure group.

"We will employ [the PSE] for all new solutions on 100 Gigabit"

"We will employ [the PSE] for all new solutions on 100 Gigabit"

Kevin Drury, Alcatel-Lucent

Photonic service engine

Dubbed the photonic service engine (PSE), Alcatel-Lucent's latest ASIC will be used in 100Gbps line cards that will come to market in the second half of 2012.

The PSE compromises coherent transmitter and receiver digital signal processors (DSPs) as well as soft-decision forward error correction (SD-FEC). The transmit DSP generates the various modulation schemes, and can perform waveform shaping to improve spectral efficiency. The coherent receiver DSP is used to compensate for fibre distortions and for signal recover.

The PSE follows Alcatel-Lucent's extended reach (XR) line card announced in December 2011 that extends its 100Gbps reach from 1,500 to 2,000km. "This [PSE] will be the chipset we will employ for all new solutions on 100 Gigabit," says Kevin Drury, director of optical marketing at Alcatel-Lucent. The PSE will extend 100Gbps reach to over 3,000km.

Ciena's WaveLogic 3 is a two-device chipset. Alcatel-Lucent has crammed the functionality onto a single device. But while the device is referred to as the 400 Gigabit PSE, two PSE ASICs are needed to implement a 400Gbps signal.

"They [Ciena and Alcatel-Lucent] have set the bar for the rest of the industry"

Ron Kline, Ovum

"There are customers that are curious and interested in trialling 400Gbps but we see equal, if not higher, importance in pushing 100Gbps limits," says Manish Gulyani, vice president, product marketing for Alcatel-Lucent's networks group.

In particular, the equipment maker has improved 100Gbps system density with a card that requires two slots instead of three, and extends reach by 1.5x using the PSE.

Performance

Alcatel-Lucent makes several claims about the performance enhancements using the PSE:

- Reach: The reach is extended by 1.5x.

- Line card density: At 100Gbps the improvement is 1.5x. The current 100Gbps muxponder (10x10Gbps client input) and transponder (100Gbps client) line card designs occupy three slots whereas the PSE design will occupy two slots only. Density will be improved by 4x by adopting a 400Gbps muxponder that occupies three slots.

- Power consumption: By going to a more advanced CMOS process and by enhancing the design of the chip architecture, the PSE consumes a third less power per Gigabit of transport: from 650mW/Gbps to 425mW/Gbps. Alcatel-Lucent is not saying what CMOS process technology is used for the PSE. The company's current 100Gbps silicon uses a 65nm process and analysts believe the PSE uses a 40nm process.

- System capacity: The channel width occupied by the signal can be reduced by a third. A 50GHz 100Gbps wavelength can be compressed to occupy a 37.5GHz. This would improve overall 100Gbps system capacity from 8.8 Terabit-per-second (Tbps) to 11.7Tbps. Overall capacity can be improved from 88, 100Gbps ports to 44, 400Gbps interfaces. That doubles system capacity to 17.6Tbps. Using waveform shaping, this is improved by a further third, to greater than 23Tbps.

"We are not saying we are breaking the 50GHz channel spacing today and going to a flexible grid, super-channel-type construct," says Drury. "But this chip is capable of doing just that." Alcatel-Lucent will at least double network capacity when its system adopts 44 wavelengths, each at 400Gbps.

400 Gigabit

To implement a 400Gbps signal, a dual-carrier, dual-polarisation 16-QAM coherent wavelength is used that occupies 100GHz (two 50GHz channels). Alcatel-Lucent says that should it commercialise 400Gbps using waveform shaping, the channel spacing would reduce to 75GHz. But this more efficient grid spacing only works alongside a flexible grid colourless, directionless and contentionless (CDC) ROADM architecture.

A 400Gbps PSE card showing four 100 Gigabit Ethernet client signals going out as a 400Gbps wavelength. The three-slot card is comprised of three daughter boards. Source: Alcatel-Lucent.

A 400Gbps PSE card showing four 100 Gigabit Ethernet client signals going out as a 400Gbps wavelength. The three-slot card is comprised of three daughter boards. Source: Alcatel-Lucent.

Alcatel-Lucent is not ready to disclose the reach performance it can achieve with the PSE using the various modulation schemes. But it does say the PSE supports dual-polarisation bipolar phase-shift keying (DP-BPSK) for longest reach spans, as well as quadrature phase-shift keying (DP-QPSK) and 16-QAM (quadrature amplitude modulation).

"[This ability] to go distances or to sacrifice reach to increase bandwidth, to go from 400km metro to trans-Pacific by tuning software, that is a big advantage," says Ovum's Kline. "You don't then need as many line cards and that reduces inventory."

Market status

Alcatel-Lucent says that it has 55 customers that have deployed over 1,450 100Gbps transponders.

A software release later this year for Alcatel-Lucent's 1830 Photonic Service Switch will enable the platform to support 100Gbps PSE cards.

A 400Gbps card will also be available this year for operators to trial.

Cisco Systems' 100 Gigabit spans metro to ultra long-haul

Cisco Systems has demonstrated 100 Gigabit transmission over a 3,000km span. The coherent-based system uses a single carrier in a 50GHz channel to transmit at 100 Gigabit-per-second (Gbps). According to Cisco, no Raman amplification or signal regeneration is needed to achieve the 3,000km reach.

Feature: Beyond 100G - Part 2

"The days of a single modulation scheme on a part are probably going to come to an end in the next two to three years"

Greg Nehib, Cisco

The 100Gbps design is also suited to metro networks. Cisco's design is compact to meet the more stringent price and power requirements of metro. The company says it can fit 42, 100Gbps transponders in its ONS 15454 Multi-service Transport Platform (MSTP), which is a 7-foot rack. "We think that is double the density of our nearest competitor today," claims Greg Nehib, product manager, marketing at Cisco Systems.

Also shown as part of the Cisco demonstration was the use of super-channels, multiple carriers that are combined to achieve 400 Gigabit or 1 Terabit signals.

Single-carrier 100 Gigabit

Several of the first-generation 100Gbps systems from equipment makers use two carriers (each carrying 50Gbps) in a 50GHz channel, and while such equipment requires lower-speed electronics, twice as many coherent transmitters and receivers are needed overall.

Alcatel-Lucent is one vendor that has a single-carrier 50GHz system and so has Huawei. Ciena via its Nortel acquisition offers a dual-carrier 100Gbps system, as does Infinera. With Ciena's announcement of its WaveLogic 3 chipset, it is now moving to a single-carrier solution. Now Cisco is entering the market with a single-carrier system.

"When you have a single carrier, you can get upwards of 96 channels of 100Gbps in the C-band," says Nehib. "The equation here is about price, performance, density and power."

What has been done

Cisco's 100Gbps design fits on a 1RU (rack unit) card and uses the first 100Gbps coherent receiver ASIC designed by the CoreOptics team acquired by Cisco in May 2010.

The demonstrated 3,000km reach was made using low-loss fibre. "This is to some degree a hero experiment," says Nehib. "We have achieved 3,000km with SMF ULL fibre from Corning; the LL is low loss." Normal fibre has a loss of 0.20-0.25dB/km while for ULL fibre it is in the 0.17dB/km range.

"You can do the maths and calculate the loss we are overcoming over 3,000km. We just want to signal that we have very good performance for ultra long-haul," says Nehib, who admits that results will vary in networks, depending on the fibre.

Nehib says Cisco's coherent receiver achieves a chromatic dispersion tolerance of 70,000 ps/nm and 100ps differential group delay. Differential group delay is a non-linear effect, says Nehib, that is overcome using the DSP-ASIC. The greater the group delay tolerance, the better the distance performance. These metrics, claims Cisco, are currently unmatched in the industry.

The company has not said what CMOS process it is using for its ASIC design. But this is not the main issue, says Nehib: "We are trying to develop a part that is small so that it fits in many different platforms, and we can now use a single part number to go from metro performance all the way to ultra long-haul."

Another factor that impacts span performance is the number of lit channels. Cisco, in the test performed by independent test lab EANTC, the European Advanced Network Test Center, used 70 wavelengths. "With 70 channels the performance would have been very close to what we would have achieved with [a full complement of] 80 channels," says Nehib.

Super-channels

A super-channel refers to a signal made up of several wavelengths. Infinera, with its DTN-X, uses a 500Gbps super-channel, comprising five 100Gbps wavelengths.

Using a super-channel, an operator can turn up multiple 100Gbps channels at once. If an operator wants to add a 100Gbps wavelength, a client interface is simply added to a spare 100Gbps wavelength making up the super-channel. In contrast turning up a 100Gbps wavelength in current systems usually requires several days of testing to ensure it can carry live traffic alongside existing links.

Another benefit of super-channels is scale by turning up multiple wavelengths simultaneously. As traffic grows so does the work load on operators' engineering teams. Super-channels aid efficiency.

"There is one other point that we hear quite often," says Nehib. "One other attraction of super-channels is overall spectral efficiency." The carriers that make up the signal can be packed more closely, expanding overall fibre capacity.

"Just like with 10 Gig, we think at some point in the future the 100 Gig network will be depleted, especially in the largest networks, and operators will be interested in 400 Gig and Terabit interfaces," says Nehib. "If that wavelength can further benefit from advanced modulation schemes and super-channels through flex[ible] spectrum deployment then you can get more total bandwidth on the fibre and better utilisation of your amplifiers."

Cisco's 100Gbps lab demonstration also showed 400 Gigabit and 1 Terabit super-channels, part of its research work with the Politechnico di Torino. "We are going to move on to other advanced modulation techniques and deliver 400 Gigabit and Terabit interfaces in future," says Nehib.

Existing 100Gbps systems use dual-polarisation, quadrature phase-shift keying (DP-QPSK). Using 16-QAM (quadrature amplitude modulation) at the same baud rate doubles the data rate. Using 16-QAM also benefits spectral utilisation. If the more intelligent modulation format is used in a super-channel format, and the signal is fitted in the most appropriate channel spacing using flexible spectrum ROADMs, overall capacity is increased. However, the spectral efficiency of 16-QAM comes at the expense of overall reach.

"You are able to best match the rate to the reach to the spectrum," says Nehib. "The days of a single modulation scheme on a part are probably going to come to an end in the next two to three years."

Cisco has yet to discuss the addition of a coherent transmitter DSP which through spectral shaping can bunch wavelengths. Such an approach has just been detailed by Ciena with its WaveLogic 3 and Alcatel-Lucent with its 400 Gig photonic service engine.

For the Terabit super-channel demonstration, Cisco used 16-QAM and a flexible spectrum multiplexer. "The demo that we showed is not necessarily indicative of the part we will bring to market," says Nehib, pointing out that it is still early in the development cycle. "We are looking at the spectral efficiency of super-channels, different modulation schemes, flex-spectrum multiplexer, availability, quality, loss etc.," says Nehib. "We have not made firm technology choices yet."

Cisco's 100Gbps system is in trials with some 40 customers and can be ordered now. The product will be generally available in the near future, it says.

Further reading:

Light Reading: EANTC's independent test of Cisco's CloudVerse architecture. Part 4: Long-haul optical transport

Challenges, progress & uncertainties facing the optical component industry

In recent years the industry has moved from direct detection to coherent transmission and has alighted on a flexible ROADM architecture. The result is a new level in optical networking sophistication. OFC/NFOEC 2012 will showcase the progress in these and other areas of industry consensus as well as shining a spotlight on issues less clear.

Optical component players may be forgiven for the odd envious glance towards the semiconductor industry and its well-defined industry dynamics.

The semiconductor industry has Moore’s Law that drives technological progress and the economics of chip-making. It also experiences semiconductor cycles - regular industry corrections caused by overcapacity and excess inventory. The semiconductor industry certainly has its challenges but it is well drilled in what to expect.

Optical challenges

The optical industry experienced its own version of a semiconductor cycle in 2010-11 - strong growth in 2010 followed by a correction in 2011. But such market dynamics are irregular and optical has no Moore's Law.

Optical players must therefore work harder to develop components to meet the rapid traffic growth while achieving cost efficiencies, denser designs and power savings.

Such efficiencies are even more important as the marketplace becomes more complex due to changes in the industry layers above components. The added applications layer above networks was highlighted in the OFC/NFOEC 2012 news analysis by Ovum’s Karen Liu. The analyst also pointed out that operators’ revenues and capex growth rates are set to halve in the years till 2017 compared to 2006-2010.

Such is the challenging backdrop facing optical component players.

Consensus

Coherent has become the defacto standard for long-haul high-speed transmission. Optical system vendors have largely launched their 100Gbps systems and have set their design engineers on the next challenge: addressing designs for line rates beyond 100Gbps.

Infinera detailed its 500Gbps super-channel photonic integrated circuit last year. At OFC/NFOEC it will be interesting to learn how other equipment makers are tackling such designs and what activity and requests optical component vendors are seeing regarding the next line rates after 100Gbps.

Meanwhile new chip designs for transport and switching at 100Gbps are expected at the show. AppliedMicro is sampling its gearbox chip that supports 100 Gigabit Ethernet and OTU4 optical interfaces. More announcements should be expected regarding merchant 100Gbps digital signal processing ASIC designs.

An architectural consensus for wavelength-selective switches (WSSes) - the key building block of ROADMs - are taking shape with the industry consolidating on a route-and-select architecture, according to analysts.

Gridless - the ROADM attribute that supports differing spectral widths expected for line rates above 100Gbps - is a key characteristic that WSSes must support, resulting in more vendors announcing liquid crystal on silicon designs.

Client-side 40 and 100 Gigabit Ethernet (GbE) interfaces have a clearer module roadmap than line-side transmission. After the CFP comes the CFP2 and CFP4 which promise denser interfaces and Terabit capacity blades. Module form factors such as the QSFP+ at 40GbE and in time 100GbE CFP4s require integrated photonic designs. This is a development to watch for at the show.

Others areas to note include tunable-laser XFPs and even tunable SFP+, work on which has already been announced by JDS Uniphase.

Lastly, short-link interfaces and in particular optical engines is another important segment that ultimately promises new system designs and the market opportunity that will unleash silicon photonics.

Optical engines can simplify high-speed backplane designs and printed circuit board electronics. Electrical interfaces moving to 25Gbps is seen as the threshold trigger when switch makers decide whether to move their next designs to an optical backplane.

The Optical Internetworking Forum will have a Physical and Link Layer (PLL) demonstration to showcase interoperability of the Forum’s Common Electrical Interface (CEI) 28Gbps Very Short Reach (VSR) chip-to-module electrical interfaces, as well as a demonstration of the CEI-25G-LR backplane interface.

Companies participating in the interop include Altera, Amphenol, Fujitsu Optical Components, Gennum, IBM, Inphi, Luxtera, Molex, TE Connectivity and Xilinx.

Altera has already unveiled a FGPA prototype that co-packages 12x10Gbps transmitter and receiver optical engines alongside its FPGA.

Uncertainties

OFC/NFOEC 2012 also provides an opportunity to assess progress in sectors and technology where there is less clarity. Two sectors of note are next-generation PON and the 100Gbps direct-detect market.

For next-generation PON, several ideas are being pursued, faster extensions of existing PON schemes such as a 40Gbps version of the existing time devision multiplexing PON schemes, 40G PON based on hybrid WDM and TDM schemes, WDM-PON and even ultra dense WDM-PON and OFDM-based PON schemes.

The upcoming show will not answer what the likely schemes will be but will provide an opportunity to test what the latest thinking is.

The same applies for 100 Gigabit direct detection.

There are significant cost advantages to this approach and there is an opportunity for the technology in the metro and for data centre connectivity. But so far announcements have been limited and operators are still to fully assess the technology. Further announcements at OFC/NFOEC will highlight the progress being made here.

The article has been written as a news analysis published by the organisers before this year's OFC/NFOEC event.