Is the tunable laser market set for an upturn?

Part 2: Tunable laser market

"The tunable laser market requires a lot of patience to research." So claims Vladimir Kozlov, CEO of LightCounting Market Research. Kozlov should know; he has spent the last 15 years tracking and forecasting lasers and optical modules for the telecom and datacom markets.

Source: LightCounting, Gazettabyte

Source: LightCounting, Gazettabyte

The tunable laser market is certainly sizeable; over half a million units will be shipped in 2014, says LightCounting. But the market requires care when forecasting. One subtlety is that certain optical component companies - Finisar, JDSU and Oclaro - are vertically integrated and use their own tunable lasers within the optical modules they sell. LightCounting counts these as module sales rather than tunable laser ones.

Another issue is that despite the development of advanced reconfigurable optical add/ drop multiplexers (ROADMs) and tunable lasers, the uptake of agile optical networking has been limited.

"Verizon is bullish on getting the next generation of colourless, directionless and contentionless ROADMS to reconfigure the network on-the-fly," says Kozlov. "But I'm not so sure Verizon is going to be successful in convincing the industry that this is going to be a good market for [ROADM] suppliers to sell into."

Reconfigurability helps engineers at installations when determining which channels to add or drop, but there is little evidence of operators besides Verizon talking about using ROADMS to change bandwidth dynamically, first in one direction and then the other, he says.

Another indicator of the reduced status of tunable lasers is NeoPhotonics's intention to purchase Emcore's tunable external cavity laser as well as its module assets for US $17.5 million. Emcore acquired the laser when it bought Intel's optical platform division for $85 million in 2007, while Intel acquired it from New Focus in 2002 for $50 million. NeoPhotonics has also spent more in the past: it bought Santur's tunable laser for $39 million in 2011.

"There was so much excitement with so many players [during the optical bubble of 1999-2000], the market was way too competitive and eventually it drove vendors to the point where they would prefer to sell the business for pennies rather than keep it running," says Kozlov. "Emcore has been losing money, it is not a highly profitable business." Yet for Kozlov, Emcore's tunable laser is probably the best in the business with its very narrow line-width compared to other devices.

Tunable laser market

Tunable lasers have failed to get into the mainstream of the industry. "If you look at DWDM, I'm guessing that 70 percent of lasers sold are still fixed wavelength or temperature-tunable over a few wavelengths," says Kozlov. System vendors such as Huawei and ZTE advertise their systems with tunable lasers. "But when we asked them how they are using tunable lasers, they admitted that the bulk of their shipments are fixed-wavelength devices because whatever little they can save on cost, they will."

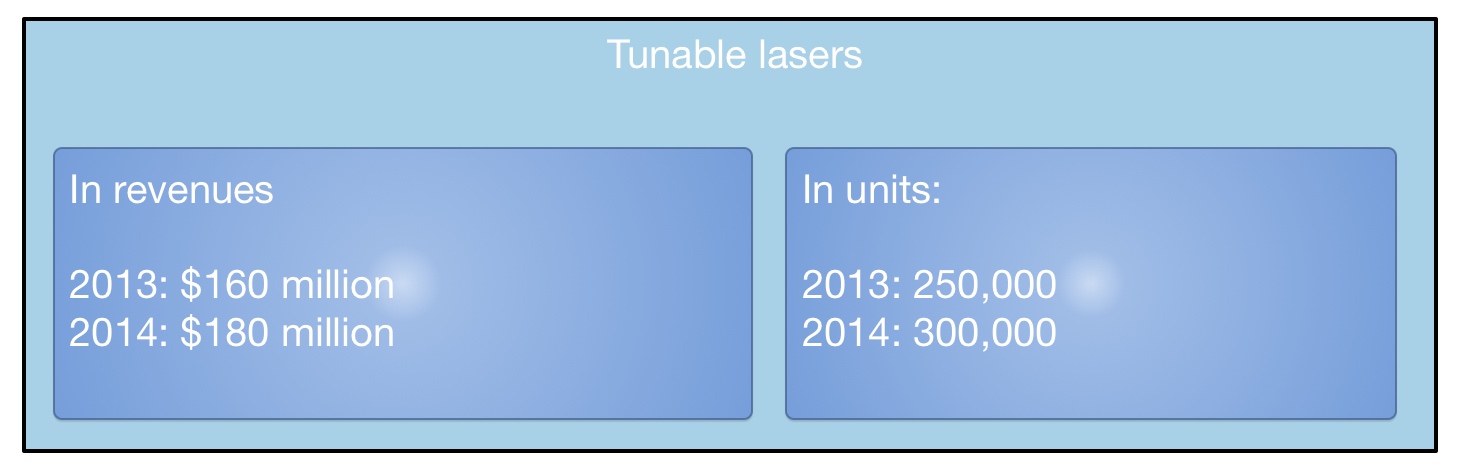

LightCounting valued the 2013 tunable laser market at $160 Million, growing to $180 Million in 2014. This equates to 250,000 units sold in 2013 and 300,000 units this year. "Most of these are for coherent systems," says Kozlov. The number of tunable lasers sold in modules - mainly XFPs but also SFPs and 300-pin modules - is 250,000 million units. "Half a million units a year; if you look at actual shipments, it is quite a lot," says Kozlov.

What next?

"I'm hoping we are reaching the low point in the tunable laser market as vendors are struggling and sales are at a very low valuation," says Kozlov.

The advent of more complex modulation schemes for 400 Gigabit and greater speed optical transmission, and the adoption of silicon photonics-based modulators for long haul will require higher powered lasers. But so much progress has been made by laser designers over the last 15 years, especially during the bubble, that it will last the industry for at least another decade or two, says Kozlov: "Incremental progress will continue and hopefully greater profitability."

For Part 1: NeoPhotonics to expand its tunable laser portfolio, click here

Optical transceiver market to grow 50 percent by 2017

- The optical transceiver market will grow to US $5.1bn in 2017

- The fierce price declines of 2012 will lessen during the forecast period

- Stronger traffic growth could have a significant positive effect on transceiver market growth

"The price declines in 2012 were brutal but they will not happen again [during the forecast period]"

"The price declines in 2012 were brutal but they will not happen again [during the forecast period]"

Vladimir Kozlov, LightCounting

The global optical transceiver market will grow strongly over the next five year to $5.1bn in 2017, from $3.4bn in 2012. So claims market research company, LightCounting, in its latest telecom and datacom forecast.

"That [market value] does not include tunable lasers, wavelength-selective switches, pump lasers and amplifiers which will add some $1bn or $2bn more [in 2017]," says Vladimir Kozlov, CEO of LightCounting.

One key assumption underpinning the forecast is that competitive pressures will ease. "The price declines in 2012 were brutal but they will not happen again [during the forecast period]," says Kozlov.

Optical transceivers

The optical transceiver market saw price declines as high as 30 percent last year. These were not new products ramping in volume where sharp price declines are to be expected, says Kozlov. Last year also saw fierce competition among the service providers while the steepest price declines were experienced by the telecom equipment makers.

One optical transceiver sector that performed well last year is high-speed optical transceivers and in particular Ethernet.

The 100 Gigabit Ethernet (GbE) market saw revenue growth due to strong demand for the 100GBASE-LR4 10km transceiver even though its unit price declined 30 percent. This is a sector the Chinese optical transceiver players are eyeing as they look to broaden the markets they address.

One unheralded market that did well was 40 Gigabit transceivers for telecoms and the data centre. "This is 40 Gig short reach mostly - up to 100m - but also 10km reach transceivers did well in the data centre," says Kozlov.

LightCounting expects the steady growth of 40GbE to continue; 40GbE transceivers use 10 Gig technology co-packaged into one module, offer improved port density and have a lower power and cost compared to four 10GbE transceivers.

Even the veteran 10GbE market continues to grow. Some 7-8M 10GbE short reach and long reach units were sold in 2012 growing to 10M units this year.

Meanwhile, the 100 Gigabit coherent long-haul transponder market was small in 2012. The optical vendors only started selling in volume last year and most of the system vendors manufacture their own 100 Gigabit-per-second (Gbps) designs using discrete components. "Those companies that sell modulators and receivers for 100 Gig did really well in 2012," says Kozlov.

LightCounting expects the 100Gbps coherent transponder market will grow in 2013 as system vendors embrace more third-party 100 Gig transponders. "We estimate that the optical transceiver vendors captured 10-15 percent of the 40 and 100 Gig market and this will grow to 18-20 percent in 2013," says Kozlov.

Other markets that grew in 2012 include optical access. The fibre-to-the-x (FTTx) continues to grow in terms of units shipped, with transceivers and board optical sub-assembly (BOSA) designs sharing the volumes.

LightCounting says that the number of optical network units (ONU) exceeded by more than double the number of FTTx subscribers added in 2012: 35-40M ONU transceivers and BOSAs compared to 15M new subscribers.

The result was a market value of $700M in 2012 compared to $300M in 2009. But because of the excess in shipments compared to new subscribers, Kozlov expects the FTTx market to slow down. "That is probably a sure sign that it is going to grow again," he quips.

Market expectations

Kozlov will be watching how the optical interconnect market does this year. The active optical cable market did well in 2012 and this is likely to continue. Kozlov is interested to see if silicon photonics starts to make its mark in the transceiver market, citing as an example Cisco's in-house silicon photonics-based CPAK transceiver. He also expects the 40G and 100Gbps module makers to do well.

LightCounting stresses the wide discrepancy between video traffic growth through 2017 as forecast by Bell Labs and by Cisco Systems. This is important because the optical transceiver forecast model developed by LightCounting is sensitive to traffic growth. LightCounting has averaged the two forecasts but if video traffic grows more quickly, the overall transceiver market will exceed the market research company's 2017 forecast.

Another reason why Kozlov is upbeat about the market's prospects is that while the system vendors suffered the sharpest price declines - up to 35 percent in 2012 - this will not continue.

The sharp falls in equipment prices were due largely to the fierce competition provided by the Chinese giants Huawei and ZTE. But relief is expected with government initiatives in Europe and the United States to limit the influence of Huawei and ZTE, says Kozlov.

The U.S. government has effectively restricted sales of Huawei and ZTE networking equipment to major U.S. carriers due to cyber security concerns, while the European Commission has determined that Huawei and ZTE are both inflicting damage on European equipment vendors by dumping products onto the European market.

China and the global PON market

China has become the world's biggest market for passive optical network (PON) technology even though deployments there have barely begun. That is because China, with approximately a quarter of a billion households, dwarfs all other markets. Yet according to market research firm Ovum, only 7% of Chinese homes were connected by year end 2011.

"In 2012, BOSAs [board-based PON optical sub-assemblies] will represent the majority versus optical transceivers for PON ONTs and ONUs"

Julie Kunstler, Ovum

Until recently Japan and South Korea were the dominant markets. And while PON deployments continue in these two markets, the rate of deployments has slowed as these optical access markets mature.

According to Ovum, slightly more than 4 million PON optical line terminals (OLTs) ports, located in the central office, were shipped in Asia Pacific in 2011, of which China accounted for the majority. Worldwide OLT shipments for the same period totaled close to 4.5 million. The fact that in China the ratio of OLT to optical network terminal (ONT), the end terminal at the home or building, deployed is relatively low highlights that in the Chinese market the significant growth in PON end terminals is still to come.

The strength of the Chinese market has helped local system vendors Huawei, ZTE and Fiberhome become leading global PON players, accounting for over 85% of the OLTs sold globally in 2011, says Julie Kunstler, principal analayst, optical components at Ovum. Moreover, around 60% of fibre-to-the-x deployments in Europe, Middle East and Africa were supplied by the Chinese vendors. The strongest non-Chinese vendor is Alcatel-Lucent.

Ovum says that the State Grid China Corporation, the largest electric utility company in China, has begun to deploy EPON for their smart grid trial deployments. PON is preferred to wireless technology because of its perceived ability to secure the data. This raises the prospect of two separate PON lines going to each home. But it remains to be seen, says Kunstler, whether this happens or whether the telcos and utilities share the access network.

"After China the next region that will have meaningful numbers is Eastern Europe, followed by South and Central America and we have already seen it in places like Russia,” says Kunstler. Indeed FTTx deployments in Eastern Europe already exceed those in Western Europe.

EPON and GPON

In China both Ethernet PON (EPON) and Gigabit PON (GPON) are being deployed. Ovum estimates that in 2011, 65% of equipment shipments were EPON while GPON represented 35% GPON in China.

China Telecom was the first of the large operators in China to deploy PON and began with EPON. Ovum is now seeing deployments of GPON and in the 3rd quarter of 2012, GPON OLT deployments have overtaken EPON.

China Mobile, not a landline operator, started deployments later and chose GPON. But these GPON deployments are on top of EPON, says Kunstler: "EPON is still heavily deployed by China Telecom, while China Mobile is doing GPON but it is a much smaller player." Moreover, Chinese PON vendors also supplying OLTs that support EPON and GPON, allowing local decisions to be made as to which PON technology is used.

One trend that is impacting the traditional PON optical transceiver market is the growing use of board-based PON optical sub-assemblies (BOSAs). Such PON optics dispenses with the traditional traditional optical module form factor in the interest of trimming costs.

“A number of the larger, established ODMs [original design manufacturers] have begun to ship BOSA-based PON CPEs,” says Kunstler. In 2012, BOSAs will represent the majority versus optical transceivers for PON ONTs/ONUs.” says Kunstler.

10 Gigabit PON

Ovum says that there has been very few deployments of next generation 10G EPON and XG-PON, the 10 Gigabit version of GPON.

"There have been small amounts of 10G [EPON] in China," says Kunstler. "We are talking hundreds or thousands, not the tens of thousands [of units]."

One reason for this is the relative high cost of 10 Gigabit PON which is still in its infancy. Another is the growing shift to deploy fibre-to-the-home (FTTh) versus fibre-to-the-building deployments in China. 10 Gigabit PON makes more sense in multi-dwelling units where the incoming signal is split between apartments. Moving to 10G EPON boosts the incoming bandwidth by 10x while XG-PON would increase the bandwidth by 4x. "The need for 10 Gig for multi-dwelling units is not as strong as originally thought," says Kunstler.

It is a chicken-and-egg issue with 10G PON, says Kunstler. The price of 10G optics would go down if there was more demand, and if there was more demand, the optical vendors would work on bringing down cost. "10G GPON will happen but will take longer," says Kunstler, with volumes starting to ramp from 2014.

However, Ovum thinks that a stronger market application for 10G PON will be for supporting wireless backhaul. The market research company is seeing early deployments of PON for wireless backhaul especially for small cell sites (e.g. picocells). Small cells are typically deployed in urban areas which is where FTTx is deployed. It is too early to know the market forecast for this application but PON will join the list of communications technologies supporting wireless backhaul.

Challenges

Despite the huge expected growth in deployments, driven by China, challenges remain for PON optical transceiver and chip vendors.

The margins on optics and PON silicon continue to be squeezed. ODMs using BOSAs are putting pricing pressure on PON transceiver costs while the vertical integration strategy of system vendors such as Huawei, which also develops some of its own components squeezes, out various independent players. Huawei has its own silicon arm called HiSilicon and its activities in PON has impacted the chip opportunity of the PON merchant suppliers.

"Depending upon who the customer is, depending upon the pricing, depending on the features and the functions, Huawei will make the decision whether they are using HiSilicon or whether they are using merchant silicon from an independent vendor, for example," says Kunstler.

There has been consolidation in the PON chip space as well as several new players. For example, Broadcom acquired Teknouvs and Broadlight while Atheros acquired Opulan and Atheros was then acquired by Qualcomm. Marvell acquired a very small start-up and is now competing with Atheros and Broadcom. Most recently, Realtek is rumored to have a very low-cost PON chip.

ZTE takes PON optical line terminal lead

ZTE shipped 1.8 million passive optical network (PON) optical line terminals (OLTs) in 2011 to become the leading supplier with 41 percent of the global market, according to Ovum.

"ZTE is co-operating with some Tier 1 operators in Europe and the US for 10GEPON and XGPON1 testing"

"ZTE is co-operating with some Tier 1 operators in Europe and the US for 10GEPON and XGPON1 testing"

Song Shi Jie, ZTE

The market research firm also ranks the Chinese equipment maker as the second largest supplier of PON optical network terminals (ONT), with 28 per cent global market share in 2011.

China now accounts for over half the total fibre-to-the-x (FTTx) deployments worldwide. ZTE says 1.05 million of its OLTs were deploy in China, with 70 percent for the EPON standard and the rest GPON. Overall EPON accounts for 85% of deployments in China. However GPON deployments are growing and ZTE expects the technology to gain market share in China.

There are some 300 million broadband users in China, made up of DSL, fibre-to-the-building (FTTB) and -curb (FTTC), says Song Shi Jie, director of fixed network product line at ZTE.

Of the three main operators, China Telecom is the largest. It is deploying FTTB and is moving to fibre-to-the-home (FTTH) deployments using GPON. China Unicom has a similar strategy. China Mobile is focussed on FTTB and LAN technology; because it is a mobile operator and has no copper line assets it uses LAN cabling for networking within the building.

The split ratio - the number of PON ONTs connected to each OLT - varies depending on the deployment. "In the fibre-to-the-building scenario, the typical ratio is 1:8 or 1:16; for fibre-to-the-home the typical ratio is 1:64," says Song.

ZTE has also deployed 200,000 10 Gigabit EPON (10GEPON) lines in China but none elsewhere, either 10GEPON or XGPON1 (10 Gigabit GPON). "ZTE is co-operating with some Tier 1 operators in Europe and the US for 10GEPON and XGPON1 testing," says Song.

Song attributes ZTE's success to such factors as reduced power consumption of its PON systems and its strong R&D in access.

The vendor says its PON platforms consume a quarter less power than the industry average. Its systems use such techniques as shutting down those OLT ports that are not connected to ONTs. It also employs port idle and sleep modes to save power when there is no traffic. Meanwhile, ZTE has 3,000 engineers engaged in fixed access product R&D.

As for the next-generation NGPON2 being development by industry body FSAN, Song says there are a variety of technologies being proposed but that the picture is still unclear.

ZTE is focussing on three main next-generation PON technologies: wavelength division multiplexing PON (WDM-PON), hybrid time division multiplexing (TDM)/ WDM-PON (or TWDM-PON) and orthogonal frequency division multiplexing (OFDM) PON. "We think OFDM PON can provide high security, high bandwidth and easy network maintenance," says Song.

ZTE says that the NGPON2 standard will be mature in 2015 but that commercial deployments will only start in 2018.

Chinese optical component vendors set for change

“If [Chinese optical component] companies get $100m from an IPO, they have the resources to really do things”

Vladimir Kozlov, LightCounting

The local OC players have benefitted from the prolonged growth of China’s economy, the rise of global telecom system vendors Huawei and ZTE, and the significant expansion in Chinese operators’ networks. But such domestic growth will not continue and will likely lead to a shake-up of the local OC firms.

“They [Chinese OC players] all have the same industry pitch: they all have huge capacity, they have tons of people and they are growing fast but when you research that, you uncover different approaches to doing business,” says Vladimir Kozlov, CEO at LightCounting.

The market research firm has identified several classes of OC player. There are quite a few mid-size companies that focus on niche local opportunities. “Very few of them have an ambition of becoming a global player,” says Kozlov. “They have been set up with local government support, primarily with the aim of employing local people and being involved in local telecom projects.”

But there are other players with broader ambitions and resources. Companies such as HiSense Broadband and HG Genuine, acknowledged manufacturers of electronics and consumer products, have formed OC business units recognising the growth potential of optical communications.

Another category that Western firms will do well to note, says Kozlov, is the Chinese OC players with a long history such as WTD and Accelink. “WTD is 30-years-old and grew from the Wuhan Research Institute that is also a founding body for Chinese system vendor FiberHome,” says Kozlov. WTD has been growing steadily and the pace has accelerated in the last two years. “WTD is becoming more aggressive and is gaining market share while Accelink has a successful IPO that brought in $100m,” he says.

Other companies will likely follow Accelink’s example and raise money through IPOs. But what will be interesting is whether such companies continue to focus on the Chinese market or start addressing issues such as what technologies they are missing and even make acquisitions, he says.

“A lot more companies will have access to financial markets as the regulation that limits how many companies can become public is relaxed,” says Kozlov. “If [Chinese OC] companies get [US] $100m from an IPO, they have the resources to really do things.”

“It is unlikely that Huawei will keep on growing as fast as it did over recent years and continue to take market share from Alcatel-Lucent, Ericsson and others for much longer”

Yet another Chinese OC player segment is start-ups funded by venture capitalists (VCs). One example is Innolight which has received funding from local VCs and a Western company. “VCs will push firms to be as ambitious as possible as they are after returns,” says Kozlov. Interest among the financial investment community is also growing given the rise of the stock price of the OC industry’s leading firms in the last year. Such interest will likely lead to investment and restructuring of local Chinese firms, he says.

Chinese OC vendors have been helped by the rise of the system vendors Huawei and ZTE. The Chinese equipment makers have been disruptive in adopting technology quickly while reducing their costs. But having become global players, Huawei and ZTE now face their own challenges.

“Both [system vendors] companies have caught up on the technology and the next step for them is to see whether they can become leaders in technology and stay ahead of an Alcatel-Lucent or a Ciena,” says Kozlov. “They have the ambition but can they do it?” Kozlov notes that Chinese companies are now highly active with patent applications: “Chinese firms recognise that this is how they will achieve a longer-term advantage and protect their own technologies.”

Another challenge facing the system vendors, common to many technology industries, is that no one player dominates a market. “Usually three global companies share the dominance; the same if it is a local market,” says Kozlov. “It is therefore unlikely that Huawei will keep on growing as fast as it did over recent years and continue to take market share from Alcatel-Lucent, Ericsson and others for much longer.”

This will require Huawei and ZTE to adapt to more moderate growth in future. Meanwhile North American and European system vendors have long responded to the competitive threat, moving their manufacturing to Asia Pacific - and China in particular - to benefit from reduced operating costs. For the Chinese OC vendors, yet to become global players, the chance to be as disruptive as the Chinese system vendors has gone since leading OC vendors have established local manufacturing.

Can Western companies learn from the experience of Chinese system and OC vendors? Kozlov is not so sure.

The Chinese have proved adept at learning the business and mastering new technologies. The examples of Huawei and ZTE that have disrupted the market by being as efficient as possible have proved a wake-up call for Western companies. “I don’t see anything beyond that that Western companies can learn; it is still the Chinese that are learning from Western companies,” says Kozlov. “This does not mean that the Western companies have nothing to worry about; there is plenty of room for improvement in the industry supply chain.”

Looking at the decade ahead, Kozlov expects Huawei to have a much greater penetration in the North American telecom market. “And as it [Huawei] builds up its own intellectual property, it will be better able to compete with Cisco Systems and H-P in the datacom market,” says Kozlov. And as Chinese companies get access to greater finance he also expects they will start acquiring Western firms to gain expertise and greater access to markets.