The uphill battle to keep pace with bandwidth demand

Relative traffic increase normalised to 2010 Source: IEEE

Relative traffic increase normalised to 2010 Source: IEEE

Optical component and system vendors will be increasingly challenged to meet the expected growth in bandwidth demand.

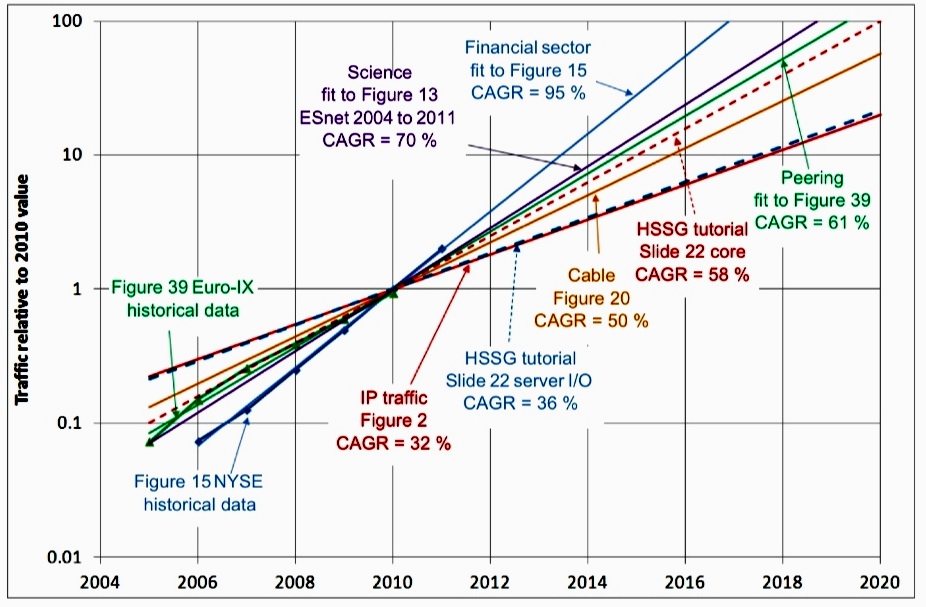

According to a recent comprehensive study by the IEEE (The IEEE 802.3 Industry Connections Ethernet Bandwidth Assessment report), bandwidth requirements are set to grow 10x by 2015 compared to demand in 2010, and a further 10x between 2015 and 2020. Meanwhile, the technical challenges are growing for the vendors developing optical transmission equipment and short-reach high-speed optical interfaces.

Fibre bandwidth is becoming a scarce commodity and various techniques will be required to scale capacity in metro and long-haul networks. The IEEE is expected to develop the next-higher speed Ethernet standard to follow 100 Gigabit Ethernet (GbE) in 2017 only. The IEEE is only talking about capacities and not interface speeds. Yet, at this early stage, 400 Gigabit Ethernet looks the most likely interface.

"The various end-user markets need technology that scales with their bandwidth demands and does so economically. The fact that vendors must work harder to keep scaling bandwidth is not what they want to hear"

A 400GbE interface will comprise multiple parallel lanes, requiring the use of optical integration. A 400GbE interface may also embrace modulation techniques, further adding to the size, complexity and cost of such an interface. And to achieve a Terabit, three such interfaces will be needed.

All these factors are conspiring against what the various end-user bandwidth sectors require: line-side and client-side interfaces that scale economically with bandwidth demand. Instead, optical components, optical module and systems suppliers will have to invest heavily to develop more complex solutions in the hope of matching the relentless bandwidth demand.

The IEEE 802.3 Bandwidth Assessment Ad Hoc group, which produced the report that highlights the hundredfold growth in bandwidth demand between 2010 and 2020, studied several sectors besides core networking and data centre equipment such as servers. These include Internet exchanges, high-performance computing, cable operators (MSOs) and the scientific community.

The difference growth rates in bandwidth demand it found for the various sectors are shown in the chart above.

Optical transport

A key challenge for optical transport is that fibre spectrum is becoming a precious commodity. Scaling capacity will require much more efficient use of spectrum.

To this aim, vendors are embracing advanced modulation schemes, signal processing and complex ASIC designs. The use of such technologies also raises new challenges such as moving away from a rigid spectrum grid, requiring the introduction of flexible-grid switching elements within the network.

And it does not stop there.

Already considerable development work is underway to use multi-carriers - super-channels - whose carrier count can be adapted on-the-fly depending on demand, and which can be crammed together to save spectrum. This requires advanced waveform shaping based on either coherent orthogonal frequency division multiplexing (OFDM) or Nyquist WDM, adding further complexity to the ASIC design.

At present, a single light path can be increased from 100 Gigabit-per-second (Gbps) to 200Gbps using the 16-QAM amplitude modulation scheme. Two such light paths give a 400Gbps data rate. But 400Gbps requires more spectrum than the standard 50GHz band used for 100Gbps transmission. And using QAM reduces the overall optical transmission reach achieved.

The shorter resulting reach using 16-QAM or 64-QAM may be sufficient for metro networks (~1000km) but to achieve long-haul and ultra-long-haul spans will require super-channels based on multiple dual-polarisation, quadrature phase-shift keying (DP-QPSK) modulated carriers, each occupying 50GHz. Building up a 400Gbps or 1 Terabit signal this way uses 4 or 10 such carriers, respectively - a lot of spectrum. Some 8Tbps to 8.8Tbps long-haul capacity result using this approach.

The main 100Gbps system vendors have demonstrated 400Gbps using 16-QAM and two carriers. This doubles system capacity to 16-17.6Tbps. A further 30% saving in bandwidth using spectral shaping at the transmitter crams the carriers closer together, raising the capacity to some 23Tbps. The eventual adoption of coherent OFDM or Nyquist WDM will further boost overall fibre capacity across the C-band. But the overall tradeoff of capacity versus reach still remains.

Optical transport thus has a set of techniques to improve the amount of traffic it can carry. But it is not at a pace that matches the relentless exponential growth in bandwidth demand.

After spectral shaping, even more complex solutions will be needed. These include extending transmission beyond the C-band, and developing exotic fibres. But these are developments for the next decade or two and will require considerable investment.

The various end-user markets need technology that scales with their bandwidth demands and does so economically. The fact that vendors must work harder to keep scaling bandwidth is not what they want to hear.

"No-one is talking about a potential bandwidth crunch but if it is to be avoided, greater investment in the key technologies will be needed. This will raise its own industry challenges. But nothing like those to be expected if the gap between bandwidth demand and available solutions grows"

Higher-speed Ethernet

The IEEE's Bandwidth Assessment study lays the groundwork for the development of the next higher-speed Ethernet standard.

Since the standard work has not yet started, the IEEE stresses that it is premature to discuss interface speeds. But based on the state of the industry, 400GbE already looks the most likely solution as the next speed hike after 100GbE. Adopting 400GbE, several approaches could be pursued:

- 16 lanes at 25Gbps: 100GbE is moving to a 4x25Gbps electrical interface and 400GbE could exploit such technology for a 16-lane solution, made up of four, 4x25Gbps interfaces. "If I was a betting man, I'd probably put better odds on that [25Gbps lanes] because it is in the realm of what everyone is developing," John D'Ambrosia, chair of the IEEE 802.3 Industry Connections Higher Speed Ethernet Consensus group and chair of the the IEEE 802.3 Bandwidth Assessment Ad Hoc group, told Gazettabyte.

- 10 lanes at 40Gbps: The Optical Internetworking Forum (OIF) has started work on an electrical interface operating between 39 and 56Gbps (Common Electrical Interface - 56G-Close Proximity Reach). This could lead to 40Gbps lanes and a 10x40Gbps implementation for a 400Gbps Ethernet design.

- Modulation: For the 100Gbps backplane initiative, the IEEE is working on pulse-amplitude modulation (PAM), says D'Ambrosia. Such modulation could be used for 400GbE. Modulation is also being considered by the IEEE to create a single-lane 100Gbps interface. Such a solution could lead to a 4-lane 400GbE solution. But adopting modulation comes at a cost: more sophisticated electronics, greater size and power consumption.

As with any emerging standard, first designs will be large, power-hungry and expensive. The industry will have to work hard to produce more integrated 16-lane or 10-lane designs. Size and cost will also be important given that three 400GbE modules will be needed to implement a Terabit interface.

The challenge for component and module vendors is to develop such multi-lane designs yet do so economically. This will require design ingenuity and optical integration expertise.

Timescales

Super-channels exist now - Infinera is shipping its 5x100Gbps photonic integrated circuit. Ciena and Alcatel-Lucent are introducing their latest generation DSP-ASICs that promise 400Gbps signals and spectral shaping while other vendors have demonstrated such capabilities in the lab.

The next Ethernet standard is set for completion in 2017. If it is indeed based on a 400GbE Ethernet interface, it will likely use 4x25Gbps components for the first design, benefiting from emerging 100GbE CFP2 and CFP4 modules and their more integrated designs. But given the standard will only be completed in five years' time, new developments should also be expected.

No-one is talking about a potential bandwidth crunch but if it is to be avoided, greater investment in the key technologies will be needed. This will raise its own industry challenges. But nothing like those to be expected if the gap between bandwidth demand and available solutions grows.

The post-100 Gigabit era

Feature: Beyond 100G - Part 4

The latest coherent ASICs from Ciena and Alcatel-Lucent coupled with announcements from Cisco and Huawei highlight where the industry is heading with regard high-speed optical transport. But the announcements also raise questions too.

Source: Gazettabyte

Source: Gazettabyte

Observations and queries

- Optical transport has had a clear roadmap: 10 to 40 to 100 Gigabit-per-second (Gbps). 100Gbps optical transport will be the last of the fixed line-side speeds.

- After 100Gbps will come flexible speed-reach deployments. Line-side optics will be able to implement 50Gbps, 100Gbps, 200Gbps or even faster speeds with super-channels, tailored to the particular link.

- Variable speed-reach designs will blur the lines between metro and ultra long-haul. Does a traditional metro platform become a trans-Pacific submarine system simply by adding a new line card with the latest coherent ASIC boasting transmit and receive digital signal processors (DSPs), flexible modulation and soft-decision forward error correction?

Source: Gazettabyte

- The cleverness of optical transport has shifted towards electronics and digital signal processing and away from photonics. Optical system engineers are being taxed as never before as they try to extend the reach of 100, 200 and 400Gbps to match that of 10 and 40Gbps but what is key for platform differentiation is the DSP algorithms and ASIC design.

- Optical is the new radio. This is evident with the adding of a coherent transmit DSP that supports the various modulation schemes and allows spectral shaping, bunching carriers closer to make best use of the fibre's bandwidth.

- The radio analogy is fitting because fibre bandwidth is becoming a scarce resource. Usable fibre capacity has more than doubled with these latest ASIC announcements. Moving to 400Gbps doubles overall capacity to some 18 Terabits. Spectral shaping boosts that even further to over 23 Terabits. Last week 8.8 Terabits (88x100Gbps) was impressive.

- Maximising fibre capacity is why implementing single-carrier 100Gbps signals in 50GHz channels is now important.

- Super-channels, combining multiple carriers, have a lot of operational merits (see the super-channel section in the Cisco story). Infinera announced its 500Gbps super-channel over 250GHz last year. Now Ciena and Alcatel-Lucent highlight how a dual-carrier, dual-polarisation 16-QAM approach in 100GHz implements a 400Gbps signal.

- Despite all the talk of 16-QAM and 400Gbps wavelengths, 100Gbps is still in its infancy and will remain a key technology for years to come. Alcatel-Lucent, one of the early leaders in 100Gbps, has deployed 1,450 100 Gig line units since it launched its system in June 2010.

- Photonic integration for coherent will remain of key importance. Not so much in making yet more complex optical structures than at 100Gbps but shrinking what has already been done.

- Is there a next speed after 100Gbps? Is it 200Gbps until 400Gbps becomes established? Is it 500Gbps as Infinera argues? The answer is that it no longer matters. But then what exactly will operators use to assess the merits of the different vendors' platforms? Reach, power, platform density, spectral efficiency and line speeds are all key performance parameters but assessing each vendor's platform has clearly got harder.

- It is the system vendors not the merchant chip makers that are driving coherent ASIC innovation. The market for 100Gbps coherent merchant chips will remain an important opportunity given the early status of the market but how will coherent merchant chip vendors compete, several of them startups, with the system vendors' deeper pockets and sophisticated ASIC designs?

- Optical transponder vendors at least have more scope for differentiation but it is now also harder. Will one or two of the larger module makers even acquire a coherent ASSP maker?

- Infinera announced its 100G coherent system last year. Clearly it is already working on its next-generation ASIC. And while its DTN-X platform boasts a 500Gbps super-channel photonic chip, its overall system capacity is 8 Terabit (160x50Gbps, each in 25GHz channels). How will Infinera respond, not only with its next ASIC but also its next-generation PIC, to these latest announcements from Ciena and Alcatel-Lucent?

Challenges, progress & uncertainties facing the optical component industry

In recent years the industry has moved from direct detection to coherent transmission and has alighted on a flexible ROADM architecture. The result is a new level in optical networking sophistication. OFC/NFOEC 2012 will showcase the progress in these and other areas of industry consensus as well as shining a spotlight on issues less clear.

Optical component players may be forgiven for the odd envious glance towards the semiconductor industry and its well-defined industry dynamics.

The semiconductor industry has Moore’s Law that drives technological progress and the economics of chip-making. It also experiences semiconductor cycles - regular industry corrections caused by overcapacity and excess inventory. The semiconductor industry certainly has its challenges but it is well drilled in what to expect.

Optical challenges

The optical industry experienced its own version of a semiconductor cycle in 2010-11 - strong growth in 2010 followed by a correction in 2011. But such market dynamics are irregular and optical has no Moore's Law.

Optical players must therefore work harder to develop components to meet the rapid traffic growth while achieving cost efficiencies, denser designs and power savings.

Such efficiencies are even more important as the marketplace becomes more complex due to changes in the industry layers above components. The added applications layer above networks was highlighted in the OFC/NFOEC 2012 news analysis by Ovum’s Karen Liu. The analyst also pointed out that operators’ revenues and capex growth rates are set to halve in the years till 2017 compared to 2006-2010.

Such is the challenging backdrop facing optical component players.

Consensus

Coherent has become the defacto standard for long-haul high-speed transmission. Optical system vendors have largely launched their 100Gbps systems and have set their design engineers on the next challenge: addressing designs for line rates beyond 100Gbps.

Infinera detailed its 500Gbps super-channel photonic integrated circuit last year. At OFC/NFOEC it will be interesting to learn how other equipment makers are tackling such designs and what activity and requests optical component vendors are seeing regarding the next line rates after 100Gbps.

Meanwhile new chip designs for transport and switching at 100Gbps are expected at the show. AppliedMicro is sampling its gearbox chip that supports 100 Gigabit Ethernet and OTU4 optical interfaces. More announcements should be expected regarding merchant 100Gbps digital signal processing ASIC designs.

An architectural consensus for wavelength-selective switches (WSSes) - the key building block of ROADMs - are taking shape with the industry consolidating on a route-and-select architecture, according to analysts.

Gridless - the ROADM attribute that supports differing spectral widths expected for line rates above 100Gbps - is a key characteristic that WSSes must support, resulting in more vendors announcing liquid crystal on silicon designs.

Client-side 40 and 100 Gigabit Ethernet (GbE) interfaces have a clearer module roadmap than line-side transmission. After the CFP comes the CFP2 and CFP4 which promise denser interfaces and Terabit capacity blades. Module form factors such as the QSFP+ at 40GbE and in time 100GbE CFP4s require integrated photonic designs. This is a development to watch for at the show.

Others areas to note include tunable-laser XFPs and even tunable SFP+, work on which has already been announced by JDS Uniphase.

Lastly, short-link interfaces and in particular optical engines is another important segment that ultimately promises new system designs and the market opportunity that will unleash silicon photonics.

Optical engines can simplify high-speed backplane designs and printed circuit board electronics. Electrical interfaces moving to 25Gbps is seen as the threshold trigger when switch makers decide whether to move their next designs to an optical backplane.

The Optical Internetworking Forum will have a Physical and Link Layer (PLL) demonstration to showcase interoperability of the Forum’s Common Electrical Interface (CEI) 28Gbps Very Short Reach (VSR) chip-to-module electrical interfaces, as well as a demonstration of the CEI-25G-LR backplane interface.

Companies participating in the interop include Altera, Amphenol, Fujitsu Optical Components, Gennum, IBM, Inphi, Luxtera, Molex, TE Connectivity and Xilinx.

Altera has already unveiled a FGPA prototype that co-packages 12x10Gbps transmitter and receiver optical engines alongside its FPGA.

Uncertainties

OFC/NFOEC 2012 also provides an opportunity to assess progress in sectors and technology where there is less clarity. Two sectors of note are next-generation PON and the 100Gbps direct-detect market.

For next-generation PON, several ideas are being pursued, faster extensions of existing PON schemes such as a 40Gbps version of the existing time devision multiplexing PON schemes, 40G PON based on hybrid WDM and TDM schemes, WDM-PON and even ultra dense WDM-PON and OFDM-based PON schemes.

The upcoming show will not answer what the likely schemes will be but will provide an opportunity to test what the latest thinking is.

The same applies for 100 Gigabit direct detection.

There are significant cost advantages to this approach and there is an opportunity for the technology in the metro and for data centre connectivity. But so far announcements have been limited and operators are still to fully assess the technology. Further announcements at OFC/NFOEC will highlight the progress being made here.

The article has been written as a news analysis published by the organisers before this year's OFC/NFOEC event.