Ciena shops for photonic technology for line-side edge

Part 3: Acquisitions and silicon photonics

Ciena is to acquire the high-speed photonics components division of Teraxion for $32 million. The deal includes 35 employees and Teraxion’s indium phosphide and silicon photonics technologies. The systems vendor is making the acquisition to benefit its coherent-based packet-optical transmission systems in metro and long-haul networks.

Sterling Perrin

Sterling Perrin

“Historically Ciena has been a step ahead of others in introducing new coherent capabilities to the market,” says Ron Kline, principal analyst, intelligent networks at market research company, Ovum. “The technology is critical to own if they want to maintain their edge.”

“Bringing in-house not everything, just piece parts, are becoming differentiators,” says Sterling Perrin, senior analyst at Heavy Reading.

Ciena designs its own WaveLogic coherent DSP-ASICs but buys its optical components. Having its own photonics design team with expertise in indium-phosphide and silicon photonics will allow Ciena to develop complete line-side systems, optimising the photonics and electronics to benefit system performance.

Owning both the photonics and optics also promises to reduce power consumption and improve line-side port density.

“These assets will give us greater control of a critical roadmap component for the advancement of those coherent solutions,” a Ciena spokesperson told Gazettabyte. “These assets will give us greater control of a critical enabling technology to accelerate the pace of our innovation and speed our time-to-market for key packet-optical solutions.”

Ciena have always been do-it-yourself when it comes to optics, and it is an area where they has a huge heritage. So it is an interesting admission that they need somebody else to help them.

The OME 6500 packet optical platform remains a critical system for Ciena in terms of revenues, according to a recent report from the financial analyst firm, Jefferies.

Ciena have always been do-it-yourself when it comes to optics, and it is an area where they have a huge heritage, says Perrin: “So it is an interesting admission that they need somebody else to help them.” It is the silicon photonics technology not just photonic integration that is of importance to Ciena, he says.

Coherent competition

Infinera, which designs its own photonic integrated circuits (PICs) and coherent DSP-ASIC, recently detailed its next-generation coherent toolkit prior to the launch of its terabit PIC and coherent DSP-ASIC. The toolkit uses sub-carriers, parallel processing soft-decision forward-error correction (SD-FEC) and enhanced modulation techniques. These improvements reflect the tighter integration between photonics and electronics for optical transport.

Cisco Systems is another system vendor that develops its own coherent ASICs and has silicon photonics expertise with its Lightwire acquisition in 2012, as does Coriant which works with strategic partners while using merchant coherent processors. Huawei has photonic integration expertise with its acquisitions of indium phosphide UK specialist CIP Technologies in 2012 and Belgian silicon photonics start-up Caliopa in 2013.

Cisco may have started the ball rolling when they acquired silicon photonics start-up Lightwire, and at the time they were criticised for doing so, says Perrin: “This [Ciena move] seems to be partially a response, at least a validation, to what Cisco did, bringing that in-house.”

Optical module maker Acacia also has silicon photonics and DSP-ASIC expertise. Acacia has launched 100 gigabit and 200-400 gigabit CFP optical modules that use silicon photonics.

Companies like Coriant and lots of mid-tier players can use Acacia and rely on the expertise the start-up is driving in photonic integration on the line side, says Perrin. ”Now Ciena wants to own the whole thing which, to me, means they need to move more rapidly, probably driven by the Acacia development.”

Teraxion

Ciena has been working with Canadian firm Teraxion for a long time and the two have a co-development agreement, says Perrin.

Teraxion was founded in 2000 during the optical boom, specialising in dispersion compensation modules and fibre Bragg gratings. In recent years, it has added indium-phosphide and silicon photonics expertise and in 2013 acquired Cogo Optronics, adding indium-phosphide modulator technology.

Teraxion detailed an indium phosphide modulator suited to 400 gigabit at ECOC 2015. Teraxion said at the time that it had demonstrated a 400-gigabit single-wavelength transmission over 500km using polarisation-multiplexed, 16-QAM (PM-16QAM), operating at a symbol rate of 56 gigabaud.

It also has a coherent receiver technology implemented using silicon photonics.

The remaining business of Teraxion covers fibre-optic communication, fibre lasers and optical-sensing applications which employs 120 staff will continue in Québec City.

Ovum Q&A: Infinera as an end-to-end systems vendor

Infinera hosted an Insight analyst day on October 6th to highlight its plans now that it has acquired metro equipment player, Transmode. Gazettabyte interviewed Ron Kline, principal analyst, intelligent networks at market research firm, Ovum, who attended the event.

Q. Infinera’s CEO Tom Fallon referred to this period as a once-in-a-decade transition as metro moves from 10 Gig to 100 Gig. The growth is attributed mainly to the uptake of cloud services and he expects this transition to last for a while. Is this Ovum’s take?

Ron Kline, OvumRK: It is a transition but it is more about coherent technology rather than 10 Gig to 100 Gig. Coherent enables that higher-speed change which is required because of the level of bandwidth going on in the metro.

Ron Kline, OvumRK: It is a transition but it is more about coherent technology rather than 10 Gig to 100 Gig. Coherent enables that higher-speed change which is required because of the level of bandwidth going on in the metro.

We are going to see metro change from 10 Gig to 100 Gig, much like we saw it change from 2.5 Gig to 10 Gig. Economically, it is going to be more feasible for operators to deploy 100 Gig and get more bang for their buck.

Ten years is always a good number from any transition. If you look at SONET/SDH, it began in the early 1990s and by 2000 was mainstream.

If you look at transitions, you had a ten-year time lag to get from 2.5 Gig to 10 Gig and you had another ten years for the development of 40 Gig, although that was impacted by the optical bubble and the [2008] financial crisis. But when coherent came around, you had a three-year cycle for 100 gigabit. Now you are in the same three-year cycle for 200 and 400 gigabit.

Is 100 Gig the unit of currency? I think all logic tells us it is. But I’m not sure that ends up being the story here.

If you get line systems that are truly open then optical networking becomes commodity-based transponders - the white box phenomenon - then where is the differentiation? It moves into the software realm and that becomes a much more important differentiator.

Infinera’s CEO asserted that technology differentiation has never been more important in this industry. Is this true or only for certain platforms such as for optical networking and core routers?

If you look at Infinera, you would say their chief differentiator is the PIC (photonic integrated circuit) as it has enabled them to do very well. But other players really have not tried it. Huawei does a little but only in the metro and access.

It is true that you need differentiation, particularly for something as specialised as optical networking. The edge has always gone to the company that can innovate quickest. That is how Nortel did it; they were first with 10 gigabit for long haul and dominated the market.

When you look at coherent, the edge has gone to the quickest: Ciena, Alcatel-Lucent, Huawei and to a certain extent Infinera. Then you throw in the PIC and that gives Infinera an edge.

But then, on the flip side, there is this notion of disaggregation. Nobody likes to say it but it is the commoditisation of the technology; that is certainly the way the content providers are going.

If you get line systems that are truly open then optical networking becomes commodity-based transponders - the white box phenomenon - then where is the differentiation? It moves into the software realm and that becomes a much more important differentiator.

I do think differentiation is important; it always is. But I’m not sure how long your advantage is these days.

Infinera argues that the acquisition of Transmode will triple the total available market it can address.

Infinera definitely increases its total available market. They only had an addressable market related to long haul and submarine line terminating equipment. Now this [acquisition of Transmode] really opens the door. They can do metro, access, mobile backhaul; they can do a lot of different things.

We don’t necessarily agree with the numbers, though, it more a doubling of the addressable market.

The rolling annual long-haul backbone global market (3Q 2014 to 2Q 2015) and the submarine line terminating equipment market where they play [pre-Transmode] was $5.2 billion. If you assume the total market of $14.2 billion is addressable then yes it is nearly a tripling but that includes the legacy SONET/SDH and Bandwidth Management segments which are rapidly declining. Nevertheless, Tom’s point is well-taken, adding a further $5.8 billion for the metro and access WDM markets to their total addressable market is significant.

Tom Fallon also said vendor consolidation will continue, and companies will need to have scale because of the very large amounts of R&D needed to drive differentiation. Is scale needed for a greater R&D spend to stay ahead of the competition?

When you respond to an operator’s request-for-proposal, that is where having end-to-end scale helps Infinera; being able to be a one-stop shop for the metro and long haul.

If I’m an operator, I don’t have to get products from several vendors and be the systems integrator.

Infinera announced a new platform for long haul, the XT-500, which is described as a telecom version of its data centre interconnect Cloud Xpress platform. Why do service providers want such a platform, and how does it differ from cloud Xpress?

Infinera’s DTN-X long haul platform is very high capacity and there are applications where you don’t need a such a large platform. That is one application.

The other is where you lease space [to house your equipment]. If I am going to lease space, if I have a box that is 2 RU (rack unit) high and can do 500 gigabit point-to-point and I don’t need any cross-connect, then this smaller shelf size makes a lot of sense. I’m just transporting bandwidth.

Cloud Xpress is a scaled-down product for the metro. The XT-500 is carrier-class, e.g. NEBS [Network Equipment-Building System] compliant and can span long-haul distances.

Infinera has also announced the XTC-2. What is the main purpose of this platform?

The platform is a smaller DTN-X variant to serve smaller regions. For example you can take a 500 gigabit PIC super-channel and slice it up. That enables you to do a hub-and-spoke virtual ring and drop 100 Gig wavelengths at appropriate places. The system uses the new metro PICs introduced in March. At the hub location you use an ePIC that slices up the 500G into individually routable 100G channels and at the hub location, where the XTC-2 is, you use an oPIC-100.

Does the oPIC-100 offer any advantage compared to existing100 Gig optics?

I don’t think it has a huge edge other than the differentiation you get from a PIC. In fact it might be a deterrent: you have to buy it from Infinera. It is also anti-trend, where the trend is pluggables.

But the hub and spoke architecture is innovative and it will be interesting to see what they do with the integration of PIC technology in Transmode’s gear.

Acquiring Transmode provides Infinera with an end-to-end networking portfolio? Does it still lack important elements? For example, Ciena acquired Cyan and gained its Blue Planet SDN software.

Transmode has a lot of different technologies required in the metro: mobile back-haul, synchronisation, they are also working on mobile front-hauling, and their hardware is low power.

Transmode has pretty much everything you need in these smaller platforms. But it is the software piece that they don’t have. Infinera has a strategy that says: we are not going to do this; we are going to be open and others can come in through an interface essentially and run our equipment.

That will certainly work.

But if you take a long view that says that in future technology will be commoditised, then you are in a bad spot because all the value moves to the software and you, as a company, are not investing and driving that software. So, this could be a huge problem going forward.

What are the main challenges Infinera faces?

One challenge, as mentioned, is hardware commoditisation and the issue of software.

Hardware commodity can play in Infinera’s favour. Infinera should have the lowest-cost solution given its integrated solution, so large hardware volumes is good for them. But if pluggable optics is a requirement, then they could be in trouble with this strategy

The other is keeping up with the Joneses.

I think the 500 Gig in 100 Gig channels is now not that exciting. The 500 Gig PIC is not creating as much advantage as it did before. Where is the 1.2 terabit PIC? Where is the next version that drives Infinera forward?

And is it still going to be 100 Gig? They are leading me to believe it won’t just be. Are they going to have a PIC that is 12 channels that are tunable in modulation formats to go from 100 to 200 to 400 Gig.

They need to if they want to stay competitive with everyone else because the market is moving to 200 Gig and 400 Gig. Our figures show that over 2,000 multi-rate (QPSK and 16-QAM) ports have been shipped in the last year (3Q 2014 to 2Q 2015). And now you have 8-QAM coming. Infinera’s PIC is going to have to support this.

Infinera’s edge is the PIC but if you don’t keep progressing the PIC, it is no longer an edge.

These are the challenges facing Infinera and it is not that easy to do these things.

Infinera introduces flexible grid 500G super-channel ROADM

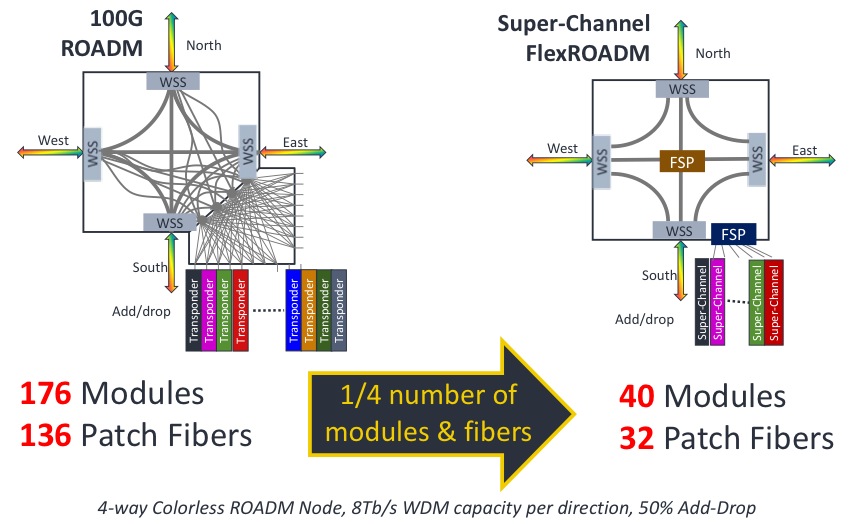

An example showing the impact of a 500G super-channel ROADM node. Source: Infinera

An example showing the impact of a 500G super-channel ROADM node. Source: Infinera

"The FlexROADM will open up the Tier-1 operators in a way Infinera has not been able to do before," says Dana Cooperson, vice president, network infrastructure at market research firm, Ovum. "The DTN-X was necessary but not sufficient; the ROADM is the last piece."

The FlexROADM is claimed to deliver two industry firsts: it can add and drop flexible-grid-based 500 Gig super-channels, and uses the Internet Engineering Task Force’s (IETF) spectrum switched optical networks (SSON).

"SSON is the next generation of WSON [Wavelength Switched Optical Network control plane], except it manages spectrum," says Ron Kline, principal analyst, network infrastructure also at Ovum.

The DTN-X platform combines Infinera's 500 Gig photonic integrated circuits and OTN (Optical Transport Network) switching. With the FlexROADM, Infinera has added switching at the optical layer in 500 Gig increments. Infinera can now offer enhanced multi-layer network optimisation with the combination of electrical and optical switching.

"Optical bypass before was manual using patch cords, now operators can reconfigure with the FlexROADM," says Kline. "It also provides new optical restoration capabilities that Infinera did not have."

The FlexROADM supports up to nine degrees, and is available in colourless, colourless and directionless, and full colourless, directionless and contentionless (CDC) versions.

"The debate about contentionless continues," says Kline. "It is safe to assume that for the majority of applications flexible grid, colourless and directionless will be the high runner." Contentionless will be used by the big carriers, he says, but in certain locations only.

Infinera says the line system announced will support up to 24 Terabit-per-second (Tbps) when it ships in September. The maximum long-haul capacity using its current PM-QPSK super-channels is 9.5Tbps per fibre pair.

"In the future when we enable metro-reach super-channels using PM-16-QAM, they will support 24 Terabit-per-second per fibre pair using the line system we are announcing," says Geoff Bennett, director, solutions and technology at Infinera.

Bennett says the data rate and the spectral efficiency for a given sub-carrier can be varied depending on the reach required. The spacing between sub-carriers that make up a super-channel also can be varied depending on reach. Many different transmission possibilities exist, says Bennett, but to explain the concept, he cites two examples.

The 24Tbps capacity with PM-16-QAM modulation uses pulse shaping at the transmitter to achieve 'Nyquist DWDM' channel spacing, the spacing between channels that approximates the baud rate, says Bennett.

"At this time we are not disclosing the details of the channel spacing, or the number of sub-carriers used by our future line modules," says Bennett. "But the total super-channel spectral width is the equivalent of 200GHz if you are transmitting a one Terabit super-channel, for example." This equates to a spectral efficiency of 5b/s/Hz, and using 16-QAM, the reach achieved will be 600-700km.

"The system we have just launched is designed to operate in long-haul networks and uses PM-QPSK," says Bennett. "For an ultra long-haul reach requirement of 4,500km, the super-channel comprises ten sub-carriers; a total of 500 Gbps over a spectral width of 250 GHz." These line cards are available now, he says.

Infinera continues to make steady market progress, according to Ovum. The company is in the top 10 system vendors globally, while in backbone and 100 Gigabit, Infinera is fourth.

Ovum on Infinera's Intelligent Transport Network strategy

Infinera announced that TeliaSonera International Carrier (TSIC) is extending the use of its DTN-X to its European network, having already adopted the platform in the US. Infinera has also outlined the next evolution in its networking strategy, dubbed the Intelligent Transport Network.

Dana Cooperson

Dana Cooperson

Gazettabyte asked Dana Cooperson, vice president and practice leader, and Ron Kline, principal analyst, both in the network infrastructure group at market research firm, Ovum, about the announcement and Infinera's outlined strategy.

What has been announced

TSIC is adding Infinera's DTN-X to boost network capacity in Europe and accommodate its own growing IP traffic. TSIC already has deployed 100 Gig technology in its European network, using a Coriant product. The wholesale operator will sell 100 Gig services, activating capacity using the DTN-X's 'instant bandwidth' feature based on already-lit 100 Gig light paths that make up its 500 Gigabit super-channels.

Meanwhile, Infinera has detailed its Intelligent Transport Network strategy that extends its digital optical network that performs optical-electrical-optical (OEO) conversion using its 500 Gig photonic integrated circuits (PICs) coupled with OTN (Optical Transport Network) switching to include additional features. These include multi-layer switching – reconfigurable optical add/drop multiplexers (ROADMs) and MPLS (Multi-Protocol Label Switching) – and PICs with terabit capacity

Q&A with Dana Cooperson and Ron Kline

Q. What is significant about Infinera's Intelligent Transport Network strategy?

Dana C: Infinera is being more public about its longer-term strategy - to 2020 - which includes evolving from its digital optical network messaging to a network that includes multiple layers and types of switching, and more automation. Infinera is not announcing more functionality availability now.

Infinera makes much play about its 500 Gig super-channels. More recently it has detailed such platform features as instant bandwidth and Fast Shared Mesh Protection supported in hardware. Are these features giving operators something new and is Infinera gaining market share as a result?

Dana C: Instant Bandwidth provides a way for Infinera’s operator customers to have their cake and eat it. They can install 500 Gig super-channels ahead of demand, and not pay for each 100 Gig sub-channel until they have a need for that bandwidth. It is a simple process at that point to 'turn on' the next 100 Gig worth of bandwidth within the super-channel.

By installing all five 100 Gig channels at once, the operator can simplify operations - lower opex - and allow quicker time-to-revenue without having to take the capex hit until the bandwidth needs materialise. This is an improvement over the DTN platform, which gave customers the 10x10 Gig architecture to let them pre-position bandwidth before the need for it materialised and save on opex, but at the cost of higher up-front capex than was ideal.

Talking to TSIC confirm that this added flexibility the DTN-X provides has allowed them to win wholesale business from competitors while tying capex more directly to revenue.

Ron K: Although pay-as-you go capability is available, analysis of 100 Gig shipments to date indicate most customers are paying for all five up front.

Dana C: I have not directly talked with an Infinera customer that has confirmed the benefit of Fast Shared Mesh Protection, but the feature certainly seems to be of value to customers and prospects. Our research indicates the continued search for better, more efficient mesh protection. Hardware-enabled protection should provide better latency (higher speed).

Ron K: Resiliency and mesh protection are critical requirements if you want to participate in the market. Shared mesh assumes that you have idle protection capacity available in case there is a failure. That is expensive. However, with Infinera’s technology - the PIC and Instant Bandwidth - it is not as difficult.

Restoration is all about speed – how fast can you get the network back up. It is not always milliseconds, sometimes it is half a minute. But during catastrophic failure events such as an earthquake, where a user can loose entire nodes, 30 seconds may not be so bad. Infinera has implemented the switch in hardware, based on a pre-planned map, so it is quicker.

Dana C: As for what impact these capabilities are having on market share, Infinera has climbed to the No.3 player in 100 Gig DWDM in three quarters since the DTN-X has become available.

They’ve jumped back up to No.4 globally in backbone WDM/CPO-T (converged packet optical transport) after sinking to sixth when they were losing share because they were without a viable 40 Gig solution. They made the right call at that time to focus on 100 Gig systems based on the 500 Gig PIC rather than chase 40 Gig. They are both keeping and expanding with existing DTN customers, TSIC being one, and picking up new customers.

Ron Kline

Ron Kline

Ron K:They are definitely picking up share. However, I’m not sure if they can sustain it. The reason for the share jump is they are selling 100 Gig, five at a time. Remember, most customers elect to pay for all five. That means future sales will lag because customers have pre-positioned the bandwidth.

Looking at the customers is probably a better indicator: Infinera has some 27 customers, maybe 30 by now, which provide a good embedded base. Still, 27 customers is low compared to Ciena, Alcatel-Lucent, Huawei and even Cisco.

When Infinera first announced the DTN-X in 2011 it talked about how it would add MPLS support. Now outlining its Intelligent Transport Network strategy it has still to announce MPLS support. Do operators not need this network feature yet in such platforms and if not, why?

Dana C: The market is still sorting out exactly what is needed for sub-wavelength switching and where it is needed. Cisco’s and Juniper’s approaches are very different in the routing world —essentially, a lower-cost MPLS blade for the CRS versus a whole new box in the PTX; there is no right way there.

Within packet-aware optical products, the same is true: What is the right level of integration of OTN versus MPLS? It depends on where you are in the network, what that carrier’s service mix is, and how fast the mix is changing.

Many carriers are still struggling with their rigid organisational structures, and how best to manage products that are optical and packet in equal measure. So I don’t think Infinera is late, they are just reacting to their customers’ priorities and doing other things first.

Ron K: This is the $64,000 question: MPLS versus OTN. I’m not sure how it will eventually play out. I am asking service providers now.

OTN is a carrier protocol developed for carriers by carriers (the replacement for SONET/SDH). They will be the ones to use it because they have multi-service networks and need the transparency OTN provides. Google types and cable operators will not use OTN switching - they will lean towards the label-switched path (LSP) route. Even Tier-1 operators who have both types of networks will most likely maintain separation.

"The trick is to optimise around the requirements that net you the biggest total available market and which maximise your strengths and minimise your weaknesses. You can’t be all things to all carriers."

If Infinera has its digital optical network, why is it now also talking about ROADMs? And does having both benefit operators?

Dana C: Yes, having both benefits operators. From discussions with Infinera's customers, it is true that the digital nodes give them flexibility, but they do introduce added cost. For those nodes where customers have little need to add/ drop traffic, a ROADM would provide a more cost-efficient option to a node that performs OEO for all the traffic. So, with a ROADM option customers would have more control over node design.

Infinera talks about its next-gen PICs that will support a Terabit and more. After nearly a decade of making PICs, how does Ovum view the significance of the technology?

Dana C: While more vendors are doing photonic integration R&D, and some - Huawei comes to mind - have released some PIC-based products, no one has come close to Infinera in what it can do with photonic integration. Speaking with quite a few of Infinera’s customers, they are very happy with the technology, the system, and the support.

Each generation of PIC requires a significant R&D effort, but it does provide differentiation. Infinera has managed to stay focused and implement on time and on spec. I see them as the epitome of a “specialist” vendor. They are of similar size to Coriant and Tellabs, which have seen their fortunes wane, and ADVA Optical Networking. So I would say they are a very good example of what focus and differentiation can do.

Now, is the PIC the only way to approach system architecture? No. As noted before, some Infinera clients have told me that the lack of a ROADM has hurt them in competitive situations, as did the need to pay for all the pre-positioned bandwidth up front (true for the DTN, not the DTN-X).

From my days in product development, I know you have to optimise around a set of requirements, and the trick is to optimise around the requirements that net you the biggest total available market and which maximise your strengths and minimise your weaknesses. You can’t be all things to all carriers.

What is significant about the latest TeliaSonera network win and what does it mean for Coriant?

Dana C: Infinera is announcing an extension of its deployments at TSIC from North America to now include Europe as well. When you ask what this means to Coriant, their incumbent supplier in Europe, the answer is not clear cut. This gives Infinera an expanded hunting licence and it gives Coriant some cause for worry.

TSIC values both vendors and both will have their place in the European network. TSIC plans to use the vendors in different regions.

I am sure TSIC will try and play each off against the other to get the best price. It is looking for more flexibility and some healthy competition.