Ranovus shows 200 gigabit direct detection at ECOC

Ranovus has announced it first direct-detection optical products for applications including data centre interconnect.

One product is a 200 gigabit-per-second (Gbps) dense wavelength-division multiplexing (WDM) CFP2 pluggable optical module that spans distances up to 130km. Ranovus will also sell the 200Gbps transmitter and receiver optical engines that can be integrated by vendors onto a host line card.

The dense WDM direct-detection solution from Ranovus is being positioned as a cheaper, lower-power alternative to coherent optics used for high-capacity metro and long-haul optical transport. Using such technology, service providers can link their data centre buildings distributed across a metro area.

The cost [of the CFP2 direct detection] proves in much better than coherent

“The power consumption [of the direct-detection design] is well within the envelope of what the CFP2 power budget is,” says Saeid Aramideh, a Ranovus co-founder and chief marketing. The CFP2 module's power envelop is rated at 12W and while there are pluggable CFP2-ACO modules now available, a coherent DSP-ASIC is required to work alongside the module.

“The cost [of the CFP2 direct detection] proves in much better than coherent does,” says Aramideh, although he points out that for distances greater than 120km, the economics change.

The 200Gbps CFP2 module uses four wavelengths, each at 50Gbps. Ranovus is using 25Gbps optics with 4-level pulse-amplitude modulation (PAM-4) technology provided by fabless chip company Broadcom to achieve the 50Gbps channels. Up to 96, 50 Gbps channels can be fitted in the C-band to achieve a total transmission bandwidth of 4.8 terabits.

Ranovus is demonstrating at ECOC eight wavelengths being sent over 100km of fibre. The link uses a standard erbium-doped fibre amplifier and the forward-error correction scheme built into PAM-4.

Technologies

Ranovus has developed several key technologies for its proprietary optical interconnect products. These include a multi-wavelength quantum dot laser, a silicon photonics based ring-resonator modulator, an optical receiver, and the associated driver and receiver electronics.

The quantum dot technology implements what is known as a comb laser, producing multiple laser outputs at wavelengths and grid spacings that are defined during fabrication. For the CFP2, the laser produces four wavelengths spaced 50GHz apart.

For the 200Gbps optical engine transmitter, the laser outputs are fed to four silicon photonics ring-resonator modulators to produce the four output wavelengths, while at the receiver there is an equivalent bank of tuned ring resonators that delivers the wavelengths to the photo-detectors. Ranovus has developed several receiver designs, with the lower channel count version being silicon photonics based.

The quantum dot technology implements what is known as a comb laser, producing multiple laser outputs at wavelengths and grid spacings that are defined during fabrication.

The use of ring resonators - effectively filters - at the receiver means that no multiplexer or demultiplexer is needed within the optical module.

“At some point before you go to the fibre, there is a multiplexer because you are multiplexing up to 96 channels in the C-band,” says Aramideh. “But that multiplexer is not needed inside the module.”

Company plans

The startup has raised $35 million in investment funding to date. Aramideh says the start-up is not seeking a further funding round but he does not rule it out.

The most recent funding round, for $24 million, was in 2014. At the time the company was planning to release its first product - a QSFP28 100-Gigabit OpenOptics module - in 2015. Ranovus along with Mellanox Technologies are co-founders of the dense WDM OpenOptics multi-source agreement that supports client side interface speeds at 100Gbps, 400Gbps and terabit speeds.

However, the company realised that 100-gigabit links within the data centre were being served by the coarse WDM CWDM4 and CLR4 module standards, and it chose instead to focus on the data centre interconnect market using its direct detection technology.

Ranovus has also been working with ADVA Optical Networking with it data centre interconnect technology. Last year, ADVA Optical Networking announced its FSP 3000 CloudConnect data centre interconnect platform that can span both the C- and L-bands.

Also planned by Ranovus is a 400-gigabit CFP8 module - which could be a four or eight channel design - for the data centre interconnect market.

Meanwhile, the CFP2 direct-detection module and the optical engine will be generally available from December.

Ranovus readies its interfaces for deployment

- Products will be deployed in the first half of 2015

- Ranovus has raised US $24 million in a second funding round

- The start-up is a co-founder of the OpenOptics MSA; Oracle is now also an MSA member.

Ranovus says its interconnect products will be deployed in the first half of 2015. The start-up, which is developing WDM-based interfaces for use in and between data centres, has raised US $24 million in a second stage funding round. The company first raised $11 million in September 2013.

Saeid Aramideh"There is a lot of excitement around technologies being developed for the data centre," says Saeid Aramideh, a Ranovus co-founder and chief marketing and sales officer. He highlights such technologies as switch ICs, software-defined networking (SDN), and components that deliver cost savings and power-consumption reductions. "Definitely, there is a lot of money available if you have the right team and value proposition," says Aramideh. "Not just in Silicon Valley is there interest, but in Canada and the EU."

Saeid Aramideh"There is a lot of excitement around technologies being developed for the data centre," says Saeid Aramideh, a Ranovus co-founder and chief marketing and sales officer. He highlights such technologies as switch ICs, software-defined networking (SDN), and components that deliver cost savings and power-consumption reductions. "Definitely, there is a lot of money available if you have the right team and value proposition," says Aramideh. "Not just in Silicon Valley is there interest, but in Canada and the EU."

The optical start-up's core technology is a quantum dot multi-wavelength laser which it is combining with silicon photonics and electronics to create WDM-based optical engines. With the laser, a single gain block provides several channels while Ranovus is using a ring resonator implemented in silicon photonics for modulation. The company is also designing the electronics that accompanies the optics.

Aramideh says the use of silicon photonics is a key part of the design. "How do you enable cost-effective WDM?" he says."It is not possible without silicon photonics." The right cost points for key components such as the modulator can be achieved using the technology. "It would be ten times the cost if you didn't do it with silicon photonics," he says.

The firm has been working with several large internet content providers to turn its core technology into products. "We have partnered with leading data centre operators to make sure we develop the right products for what these folks are looking for," says Aramideh.

In the last year, the start-up has been developing variants of its laser technology - in terms of line width and output power - for the products it is planning. "A lot goes into getting a laser qualified," says Aramideh. The company has also opened a site in Nuremberg alongside its headquarters in Ottawa and its Silicon Valley office. The latest capital will be used to ready the company's technology for manufacturing and recruit more R&D staff, particularly at its Nuremberg site.

Ranovus is a founding member, along with Mellanox, of the 100 Gigabit OpenOptics multi-source agreement. Oracle, Vertilas and Ghiasi Quantum have since joined the MSA. The 4x25 Gig OpenOptics MSA has a reach of 2km-plus and will be implemented using a QSFP28 optical module. OpenOptics differs from the other mid-reach interfaces - the CWDM4, PSM4 and the CLR4 - in that it uses lasers at 1550nm and is dense wavelength-division multiplexed (DWDM) based.

It is never good that an industry is fragmented

That there are as many as four competing mid-reach optical module developments, is that not a concern? "It is never good that an industry is fragmented," says Aramideh. He also dismisses a concern that the other MSAs have established large optical module manufacturers as members whereas OpenOptics does not.

"We ran a module company [in the past - CoreOptics]; we have delivered module solutions to various OEMs that are running is some of the largest networks deployed today," says Aramideh. "Mellanox [the other MSA co-founder] is also a very capable solution provider."

Ranovus plans to use contract manufacturers in Asia Pacific to make its products, the same contract manufacturers the leading optical module makers use.

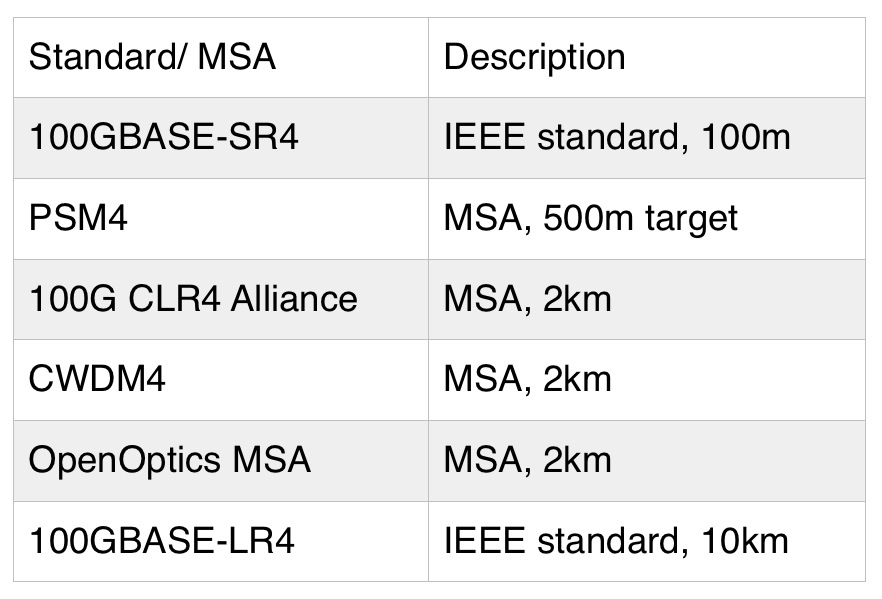

Table 1: The OpenOptics MSA

Table 1: The OpenOptics MSA

End markets

"I don't think as a business, anyone can ignore the big players upgrading data centres," says Aramideh. "The likes of Google, Facebook, Amazon, Apple and others that are switching from a three-tier architecture to a leaf and spine need longer-reach connectivity and much higher capacity." The capacity requirements are much beyond 10 Gig and 40 Gig, and even 100 Gig, he says.

Ranovus segments the adopters of interconnect into two: the mass market and the technology adopters. "Mass adoption today is all MSA-based," says Aramideh. "The -LR4 and -SR10, and the same thing is happening at 100 Gig with the QSFP28." The challenge for the optical module companies is who has the lowest cost.

Then there are the industry leaders such as the large internet content providers that want innovative products that address their needs now. "They are less concerned about multi-source standard-based solutions if you can show them you can deliver a product they need at the right cost," says Aramideh.

Ranovus will offer an optical engine as well as the QSFP28 optical module. "The notion of the integration of an optical engine with switch ICs and other piece parts in the data centre are more of an urgent need," he says.

Using WDM technology, the company has a scalable roadmap that includes 8x25 Gig and 16x25 Gig (400 Gig) designs. Also, by adding higher-order modulation, the technology will scale to 1.6 Terabit (16x100 Gig), says Aramideh.

I don't see a roadmap for coherent to become cost-effective to address the smaller distances

Ranovus is also working on interfaces to link data centres.

"These are distances much shorter than metro/ regional networks," says Aramideh, with the bulk of the requirements being for links of 15 to 40km. For such relatively short distances, coherent detection technology has a high-power consumption and is expensive. "I don't see a roadmap for coherent to become cost-effective to address the smaller distances," says Aramideh.

Instead, the company believes that a direct-detection interconnect that supports 15 to 40km and which has a spectral efficiency that can scale to 9.6 Terabit is the right way to go. If that can be achieved, then switching from coherent to direct detection becomes a no-brainer, he says. "For inter-data-centres, we are really offering an alternative to coherent."

The start-up says its technology will be in product deployment with lead customers in the first half of 2015.

Module makers rush to fill the 100 Gig mid-reach void

You may give little thought as to how your Facebook page is constructed each time you log in, or the data centre ramifications when you access Gmail. But for the internet giants, what is clear is that they need cheaper, higher-speed optical links to connect their equipment that match the growing size of their hyper-scale data centres.

The challenge for the web players is that existing 100 Gig links are either too short or too expensive. Ten and 40 Gig multimode interfaces span 300m, but at 100 Gig the reach plummets; the existing IEEE 802.3 Ethernet 100GBASE-SR10 and 100GBASE-SR4 multi-mode standards are 100m only. Meanwhile, the 10km reach of the next IEEE interface option, the 100 Gig single-mode 100GBASE-LR4, is overkill and expensive; the LR4 being sevenfold the cost of the 100GBASE-SR10, according to market research firm, LightCounting.

"The largest data centre operators will tell you less than 1km, less than 500m, is their sweet spot," says Martin Hull, director of product management at switch vendor, Arista Networks. Hyperscale data centres use a flatter switching architecture known as leaf and spine. "The flatter switching architectures require larger quantities of economical links between the leaf and spine switches," says Dale Murray, principal analyst at LightCounting.

A 'leaf' can be a top-of-rack switch connecting the servers to the larger-capacity 'spine' of the switch architecture. Operators want 100GbE interfaces with sufficient optical link budget to span 500m and greater distances, to interconnect the leaf and spine, or the spine to the data centre's edge router.

The optical industry has been heeding the web companies' request.

One reason the IEEE 802.3 Ethernet Working Group created the 802.3bm Task Force is to address mid-reach demand by creating a specification for a cheaper 500m interface. Four proposals emerged: parallel single mode (PSM4), coarse WDM (CWDM), pulse amplitude modulation, and discrete multi-tone. But none of the proposals passed the 75% voting threshold to become a standard.

The optical industry has since pursued a multi-source agreement (MSA) strategy to bring the much-needed solutions to market. In the last year, no fewer than four single-mode interfaces have emerged: the CLR4 Alliance, and the CWDM4, PSM4 and OpenOptics MSAs.

"The MSA-based solutions will have two important advantages," says Murray. "All will be much less expensive than a 10km 100Gig LR4 module and all can be accommodated by a QSFP28 form factor."

The 100 GbE PSM4, backed by the leading optical module makers (see table above), differs from the other three designs in using parallel ribbon fibre and having a 500m rather than a 2km reach. The PSM4 uses four 25 Gig channels, each sent over a fibre, such that four fibres are used in each direction. The PSM4 is technically straightforward and is likely to be the most economical for links up to 500m. In contrast, the CLR4, CWDM4 and OpenOptical all use 4x25 Gig WDM over duplex fibre. Thus, while the PSM4 will likely be the cheapest of the four modules, the link's cost advantage is eroded with distance due to the ribbon fibre cost.

The PSM4 is also attractive for secondary applications; the 25 Gig channels could be used as individual 'breakout' links. Already there is industry interest in 25GbE, while the module could be used in future for 32 Gig Fibre Channel and high-density 128 Gig Fibre Channel.

The OpenOptics MSA, backed by Mellanox and start-up Ranovus, operates in the 1550nm C-band and uses dense WDM, whereas the CLR4 Alliance and CWDM4 operate around 1310nm and use CWDM. The 100 GbE OpenOptics is also 4x25 Gig, such that the wavelengths can be spaced far apart but DWDM promises a roadmap for even higher speed interfaces.

The CLR4 Alliance is an Intel-Arista initiative that has garnered wide industry backing, but it is not an MSA. The specification is very similar to the CWDM4. Both the CLR4 and the CWDM4 include forward error correction (FEC) but whereas FEC is fundamental to the CWDM4, it is an option with the CLR4.

"We have focussed on the FEC-enabled [CWDM4] version so that optical manufacturers can develop the lowest possible cost components to support the interface," says Mitchell Fields, senior director, product marketing and strategy, fiber-optics product division at Avago. FEC adds flexibility, he says, not just in relaxing the components' specification but also simplifying module testing.

The backers of CWDM4 and CLR4 are working to align their specifications and while it is likely the two will interoperate, it remains unclear whether the two will merge.

The CWDM4 specification is likely to be completed in September with first products appearing as early as one or two quarters later. Arista points out that it already has a switch that could use CWDM4/ CLR4 modules now if they were available.

John D'Ambrosia, chairman of the Ethernet Alliance, regrets that four specifications have emerged. "My own personal belief is that it would be better for the industry overall if we didn't have so many choices," he says. "But the reality is there are a lot of different applications out there."

LightCounting expects the PSM4 and a merged CWDM offering will find strong market traction. "Avago, Finisar, JDSU and Oclaro are participating in both categories, demonstrating that each has its own value proposition," says Murray.

This article first appeared in the Optical Connections ECOC '14 magazine issue.

For a more detailed article on mid-reach optics, see p28 of the Autumn issue of Fibre Systems, click here

Article Revision: 30/10/2014: Updated members list of the OpenOptics MSA

Industry in a flurry of mid-reach MSA announcements

Another day, another multi-source agreement.

The CLR4 Alliance is the latest 100 Gig multi-source agreement (MSA) to address up-to-2km links in the data centre. The 100 Gig CLR4 Alliance is backed by around 20 companies including data centre operators, equipment vendors, optical module and component players and chip makers.

The table provides a summary of the latest MSAs and how they relate to the IEEE 100 Gigabit client interface standards. Source: Gazettabyte.

The table provides a summary of the latest MSAs and how they relate to the IEEE 100 Gigabit client interface standards. Source: Gazettabyte.

The announcement follows in the footsteps of the CWDM4 MSA, announced at the start of the week. The CWDM4 is another 100 Gig single-mode fibre MSA backed by optical module makers, Avago Technologies, Finisar, JDSU and Oclaro.

The two MSAs are the latest of several announced interfaces - three in the last three weeks - to tackle mid-reach distances from 100m-plus to 2km. The MSAs reflect an industry need to fill the void in the IEEE standards: the -SR4 multimode standard, with its 100m reach, and the 10km -LR4 that is seen as over-specified for data centre requirements.

Below is a discussion of the recent data centre MSAs

The PSM4 MSA

The PSM4 MSA is a four-channel parallel single mode interface that uses eight- or 12-fibre cabling based on the MTP/MPO optical connectors. The PSM4 uses simpler optics than the 10km IEEE 100GBASE-LR4 and the shorter-reach 2km offshoot, the CWDM4 MSA, and thus promises lower cost. But this is at the expense of using eight fibres and more expensive connectors compared to the single-mode CWDM4.

The PSM4 is expected to have a reach of at least 500m; above that the cost of the fibre becomes the dominant factor. "Note that a 500m PMD [physical medium dependent layer] at 100 Gig was an objective of the IEEE 802.3bm group but it did not happen, so the industry is defining products that fill the gap," says Dale Murray, principal analyst at LightCounting Market Research.

The PSM4 MSA was first detailed in January and includes such members as Avago Technologies, Brocade, JDSU, Luxtera, Oclaro and Panduit.

The 100 Gig CLR4 Alliance

The 100 Gig CLR4 MSA is backed by companies including ebay; equipment vendors Arista Networks, Brocade, Dell, Fujitsu, HP, and Oracle; silicon photonics players Aurrion, Intel, Skorpios Technologies (Oracle is also a proponent of silicon photonics); optical module and component players ColorChip, Kaiam, Oclaro, Oplink, NeoPhotonics; and chip vendors, Netronome and Semtech.

The 100 Gig standard is based on a QSFP form factor module and uses two single mode fibres - 1 send and 1 receive - for duplex communications. The MSA has a 2km reach and uses coarse wavelength-division multiplexing (CWDM). The 8.5mm x18mm x 72mm QSFP has a maximum power consumption of 3.5W and enables a port density of 36 modules on a face plate of a 1 rack unit card, or 3.6 Terabits overall.

At the recent OFC show, Skorpios Technologies demonstrated a QSFP28-CLR4. The silicon photonics player said its module was based on a single-chip that integrates the lasers, modulators, detectors and optical multiplexer and de-multiplexer, to deliver significant size, cost and power benefits. It also said the transceiver achieved a reach of 10km, putting its CLR4 on a par with the IEEE -LR4

At OFC ColorChip announced its iLR4 which is a QSFP28 with a 2km although, like with Skorpios, this was before the 100G CLR4 Alliance launch.

The CWDM4 MSA

The CWDM4 MSA also uses 4-channel CWDM optics and two-fibre cabling. The CWDM4 is being promoted as a complement to the PSM4. "It is MSA-based and has a 2km target," says Murray. "This is an LR4 with relaxed specs; it has no thermal electric cooler but uses the same wavelengths."

"From the link solution point of view, the PSM4 may be more cost effective than the CWDM4 up to 200m-300m," says I-Hsing Tan, segment marketing manager for Ethernet and storage optical transceivers at Avago. "But CWDM4 is for sure the winner beyond 200m and can be more cost effective than the 100GBASE-LR4 solution up to 2km."

Companies backing the CWDM4 MSA include Avago Technologies, Finisar, JDSU and Oclaro.

The OpenOptics MSA

The OpenOptics MSA was launched at OFC by Mellanox Technologies and Ranovus. The MSA uses 1550nm optics and DWDM. The first implementation will be a 100G QSFP28 module and the distance it will address is up to 2km. The MSA will also support future 400 Gig and greater interface speeds.

The degree of acceptance of the OpenOptics MSA is still to be determined compared to the more broadly backed CWDM4.

Other developments

The CLR4 Alliance may not be the final word regarding MSA announcements for the data centre.

Work is ongoing to use advanced modulation for data centre links, such as PAM-8 and carrier multi-tone.

Both Ciena's Joe Berthold and Ovum's Daryl Inniss address the importance of client-side interfaces and whether the rush to announce new MSAs is beneficial overall.

The story was first published on April 1st and has been updated to include the CLR4 Alliance MSA.