Oclaro showcases its pluggable CFP2-DCO at ECOC

Multi-sourcing CFP2-DCO modules, coherent digital signal processor (DSP) partnerships, new laser opportunities and the latest on Lumentum’s acquisition of Oclaro. A conversation with Oclaro’s chief strategy officer, Yves LeMaitre.

Oclaro demonstrated its CFP2 Digital Coherent Optics (CFP2-DCO) pluggable module working with Acacia Communications’ own CFP2-DCO at the recent European Conference on Optical Communication (ECOC), held in Rome.

Yves LeMaitreOclaro announced earlier this year that it would use Acacia’s Meru coherent DSP for a CFP2-DCO product.

Yves LeMaitreOclaro announced earlier this year that it would use Acacia’s Meru coherent DSP for a CFP2-DCO product.

The company also announced at ECOC the availability of a portfolio of single-mode lasers that operate over an extended temperature range.

“We see two new laser opportunities for us,” says LeMaitre. “The upgrade of the access networks and, concurrently, the deployment of 5G.”

Coherent pluggables

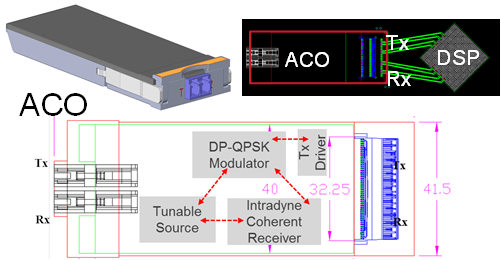

The CFP2-DCO is a dense wavelength-division multiplexing (DWDM) module that supports 100-gigabit and 200-gigabit data rates. With the CFP2-DCO design, the coherent DSP is integrated within the module, unlike the CFP2 Analog Coherent Optics (CFP2-ACO) where the DSP chip resides on the line card.

“A concern of the market is that there has been essentially only one source of CFP2-DCO for the last few years and it was Acacia,” says LeMaitre. “Now there will be a broader supply for people who want coherent pluggables.”

Oclaro has been selling a CFP2-ACO but the company could not address those systems vendors that do not have their own DSP yet want to use coherent pluggables. “Now we can leverage our optics and combine it with Acacia’s DSP and bring another source of the CFP2-DCO,” says LeMaitre.

Acacia’s Meru is a low-power DSP that supports 200 gigabit-per-second (Gbps) wavelengths using either 8-ary quadrature amplitude modulation (8-QAM) or 16-QAM. Using 8-QAM enhances the optical reach at 200 gigabit. Oclaro’s CFP2-DCO uses its indium phosphide-based optics whereas Acacia’s module uses the company’s silicon photonics technology.

Oclaro sees the deal with Acacia as a first step, given the coming generation of 400-gigabit coherent modules including the 400ZR.

Production of Oclaro’s CFP2-DCO will commence in early 2019.

WaveLogic Ai DSP

Oclaro, along with module makers Lumentum and NeoPhotonics, signed an agreement in 2017 with Ciena to use the equipment maker’s 400-gigabit WaveLogic Ai coherent DSP. Oclaro is now shipping the 400-gigabit optical module that uses the Ciena DSP.

“The market for these types of large 400-gigabit form-factor modules in fairly limited as it is already addressed by many of the network equipment manufacturers,” says LeMaitre. “It [the module] is targeted at a few customers and a few opportunities.”

When the agreement with the three module makers was announced, there was talk of Ciena developing coherent DSPs for emerging applications such as 400-gigabit pluggables. However, Ciena has since decided to bring its own coherent modules to the marketplace and Oclaro does not yet know if it will get access to Ciena’s future coherent DSPs.

“We remain very interested in working with Ciena if they give us access to a DSP that could fit into pluggable coherent solutions but we have no agreement on that,” says LeMaitre.

There is an expectation in terms of dollar-per-bit that 400-gigabit modules are not yet meeting

Access and 5G wireless

At ECOC, Oclaro announced the availability of extended-temperature 10-gigabit and 25-gigabit lasers for access network and 5G deployments. The company also detailed its electro-absorption modulated laser (EML) supporting single-wavelength 100-gigabit transmissions for the data centre.

LeMaitre says the latest laser opportunities stem from the expansion and speed upgrades of the access infrastructure as well as upcoming 5G deployments. “This is resulting in a new lease of life for single-mode lasers because of the faster speeds and increased distances,” he says. These distances range from 10-40km and even 80km.

The environmental conditions required for these applications means the lasers must operate over industrial temperature (I-Temp) ranges, from -40 to 85oC and even higher.

Oclaro’s 25-gigabit directly-modulated laser (DML) for 5G fronthaul and mid-haul applications operates at up to 95oC. This means the laser does not need a thermo-electric cooler, simplifying the module design and reducing its power consumption. The laser has also been operated at 50 gigabit-per-second (Gbps) using 4-level pulse-amplitude modulation (PAM-4).

LeMaitre says the architectures for 5G will vary depending on the density of deployments and the primary application such as broadband or the Internet of Things.

Oclaro also announced an extended temperature range DML for 10-gigabit passive optical networks such as XGS-PON and 10GE-PON. The laser, which operates at the 1270nm wavelength, is used at the optical network unit (ONU) at the premises. Oclaro is also developing new 10-gigabit EMLs for the downstream link, from the PON optical line terminal (OLT) to the ONU. Transmission distances for such PONs can be 20km.

The company recently expanded laser production at its Japan and UK facilities, while the 10- and 25-gigabit lasers are now being mass-produced.

400 Gigabit Ethernet

Oclaro was one of five companies that took part in a 100-gigabit single-wavelength interoperability demonstration organised by the Ethernet Alliance at the show. The other four were Applied Optoelectronics, InnoLight Technology, Source Photonics, and Sumitomo Electric Industries.

The company showed its EML operating at 50 gigabaud with PAM-4 in the 100-Gigabit QSFP28 module. The 50Gbaud EML can operate uncooled such that no thermo-electric cooler is needed.

Oclaro says it will soon start sampling a 400-gigabit QSFP-DD FR4 module. The 2km four-channel FR4 developed by the 100-Gigabit Single Lambda MSA will use four 50Gbaud lasers. Volume production of the FR4 module is expected from the second quarter of 2019.

LeMaitre says 400-gigabit modules for the data centre face two key challenges.

One is meeting the power consumption of the new form factor modules such as the QSFP-DD. The optics for a four-wavelength design consumes 3-4W while the accompanying PAM-4 digital signal processor can consume 7-8W. “A transceiver burning 10-12W might be an issue for large-scale deployments,” says LeMaitre. “There is a power issue here that needs to be fixed.”

The second challenge for 400-gigabit client-side is cost. The price of 100-gigabit modules has now come down considerably. “There is an expectation in terms of dollar-per-bit that 400-gigabit modules are not yet meeting,” says LeMaitre. If the DSPs have yet to meet the power needs while the cost of the new modules is not in line with the dollar-per-bit performance of 100-gigabit modules, then 400-gigabit modules will be delayed, he says.

Acquisition

Lumentum’s acquisition of Oclaro, announced in March, continues to progress.

LeMaitre says two of the main three hurdles have now been overcome: anti-trust clearance in the U.S. and gaining shareholder approval. What remains is achieving Chinese clearance via the State Authority for Market Regulation.

“Until the merger deal is closed, we have to continue to operate as two separate companies,” says LeMaitre. But that doesn't prevent the two firms planning for the day when the deal is completed. Issues being worked through include the new organisation, the geographic locations of the companies’ groups, and how the two firms will work together to build a combined financial model.

The deal is expected to close before the year-end.

Oclaro uses Acacia’s Meru DSP for its CFP2-DCO

Oclaro will use Acacia Communications’ coherent DSP for its pluggable CFP2 Digital Coherent Optics (CFP2-DCO) module. The module will be compatible with Acacia’s own CFP2-DCO, effectively offering customers a second source.

Tom Williams This is the first time Acacia is making its coherent DSP technology available to a fellow module maker, says Tom Williams, Acacia’s senior director, marketing.

Tom Williams This is the first time Acacia is making its coherent DSP technology available to a fellow module maker, says Tom Williams, Acacia’s senior director, marketing.

Acacia benefits from the deal by expanding the market for its technology, while Oclaro gains access to a leading low-power coherent DSP, the Meru, and can bring to market its own CFP2-DCO product.

Williams says the move was encouraged by customers and that having a second source and achieving interoperability will drive CFP2-DCO market adoption. That said, Acacia is not looking for further module partners. “With two strong suppliers, we don’t see a need to add additional ones,” says Williams.

“This agreement is a sign that the market is reaching maturity, with suppliers transitioning from grabbing market share at all costs to more rational strategies,” says Vladimir Kozlov, CEO and founder of LightCounting Market Research.

CFP2-DCO

The CFP2-DCO is a dense wavelength-division multiplexing module that supports 100-gigabit and 200-gigabit data rates.

With the CFP2-DCO design, the coherent DSP sits within the module, unlike the CFP2 Analog Coherent Optics (CFP2-ACO) where the DSP chip is external, residing on the line card.

According to Kevin Affolter, Oclaro’s vice president strategic marketing, the company looked at several merchant and non-merchant coherent DSPs but chose the Meru due to its low power consumption and its support for 200 gigabits using 8-ary quadrature amplitude modulation (8-QAM) as well as the 16-QAM scheme. Using 8-QAM extends the optical reach of 200-gigabit wavelengths.

This agreement is a sign that the market is reaching maturity, with suppliers transitioning from grabbing market share at all costs to more rational strategies

At 100 gigabits the CFP2-DCO achieves long-haul distances of 2,000km whereas at 200 gigabit at 8-QAM, the reach is in excess of 1,000km. The 8-QAM requires a wider passband than the 16-QAM, however, such that in certain metro networks where the signal passes through several ROADM stages, it is better to use the 16-QAM mode, says Acacia.

Source: Acacia, Gazettabyte

Source: Acacia, Gazettabyte

Oclaro’s design will combine the Meru with its indium phosphide-based optics whereas Acacia’s CFP2-DCO uses silicon photonics technology. The power consumption of the CFP2-DCO module is of the order of 20W.

The two companies say their CFP2-DCO modules will be compatible with the multi-source agreement for open reconfigurable add-drop multiplexers (ROADMs). The Open ROADM MSA is backed by 16 companies, eight of which are operators. The standard currently only defines 100-gigabit transmission based on a hard-decision forward-error correction.

“There are several carriers, AT&T being the most prominent, within Open ROADM,” says Affolter. “It makes sense for both companies to make sure the needs of Open ROADM are addressed.”

Coherent shift

In 2017, Oclaro was one of three optical module companies that signed an agreement with Ciena to use the systems vendor’s WaveLogic Ai coherent DSP to develop a 400-gigabit transponder.

Kevin Affolter

Kevin Affolter

Affolter says the Ciena and Acacia agreements should be seen as distinct; the 400-gigabit design is a large, 5x7-inch non-pluggable module designed for maximum reach and capacity. “The deals are complementary and this announcement has no impact on the Ciena announcement,” says Affolter.

Does the offering of proprietary DSPs to module makers suggest a shift in coherent that has always been seen as a strategic technology that allows for differentiation?

Affolter thinks not. “There are several vertically integrated vendors with their own DSPs that will continue to leverage their investment as much as they can,” he says. “But there is also an evolution of end customers and network equipment manufacturers that are moving to more pluggable solutions and that is where the -DCO really plays.”

Oclaro expects to have first samples of its CFP2-DCO by year-end. Meanwhile, Acacia’s CFP2-DCO has been generally available for over six months.

Lumentum jolts the industry with Oclaro acquisition

Lumentum announced on Monday its plan to acquire Oclaro in a deal worth $1.8 billion.

The prospect of consolidation among optical component players has long been mooted yet the announcement provided the first big news jolt at the OFC show, being held in San Diego this week.

Alan Lowe“Combined, we will be an industry leader in telecom transmission and transport as well as 3D sensing,” said Alan Lowe, president and CEO of Lumentum, on an analyst call discussing the deal.

Alan Lowe“Combined, we will be an industry leader in telecom transmission and transport as well as 3D sensing,” said Alan Lowe, president and CEO of Lumentum, on an analyst call discussing the deal.

Lumentum says their joint revenues totalled $1.7 billion with a 39% gross margin over the last year. And $60 million in synergies are forecast in the second year after the deal closes, which is expected to happen later this year.

The $1.8 billion acquisition will comprise 56 percent cash and 44 percent Lumentum stock. Lumentum will also raise $550 million to help finance the deal.

“This is a big deal as it consolidates the telecom part of the component market,” says Daryl Inniss, business development manager at OFS Fitel and former market research analyst.

Background

Lowe said that ever since Lumentum became a standalone company three years ago, the firm concentrated on addressing the increase in optical communications demand that started in late 2015 and then last year on ramping the production of its 3D sensing components. “Execution on major M&As had to wait,” he said.

The company investigated potential acquisitions and evaluated several key technologies including silicon photonics and indium phosphide. This led to it alighting on Oclaro with its indium phosphide and photonic integrated circuit (PIC) expertise.

Lowe also highlighted Oclaro’s strategy of the last five years of first trimming its business lines and then successfully executing on delivering optical transmission products.

Oclaro’s CEO, Greg Dougherty, CEO of Oclaro, described how his company has focussed on delivering differentiated photonic chip products to various growing end markets. “This is a very good combination for both companies and for the industry,” said Dougherty.

There is no overabundance in [optical] chip designers worldwide and together we have the strongest chip designer team in the world

Business plans

Lumentum’s business includes telecom transport components, modules and sub-systems. Its products include reconfigurable optical add/drop multiplexers (ROADMs), pump lasers, optical amplifiers and submarine products. In the second half of 2017, Lumentum’s telecom revenue mix was split three quarters telecom transport with transmission products accounted for the remaining quarter. Other Lumentum businesses include industrial lasers and 3D sensing.

In contrast, Oclaro’s focus in solely transmission components and modules, with the revenue mix in its most recent quarter being 53 percent telecom line side and 47 percent datacom client-side products.

The combined R&D resources of the merged company will allow it to do a much better job at supporting datacom products using the new QSFP-DD and OSFP form factors. “Right now I’m guessing that Alan is spread thin and I know the Oclaro datacom team has been spread thin,” says Dougherty.

The acquisition will also pool the two companies’ fabrication facilities.

Lumentum has already moved its lithium niobate manufacturing to its main gallium arsenide and indium phosphide fab in San Jose, California. San Jose also hosts a separate planar lightwave circuit fab.

Oclaro, which is headquartered in San Jose, has three photonic chip fabrication sites: an indium phosphide laser fab for datacom in Japan that makes directly modulated lasers (DMLs) and electro-absorption modulated lasers (EMLs), an indium phosphide fab in the UK that manufactures coherent optical components and sub-assemblies, and a lithium niobate fab in Italy.

The acquisition will also bolster the company’s chip design resources. “There is no overabundance in [optical] chip designers worldwide and together we have the strongest chip designer team in the world,” says Dougherty.

Lumentum plans to assign some of the chip designers to tackle a burgeoning pipeline of 3D sensing product designs.

In 2017 Lumentum reported three customers that accounted for nearly half of its revenues, while Oclaro had four customers, each accounted for 10 percent or more of its sales, in 4Q 2017. Oclaro selected customers include the webscale players, Amazon, Google and Microsoft, as well as leading systems vendors such as Ciena, Cisco, Coriant, Huawei, Juniper, Nokia and ZTE.

Both Oclaro and Lumentum, along with Neophotonics, signed an agreement with Ciena a year ago to use its WaveLogic Ai DSP in their coherent module designs.

Lumentum plans to provide more deal details closer to its closure. Meanwhile, the two CEOs will continue to run their companies with Oclaro’s Dougherty remaining at least during the transition period.

Further information:

For the link to the acquisition presentation, click here.

Oclaro’s 400-gigabit plans

Adam Carter, Oclaro’s chief commercial officer, discusses the company’s 400-gigabit and higher-speed coherent optical transmission plans and the 400-gigabit client-side pluggable opportunity.

Oclaro showcased its first coherent module that uses Ciena’s WaveLogic Ai digital signal processor at the ECOC show held recently in Gothenburg.

Adam CarterOclaro is one of three optical module makers, the others being Lumentum and NeoPhotonics, that signed an agreement with Ciena earlier this year to use the system vendor’s DSP technology and know-how to bring coherent modules to market. The first product resulting from the collaboration is a 5x7-inch board-mounted module that supports 400-gigabits on a single-wavelength.

Adam CarterOclaro is one of three optical module makers, the others being Lumentum and NeoPhotonics, that signed an agreement with Ciena earlier this year to use the system vendor’s DSP technology and know-how to bring coherent modules to market. The first product resulting from the collaboration is a 5x7-inch board-mounted module that supports 400-gigabits on a single-wavelength.

The first WaveLogic Ai-based modules are already being tested at several of Oclaro’s customers’ labs. “They [the module samples] are very preliminary,” says Adam Carter, the chief commercial officer at Oclaro. “The really important timeframe is when we get towards the new year because then we will have beta samples.”

DSP developments

The coherent module is a Ciena design and Carter admits there isn’t going to be much differentiation between the three module makers’ products.

“We have some of the key components that sit inside that module and the idea is, over time, we would design in the rest of the componentry that we make that isn’t already in there,” says Carter. “But it is still going to be the same spec between the three suppliers.”

The collaboration with the module makers helps Ciena promote its coherent DSP to a wider market and in particular China, a market where its systems are not deployed.

Over time, the scope for differentiation between the three module makers will grow. “It [the deal] gives us access to another DSP chip for potential future applications,” says Carter.

Here, Oclaro will be the design authority, procuring the DSP chip for Ciena before adding its own optics. “So, for example, for the [OIF’s] 400G ZR, we would ask Ciena to develop a chip to a certain spec and then put our optical sub-assemblies around it,” says Carter. “This is where we do believe we can differentiate.”

Oclaro also unveiled at ECOC an integrated coherent transmitter and an intradyne coherent receiver optical sub-assemblies using its indium phosphide technology that operate at up to 64 gigabaud (Gbaud).

We expect to see 64Gbaud optical systems being trialed in 2018 with production systems following at the end of next year

A 64Gbaud symbol rate enables a 400-gigabit wavelength using 16-ary quadrature amplitude modulation (16-QAM) and a 600-gigabit wavelength using 64-QAM.

Certain customers want such optical sub-assemblies for their line card designs and Oclaro will also use the building blocks for its own modules. The devices will be available this quarter. “We expect to see 64Gbaud optical systems being trialed in 2018 with production systems following at the end of next year and the beginning of 2019,” says Carter.

Oclaro also announced that its lithium niobate modulator supporting 400-gigabit single wavelengths is now in volume production. “Certain customers do have their preferences when it comes to first designs and particularly for long-reach systems,” says Carter. “Lithium niobate seems to be the one people go with.”

400-gigabit form factors

Oclaro did not make any announcements regarding 400-gigabit client-side modules at ECOC. At the OFC show held earlier this year, it detailed two CFP8-based 400-gigabit designs based on eight wavelengths with reaches of 10km and 40km.

“We are sampling the 400-gigabit 10km product right now,” says Carter. “The product is being tested at the system level and will go through various qualification runs.”

The 40km CFP8 product is further out. There are customers interested in such a module as they have requirements to link IP routers that are more than 10km apart.

Carter describes the CFP8 400-gigabit modules as first-generation products. The CFP8 is similar in size to the CFP2 pluggable module and that is too large for the large-scale data centre players. They want higher aggregate bandwidth and greater front panel densities for their switches and are looking such form factors as the double-density QSFP (QSFP-DD) and the Octal Small Form Factor pluggable (OSFP).

The OSFP is a fresh design, has a larger power envelope - some 15W compared to the 12W of the QSFP-DD - and has a roadmap that supports 800-gigabit data rates. In contrast, the QSFP-DD is backward compatible with the QSFP, an attractive feature for many vendors.

But it is not only a module’s power envelope that is an issue for 400-gigabit designs but also whether a one-rack-unit box can be sufficiently cooled when fully populated to avoid thermal runaway. Some 36 QSFP-DDs can fit on the front panel compared to 32 OSFPs.

Carter stresses both form factors can’t be dismissed for 400-gigabit: “Everyone is pursuing designs that are suitable for both.” Oclaro is not an advocate of either form factor given it provides optical sub-assemblies suitable for both.

The industry really wants four-channels. When you use more lasers, you are adding more cost.

Optical formats

Oclaro’s core technology is indium phosphide and, as such, its focusses on single-mode fibre designs.

The single mode options for 400 gigabits are split between eight-wavelength designs such as the IEEE 802.3bs 2km 400GBASE-FR8 and 10km 400GBASE-LR8 and the newly announced CWDM8 MSA, and four-wavelength specifications - the 500m IEEE 802.3bs parallel fibre 400GBASE-DR4 and the 2km 100G Lambda MSA 400G-FR4 that is under development. Oclaro is a founding member of the 100 Gigabit Lambda MSA but has not joined the CWDM8 MSA.

"The industry really wants four channels," says Carter. "When you use more lasers, you are adding more cost." It is also not trivial fitting eight lasers into a CFP8 never mind into the smaller QSFP-DD and OSFP modules.

“There might be some that have the technology to do the eight-channel part and there might be customers that will use that,” says Carter. “But most of the discussions we’ve been having are around four channels.”

Challenges

The industry’s goal is to have 400-gigabit QSFP-DD and OSFP module in production by the end of next year and into 2019. “There is still some risk but everybody is driving to meet that schedule,” says Carter.

Oclaro says first samples of 100-gigabit PAM-4 chips needed for 100-gigabit single wavelengths are now in the labs. Module makers can thus add their optical sub-assemblies to the chips and start testing system performance. Four-channel PAM-4 chips will be needed for the 400-gigabit module products.

Carter also acknowledges that any further delay in four-wavelength designs could open the door for other 400-gigabit solutions and even interim 200-gigabit designs.

“As a transceiver supplier and an optical component supplier you are always aware of that,” he says. “You have to have backup plans if that comes off.”

OIF starts work on a terabit-plus CFP8-ACO module

The Optical Internetworking Forum (OIF) has started a new analogue coherent optics (ACO) specification based on the CFP8 pluggable module.

The CFP8 is the latest is a series of optical modules specified by the CFP Multi-Source Agreement and will support the emerging 400 Gigabit Ethernet standard.

Karl GassAn ACO module used for optical transport integrates the optics and driver electronics while the accompanying coherent DSP-ASIC residing on the line card.

Karl GassAn ACO module used for optical transport integrates the optics and driver electronics while the accompanying coherent DSP-ASIC residing on the line card.

Systems vendors can thus use their own DSP-ASIC, or a merchant one if they don’t have an in-house design, while choosing the coherent optics from various module makers. The optics and the DSP-ASIC communicate via a high-speed electrical connector on the line card.

ACO design

The OIF completed earlier this year the specification of the CFP2-ACO.

Current CFP2-ACO modules support single-wavelength transmission rates from 100 gigabit to 250 gigabit depending on the baud rate and modulation scheme used. The goal of the CFP8-ACO is to support up to four wavelengths, each capable of up to 400 gigabit-per-second transmissions.

This project is going to drive innovation

“This isn’t something there is a dire need for now but the projection is that this will be needed in two years’ time,” says Karl Gass of Qorvo and the OIF Physical and Link Layer Working Group optical vice chair.

OIF members considered several candidate optical modules for the next-generation ACO before choosing the CFP8. These included the existing CFP2 and the CFP4. There were some proponents for the QSFP but its limited size and power consumption is problematic when considering long-haul applications, says Gass.

Source: Finisar

Source: Finisar

One difference between the CFP2 and CFP8 modules is that the electrical connector of the CFP8 supports 16 differential pairs while the CFP2 connector supports 10 pairs.

“Both connectors have similar RF performance and therefore can handle similar baud rates,” says Ian Betty of Ciena and OIF board member and editor of the CFP2-ACO Implementation Agreement. To achieve 400 gigabit on a wavelength for the CFP8-ACO, the electrical connector will need to support 64 gigabaud.

Betty points out that for coherent signalling, four differential pairs per optical carrier are needed. “This is independent of the baud rate and the modulation format,” says Betty.

So while it is not part of the existing Implementation Agreement, the CFP2-ACO could support two optical carriers while the CFP8 will support up to four carriers.

“This is only the electrical connector interface capacity,” says Betty. “It does not imply it is possible to fit this amount of optics and electronics in the size and power budget.” The CFP8 supports a power envelope of 20W compared to 12W of the CFP2.

The CFP2-ACO showing the optical building blocks and the electrical connector linking the module to the DSP-ASIC. Source: OIF

The CFP2-ACO showing the optical building blocks and the electrical connector linking the module to the DSP-ASIC. Source: OIF

The CFP8 occupies approximately the same area as the CFP2 but is not as tall such that the module can be doubled-stacked on a line card for a total of 16 CFP8-ACOs on a line card.

Given that the CFP8 will support up to four carriers per module - each up to 400 gigabit - a future line card could support 25.6 terabits of capacity. This is comparable to the total transport capacity of current leading dense WDM optical transport systems.

Rafik Ward, vice president of marketing at Finisar, says such a belly-to-belly configuration of the modules provides future-proofing for next-generation lineside interfaces. “Having said that, it is not clear when, or how, we will be able to technically support a four-carrier coherent solution in a CFP8 form factor,” says Ward.

Oclaro stresses that such a high total capacity implies that sufficient coherent DSP silicon can fit on the line card. Otherwise, the smaller-height CFP8 module may not enable the fully expected card density if the DSP chips are too large or too power-hungry.

OIF goal

Besides resulting in a higher density module, a key OIF goal of the work is to garner as much industry support as possible to back the CFP8-ACO. “How to create the quantity of scale so that deployment becomes less expensive and therefore quicker to implement,” says Gass.

The OIF expects the work to be similar to the development of the CFP2-ACO Implementation Agreement. But one desired difference is to limit the classes associated with the module. The CFP2-ACO has three class categories based on whether the module has a limited and linear output. “The goal of the CFP8-ACO is to limit the designs to single classes per wavelength count,” says Gass.

Gass is looking forward to the CFP8-ACO specification work. Certain standards efforts largely involve making sure components fit into a box whereas the CFP8-ACO will be more engaging. “This project is going to drive innovation and that will drive some technical work,” says Gass.

ECOC '15 Reflections: Part 2

Martin Zirngibl, head of network enabling components and technologies at Bell Labs.

Silicon Photonics is seeming to gain traction, but traditional component suppliers are still betting on indium phosphide.

There are many new start-ups in silicon photonics, most seem to be going after the 100 gigabit QSFP28 market. However, silicon photonics still needs a ubiquitous high-volume application for the foundry model to be sustainable.

There is a battle between 4x25 Gig CWDM and 100 Gig PAM-4 56 gigabaud, with most people believing that 400 Gig PAM-4 or discrete multi-tone with 100 Gig per lambda will win.

Will coherent make it into black and white applications - up to 80 km - or is there a role for a low-cost wavelength-division multiplexing (WDM) system with direct detection?

One highlight at ECOC was the 3D integrated 100 Gig silicon photonics by Kaiam.

In coherent, the analogue coherent optics (ACO) model seems to be winning over the digital coherent one, and people are now talking about 400 Gig single carrier for metro and data centre interconnect applications.

As for what I’ll track in the coming year: will coherent make it into black and white applications - up to 80 km - or is there a role for a low-cost wavelength-division multiplexing (WDM) system with direct detection?

Yukiharu Fuse, director, marketing department at Fujitsu Optical Components

There were no real surprises as such at ECOC this year. The products and demonstrations on show were within expectations but perhaps were more realistic than last year’s show.

Most of the optical component suppliers demonstrated support to meet the increasing demand of data centres for optical interfaces.

The CFP2 Analogue Coherent Optics (CFP2-ACO) form factor’s ability to support multiple modulation formats configurable by the user makes it a popular choice for data centre interconnect applications. In particular, by supporting 16-QAM, the CFP2-ACO can double the link capacity using the same optics.

Lithium niobate and indium-phosphide modulators will continue to be needed for coherent optical transmission for years to come

Recent developments in indium phosphide designs has helped realise the compact packaging needed to fit within the CFP2 form factor.

I saw the level of integration and optical engine configurations within the CFP2-ACO differ from vendor to vendor. I’m interested to see which approach ends up being the most economical once volume production starts.

Oclaro introduced a high-bandwidth lithium niobate modulator for single wavelength 400 gigabit optical transmission. Lithium niobate continues to play an important role in enabling future higher baud rate applications with its excellent bandwidth performance. My belief is that both lithium niobate and indium-phosphide modulators will continue to be needed for coherent optical transmission for years to come.

Chris Cole, senior director, transceiver engineering at Finisar

ECOC technical sessions and exhibition used to be dominated by telecom and long haul transport technology. There is a shift to a much greater percentage focused on datacom and data centre technology.

What I learned at the show is that cost pressures are increasing

There were no major surprises at the show. It was interesting to see about half of the exhibition floor occupied by Chinese optics suppliers funded by several Chinese government entities like municipalities jump-starting industrial development.

What I learned at the show is that cost pressures are increasing.

New datacom optics technologies including optical packaging, thermal management, indium phosphide and silicon integration are all on the agenda to track in the coming year.

How Oclaro's CTO keeps on top of the data deluge

Being creative, taking notes, learning and organising data are challenges that all company executives and engineers face. Andy Carter, CTO of Oclaro, is renown for his sketched diagrams and his ability to explain stuff. Gazettabyte asked him to share his experiences and thoughts on the matter.

Andy Carter, CTO

Andy Carter, CTO

"To be honest, I am an absolutely terrible note-taker. I always have been. At university, I could either listen to a lecture and try and understand it or take notes. I couldn’t do both.

If I did manage to take some notes, I rarely looked at them afterwards or found them useful.

At conferences, in the days of printed outlines, I’d make a few comments in the margins or underline items, but rarely in a separate notebook.

I remember one work colleague who would note-take in detail in real time on a Blackberry or laptop and circulate his notes immediately after meetings or a conference. He seemed to remember stuff, but it was quite off-putting as it was hard to believe he was actually listening. But he was.

The great Roman philosopher/ general Marcus Aurelius was reputed to be able to carry on five independent trains of thought at once, but one is all I can really manage.

I rely on my memory far too much. It works much better with concepts and scientific data than it does with people and names, but I can generally remember most of the key points at conferences. Maybe not exactly when and where I heard them, but enough to point a search in the right direction.

If data or a meeting or spontaneous thought leads to ideas, I will make some notes or sketches, often on longer and longer Powerpoint slide sets with simple diagrams.

I don’t understand how my memory works. Things I want to remember, that I’m interested in, just stick; things like languages and vocabulary just don’t. I was hopeless at languages at school.

"Most of my time is spent connecting observations, people, actions and past experience, and trying to make people and teams think and act scientifically and methodically"

I’m rather disorganised with email also. Everything goes into a bundle and I rely on a combination of memory and search to find what I want. It is more or less the same with documents etc. on my computer. Putting things in different boxes/ files doesn’t seem to help much, it just takes time. And with the search facilities on computers getting better and faster all the time, it is not worth structuring the data.

Maybe it is the sort of role I have now at Oclaro that I don't really need to master note-taking as such. Most of my time is spent connecting observations, people, actions and past experience, and trying to make people and teams think and act scientifically and methodically. If things go wrong, there is much more of a tendency to ‘tweak’ rather than ‘think’ these days.

One item I always have in the office is a white board. Not the write on/ rub off melamine ones but a proper one with a pad of A0 paper. I’ll pull off a sheet and have it on the table for small meetings and discussions. I will make sketches and comments on this, including concept sketches and dimensionless ‘what if’ diagrams. Others at the meeting sketch or write on this also, and often take it away at the end.

In restaurants, the ‘best’ have paper tablecloths to draw on (don’t worry about the food), or decent-sized paper menus. But beware! It can lead to trouble and secure disposal may be a problem. Certainly don’t do this at events like OFC and ECOC.

I remember explaining to our head of human resources what a WDM-PON was on a tablecloth at a restaurant in Torquay, and she remembered most of the concepts. That probably put me in Geek category 10!"

Oclaro demonstrates flexible rate coherent pluggable module

- The CFP2 coherent optical module operates at 100 and 200 Gig

- Samples are already with customers, with general availability in the first half of 2015

- Oclaro to also make more CFP2 100GBASE-LR4 products

The CFP2 is not just used in metro/ regional networks but also in long-haul applications

Robert Blum

The advent of a pluggable CFP2, capable of multi-rate long-distance optical transmission, has moved a step closer with a demonstration by Oclaro. The optical transmission specialist showed a CFP2 transmitting data at 200 Gigabits-per-second.

The coherent analogue module demonstration, where the DSP-ASIC resides alongside rather than within the CFP2, took place at ECOC 2014 held in September at Cannes. Oclaro showcased the CFP2 to potential customers in March, at OFC 2014, but then the line side module supported 100 Gig only.

"What has been somewhat surprising to us is that the CFP2 is not just used in metro/ regional networks but also in long-haul applications," says Robert Blum, director of strategic marketing at Oclaro. "We are also seeing quite significant interest in data centre interconnect, where you want to get 400 Gig between sites using two CFP2s and two DSPs." Oclaro says that the typical distances are from 200km to 1,000km.

The CFP2 achieves 200 Gig using polarisation multiplexing, 16-quadrature amplitude modulation (PM-16-QAM) while working alongside ClariPhy's merchant DSP-ASIC. ClariPhy announced at ECOC that it is now shipping its 200 Gig LightSpeed-II CL20010 coherent system-on-chip, implemented using a 28nm CMOS process.

"One of the beauties of an analogue CFP2 is that it works with a variety of DSPs," says Blum. Other merchant coherent DSPs are becoming available, while leading long-haul optical equipment vendors have their own custom coherent DSPs.

Oclaro's CFP2, even when operating at 200 Gig, falls within the 12W module's power rating. "One of the things you need to have for 200 Gig is a linear modulator driver, and such drivers consume slightly more power [200mW] than limiting modulator drivers [used for 100 Gig only]," says Blum.

Oclaro will offer two CFP2 line-side variants, one with linear drivers and one using limiting ones. The limiting driver CFP2 will be used for 100 Gig only whereas the linear driver CFP2 supports 100 Gig PM-QPSK and 200 Gig PM-16-QAM schemes. "Some customers prefer the simplicity of a limiting interface; for the linear interface you have to do more calibration or set-up," says Blum. "Linear also allows you to do pre-emphasis of the signal path, from the DSP all the way to the modulator." Pre-emphasis is used to compensate for signal path impairments.

By consuming under 12W, up to eight line-side CFP2 interfaces can fit on a line card, says Blum, who also stresses the CFP2 has a 0dBm output power at 200 Gig. Achieving such an output power level means the 200 Gig signal is on a par with 100 Gig wavelengths. "When you launch a 200 Gig signal, you want to make sure that there is not a big difference between signals," says Blum.

To achieve the higher output power, the micro integrable tunable laser assembly (micro-iTLA) includes a semiconductor optical amplifier (SOA) with the laser, while SOAs are also added to the Mach–Zehnder modulator chip. "That allows us to compensate for some of the [optical] losses," says Blum.

Customers received first CFP2 samples in May, with the module currently at the design validation stage. Oclaro expects volume shipments to begin in the first half of 2015.

100 Gig and the data centre

Oclaro also announced at ECOC that it has expanded manufacturing capacity for its CFP2-based 100GBASE-LR4 10km-reach module.

One reason for the flurry of activity around 100 Gig mid-reach interfaces that span 500m-2km in the data centre is that the 100GBASE-LR4 module is relatively expensive. Oclaro itself has said it will support the PSM-4, CWDM4 and CLR4 Alliance mid-reach 100 Gig interfaces. So why is Oclaro expanding manufacturing of its CFP2-based 100GBASE-LR4?

It is about being pragmatic and finding the most cost-effective solution for a given problem

"There is no clear good solution to get 100 Gig over 500m or 2km right now," says Blum. "CFP2 is here, it is a mature technology and we have made improvements both in performance and cost."

Oclaro has improved its EML design such that the laser needs less cooling, reducing overall power dissipation. The accompanying electronic functions such as clock data recovery have also been redesigned using one IC instead of two such that the CFP2 -LR4's overall power consumption is below 8W.

Demand has been so significant, says Blum, that the company has been unable to meet customer demand. Oclaro expects that towards year-end, it will have increased its CFP2 100GBASE-LR4 manufacturing capacity by 50 percent compared to six months earlier.

"It is about being pragmatic and finding the most cost-effective solution for a given problem," says Blum. "There are other [module] variants that are of interest [to us], such as the CWDM4 MSA that offers a cost-effective way to get to 2km."

ROADMs and their evolving amplification needs

Technology briefing: ROADMs and amplifiers

Oclaro announced an add/drop routing platform at the recent OFC/NFOEC show. The company explains how the platform is driving new arrayed amplifier and pumping requirements.

A ROADM comprising amplification, line-interfaces, add/ drop routing and transponders. Source: Oclaro

A ROADM comprising amplification, line-interfaces, add/ drop routing and transponders. Source: Oclaro

Agile optical networking is at least a decade-old aspiration of the telcos. Such networks promise operational flexibility and must be scalable to accommodate the relentless annual growth in network traffic. Now, technologies such as coherent optical transmission and reconfigurable optical add/drop multiplexers (ROADMs) have reached a maturity to enable the agile, mesh vision.

Coherent optical transmission at 100 Gigabit-per-second (Gbps) has become the base currency for long-haul networks and is moving to the metro. Meanwhile, ROADMs now have such attributes as colourless, directionless and contentionless (CDC). ROADMs are also being future-proofed to support flexible grid, where wavelengths of varying bandwidths are placed across the fibre's spectrum without adhering to a rigid grid.

Colourless and directionless refer to the ROADM's ability to transmit or drop any light path from any direction or degree at any network interface port. Contentionless adds further flexibility by supporting same-colour light paths at an add or a drop.

"You can't add and drop in existing architectures the same colour [light paths at the same wavelength] in different directions, or add the same colour from a given transponder bank," says Bimal Nayar, director, product marketing at Oclaro's optical network solutions business unit. "This is prompting interest in contentionless functionality."

The challenge for optical component makers is to develop cost-effective coherent and CDC-flexgrid ROADM technologies for agile networks. Operators want a core infrastructure with components and functionality that provide an upgrade path beyond 100 Gigabit coherent yet are sufficiently compact and low-power to minimise their operational expenditure.

ROADM architectures

ROADMs sit at the nodes of a mesh network. Four-degree nodes - the node's degree defined as the number of connections or fibre pairs it supports - are common while eight-degree is considered large.

The ROADM passes through light paths destined for other nodes - known as optical bypass - as well as adds or drops wavelengths at the node. Such add/drops can be rerouted traffic or provisioned new services.

Several components make up a ROADM: amplification, line-interfaces, add/drop routing and transponders (see diagram, above).

"With the move to high bit-rate systems, there is a need for low-noise amplification," says Nayar. "This is driving interest in Raman and Raman-EDFA (Erbium-doped fibre amplifier) hybrid amplification."

The line interface cards are used for incoming and outgoing signals in the different directions. Two architectures can be used: broadcast-and-select and route-and select.

With broadcast-and-select, incoming channels are routed in the various directions using a passive splitter that in effect makes copies the incoming signal. To route signals in the outgoing direction, a 1xN wavelength-selective switch (WSS) is used. "This configuration works best for low node-degree applications, when you have fewer connections, because the splitter losses are manageable," says Nayar.

For higher-degree node applications, the optical loss using splitters is a barrier. As a result, a WSS is also used for the incoming signals, resulting in the route-and-select architecture.

Signals from the line interface cards connect to the routing platform for the add/drop operations. "Because you have signals from any direction, you need not a 1xN WSS but an LxM one," says Nayar. "But these are complex to design because you need more than one switching plane." Such large LxM WSSes are in development but remain at the R&D stage.

Instead, a multicast switch can be used. These typically are sized 8x12 or 8x16 and are constructed using splitters and switches, either spliced or planar lightwave circuit (PLC) based .

"Because the multicast switch is using splitters, it has high loss," says Nayar. "That loss drives the need for amplification."

Add/drop platform

With an 8-degree-node CDC ROADM design, signals enter and exit from eight different directions. Some of these signals pass through the ROADM in transit to other nodes while others have channels added or dropped.

In the Oclaro design, an 8x16 multicast switch is used. "Using this [multicast switch] approach you are sharing the transponder bank [between the directions]," says Nayar.

The 8-degree node showing the add/drop with two 8x16 multicast switches and the 16-transponder bank. Source: Oclaro

A particular channel is dropped at one of the switch's eight input ports and is amplified before being broadcast to all 16, 1x8 switches interfaced to the 16 transponders.

It is the 16, 1x8 switches that enable contentionless operation where the same 'coloured' channel is dropped to more than one coherent transponder. "In a traditional architecture there would only be one 'red' channel for example dropped as otherwise there would be [wavelength] contention," says Nayar.

The issue, says Oclaro, is that as more and more directions are supported, greater amplification is needed. "This is a concern for some, as amplifiers are associated with extra cost," says Nayar.

The amplifiers for the add/drop thus need to be compact and ideally uncooled. By not needing a thermo-electrical cooler, for example, the design is cheaper and consumes less power.

The design also needs to be future-proofed. The 8x16 add/ drop architecture supports 16 channels. If a 50GHz grid is used, the amplifier needs to deliver the pump power for a 16x50GHz or 800GHz bandwidth. But the adoption of flexible grid and super-channels, the channel bandwidths will be wider. "The amplifier pumps should be scalable," says Nayar. "As you move to super-channels, you want pumps that are able to deliver the pump power you need to amplify, say, 16 super-channels."

This has resulted in an industry debate among vendors as to the best amplifier pumping scheme for add/drop designs that support CDC and flexible grid.

EDFA pump approaches

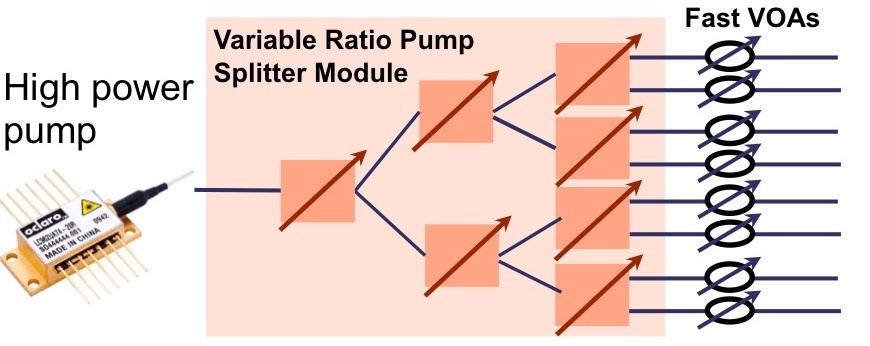

Two schemes are being considered. One option is to use one high-power pump coupled to variable pump splitters that provides the required pumping to all the amplifiers. The other proposal is to use discrete, multiple pumps with a pump used for each EDFA.

Source: Oclaro

Source: Oclaro

In the first arrangement, the high-powered pump is followed by a variable ratio pump splitter module. The need to set different power levels at each amplifier is due to the different possible drop scenarios; one drop port may include all the channels that are fed to the 16 transponders, or each of the eight amplifiers may have two only. In the first case, all the pump power needs to go to the one amplifier; in the second the power is divided equally across all eight.

Oclaro says that while the high-power pump/ pump-splitter architecture looks more elegant, it has drawbacks. One is the pump splitter introduces an insertion loss of 2-3dB, resulting in the pump having to have twice the power solely to overcome the insertion loss.

The pump splitter is also controlled using a complex algorithm to set the required individual amp power levels. The splitter, being PLC-based, has a relatively slow switching time - some 1 millisecond. Yet transients that need to be suppressed can have durations of around 50 to 100 microseconds. This requires the addition of fast variable optical attenuators (VOAs) to the design that introduce their own insertion losses.

"This means that you need pumps in excess of 500mW, maybe even 750mW," says Nayar. "And these high-power pumps need to be temperature controlled." The PLC switches of the pump splitter are also temperature controlled.

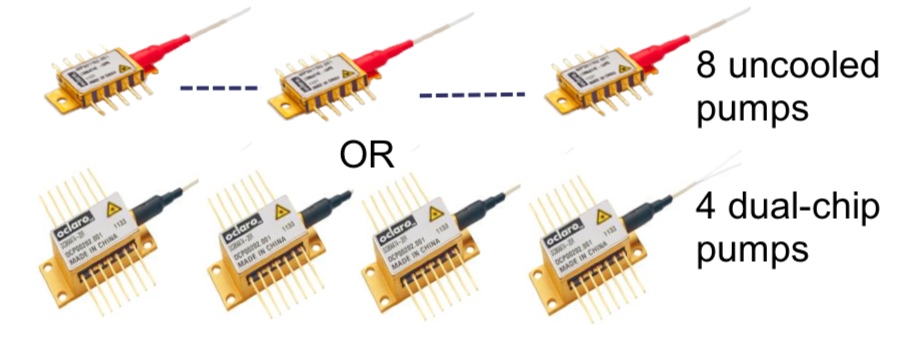

The individual pump-per-amp approach, in contrast, in the form of arrayed amplifiers, is more appealing to implement and is the approach Oclaro is pursuing. These can be eight discrete pumps or four uncooled dual-chip pumps, for the 8-degree 8x16 multicast add/drop example, with each power level individually controlled.

Source: Oclaro

Source: Oclaro

Oclaro says that the economics favour the pump-per-amp architecture. Pumps are coming down in price due to the dramatic price erosion associated with growing volumes. In contrast, the pump split module is a specialist, lower volume device.

"We have been looking at the cost, the reliability and the form factor and have come to the conclusion that a discrete pumping solution is the better approach," says Nayar. "We have looked at some line card examples and we find that we can do, depending on a customer’s requirements, an amplified multicast switch that could be in a single slot."

ECOC 2012 summary - Part 1: Oclaro

Gazettabyte completes its summary of key optical announcements at the recent ECOC show held in Amsterdam. Oclaro's announcements detailed here are followed by those of Finisar and NeoPhotonics.

Part 1: Oclaro

"Networks are getting more complex and you need automation so that they are more foolproof and more efficient operationally"

Per Hansen, Oclaro

Oclaro made several announcements at ECOC included an 8-port flexible-grid optical channel monitor, a new small form factor pump laser MSA and its first CFP2 module. The company also gave an update regarding its 100 Gigabit coherent optical transmission module as well as the company's status following Oclaro's merger with Opnext (see below).

The 8-port flexible grid optical channel monitor (OCM) is to address emerging, more demanding requirements of optical networks. "Networks are getting more complex and you need automation so that they are more foolproof and more efficient operationally," says Per Hansen, vice president of product marketing, optical networks solutions at Oclaro.

The 8-port device can monitor up to eight fibres, for example the input and seven output ports of a wavelength-selective switch or an amplifier's outputs.

The programmable OCM can do more than simply go from fibre to fibre, measuring the spectrum. The OCM can dwell on particular ports, or monitor a wavelength on particular ports when the system is adjusting or turning up a wavelength, for example.

"There is processing power included such that you can do a lot of data processing which can then be exported to the line card in the format required," says Hansen. This is important as operators start to adopt flexible-grid network architectures. "[With flexible-grid spectrum] you don't know where channels stop and start such that an OCM that looks at fixed slots in no longer enough," says Hansen.

The OCM can monitor bands finer than 6.25GHz through to the spectrum across the complete C-band.

Oclaro also detailed that its OMT-100 coherent 100 Gigabit optical module is entering volume production. "We have shipped well over 100 [units] to various customers," says Hansen. "There are a lot of system houses looking at this type of module this year." The OMT-100 was developed by Opnext and replaces Oclaro's own MI 8000XM 100 Gigabit module

The company also announced its first 100 Gigabit CFP2 module and its second-generation CFP module 16W power consumption that support the IEEE 100GBASE-LR4 10km standard.

A new small form factor multi-source agreement (MSA) for pump laser diodes was also announced at the show, involving Oclaro and 3S Photonics.

The 10-pin butterfly package is designed to replace the existing 14-pin design. "It is 75% smaller in volume - about two-thirds in each dimension," says Robert Blum, director of product marketing for Oclaro's photonic components. The MSA supports a single cooled or uncooled pump laser, and its smaller volume enables more integrated amplifier designs.

Oclaro says other companies have expressed interest in the MSA and it expects additional players to join.

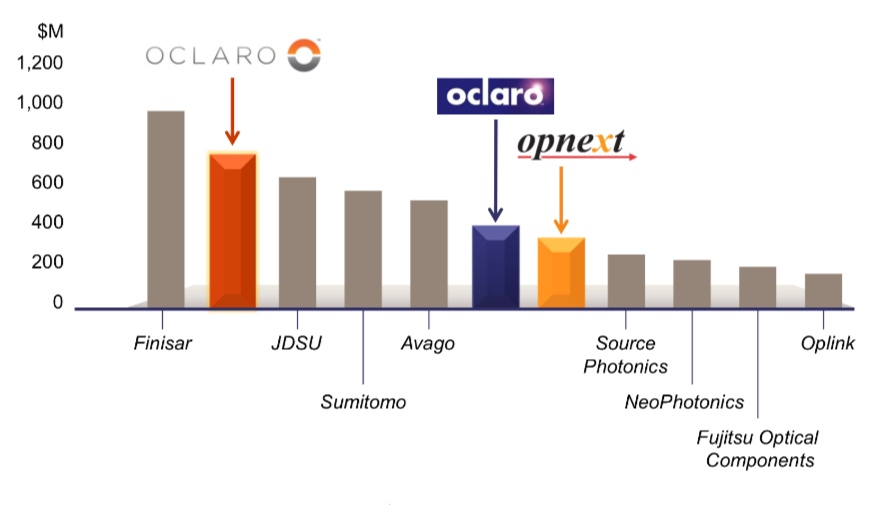

The New Oclaro

Source: Ovum

Oclaro also gave an update of the company's status following the merger with Opnext earlier this year. The now 3,000-strong company has estimated annual revenues of US $800m. This places the optical component company second only to Finisar.

The merger has broadened the company's product line, adding Opnext's strength in datacom pluggable transceivers to Oclaro's core networking products. The company is also more vertically integrated, using its optical components such as tunable laser and VCSEL technologies, modulators and receivers within its line-side transponders and pluggable optical transceivers.

"You can drive technologies in different directions and not just be out there buying components and throwing them together," says Hansen.

The company also has a range of laser diodes for industrial and consumer applications. "We [Oclaro] were already the largest merchant supplier of high-power laser diodes but now we have a complete portfolio that covers all the wavelengths from 400 up to 1500nm," says Blum.

The company has a broad range of technologies that include indium phosphide, gallium arsenide, lithium niobate, MEMS, liquid crystal and gallium nitride.

An extra business unit has also been created. To the existing optical networks solutions and the photonic components businesses there is now the modules and devices unit covering pluggable and high-speed client side transceivers, and which is based in Japan.