ECOC 2023 industry reflections - Part 3

Gazettabyte is asking industry figures for their thoughts after attending the recent ECOC show in Glasgow. In particular, what developments and trends they noted, what they learned and what, if anything, surprised them. Here are responses from Coherent, Ciena, Marvell, Pilot Photonics, and Broadcom.

Julie Eng, CTO of Coherent

It had been several years since I’d been to ECOC. Because of my background in the industry, with the majority of my career in data communications, I was pleasantly surprised to see that ECOC had transitioned from primarily telecommunications, and largely academic, into more industry participation, a much bigger exhibition, and a focus on datacom and telecom. There were many exciting talks and demos, but I don’t think there were too many surprises.

In datacom, the focus, not surprisingly, was on architectures and implementations to support artificial intelligence (AI). The dramatic growth of AI, the massive computing time, and the network interconnect required to train models are driving innovation in fibre optic transceivers and components.

There was significant discussion about using Ethernet for AI compared to protocols such as InfiniBand and NVLink. For us as a transceiver vendor, the distinction doesn’t have a significant impact as there is little if any, difference in the transceivers we make for Ethernet compared to the transceivers we make for InfiniBand/NVLink. However, the impact on the switch chip market and the broader industry are significant, and it will be interesting to see how this evolves.

Linear pluggable optics (LPO) was a hot topic, as it was at OFC 2023, and multiple companies, including Coherent, demonstrated 100 gigabit-per-lane LPO. The implementation has pros and cons, and we may find ourselves in a split ecosystem, with some customers preferring LPO and others preferring traditional pluggable optics with DSP inside the module. The discussion is now moving to the feasibility of 200 gigabit-per-lane LPO.

Discussion and demonstrations of co-packaged optics also continued, with switch vendors starting to show Ethernet switches with co-packaged optics. Interestingly, the success of LPO may push out the implementation of co-packaged optics, as LPO realizes some of the advantages of co-packaged optics with a much less dramatic architectural change.

One telecom trend was the transition to 800-gigabit digital coherent optical modules, as customers and suppliers plan for and demonstrate the capability to make this next step. There was also significant interest in and discussion about 100G ZR. We demonstrated a new version with 0dBm high optical output power at ECOC 2023 while other companies showed components to support it. This is interesting for cable providers and potentially for data centre interconnect and mobile fronthaul and backhaul.

I was very proud that our 200 gigabit-per-lane InP-based DFB-MZ laser won the 2023 ECOC Exhibition Industry Award for Most Innovative Product in the category of Innovative Photonics Component.

ECOC was a vibrant conference and exhibition, and I was pleased to attend and participate again.

Loudon Blair, senior director, corporate strategy, Ciena

ECOC 2023 in Glasgow gave me an excellent perspective on the future of optical technology. In the exhibition, integrated photonic solutions, high-speed coherent pluggable optical modules, and an array of testing and interoperability solutions were on display.

I was especially impressed by how high-bandwidth optics is being considered beyond traditional networking. Evolving use cases include optical cabling, the radio access network (RAN), broadband access, data centre fabrics, and quantum solutions. The role of optical connectivity is expanding.

In the conference, questions and conversations revolved around how we solve challenges created by the expanding use cases. How do we accommodate continued exponential traffic growth on our fibre infrastructure? Coherent optics supports 1.6Tbps today. How many more generations of coherent can we build before we move on to a different paradigm? How do we maximize density and continue to minimize cost and power? How do we solve the power consumption problem? How do we address the evolving needs of data centre fabrics in support of AI and machine learning? What is the role of optical switching in future architectures? How can we enhance the optical layer to secure our information traversing the network?

As I revisited my home city and stood on the banks of the river Clyde – at a location once the shipbuilding centre of the world – I remembered visiting my grandfather’s workshop where he built ships’ compasses and clocks out of brass.

It struck me how much the area had changed from my childhood and how modern satellite communications had disrupted the nautical instrumentation industry. In the same place where my grandfather serviced ships’ compasses, the optical industry leaders were now gathering to discuss how advances in optical technology will transform how we communicate.

It is a good time to be in the optical business, and based on the pace of progress witnessed at ECOC, I look forward to visiting San Diego next March for OFC 2024.

Dr Loi Nguyen, executive vice president and general manager of the cloud optics business group, Marvell

What was the biggest story at ECOC? That the story never changes! After 40 years, we’re still collectively trying to meet the insatiable demand for bandwidth while minimizing power, space, heat, and cost. The difference is that the stakes get higher each year.

The public debut of 800G ZR/ZR+ pluggable optics and a merchant coherent DSP marked a key milestone at ECOC 2023. For the first time, small-form-factor coherent optics delivers performance at a fraction of the cost, power, and space compared to traditional transponders. Now, cloud and service providers can deploy a single coherent optics in their metro, regional, and backbone networks without needing a separate transport box. 800 ZR/ZR+ can save billions of dollars for large-scale deployment over the programme’s life.

Another big topic at the show was 800G linear drive pluggable optics (LPO). The multi-vendor live demo at the OIF booth highlighted some of the progress being made. Many hurdles, however, remain. Open standards still need to be developed, which may prove difficult due to the challenges of standardizing analogue interfaces among multiple vendors. Many questions remain about whether LPO can be scaled beyond limited vendor selection and bookend use cases.

Frank Smyth, CTO and founder of Pilot Photonics

ECOC 2023’s location in Glasgow brought me back to the place of my first photonics conference, LEOS 2002, which I attended as a postgrad from Dublin City University. It was great to have the show close to home again, and the proximity to Dublin allowed us to bring most of the Pilot team.

Two things caught my eye. One was 100G ZR. We noted several companies working on their 100G ZR implementations beyond Coherent and Adtran (formerly Adva) who announced the product as a joint development over a year ago.

100G ZR has attracted much interest for scaling and aggregation in the edge network. Its 5W power dissipation is disruptive, and we believe it could find use in other network segments, potentially driving significant volume. Our interest in 100G ZR is in supplying the light source, and we had a working demo of our low linewidth tunable laser and mechanical samples of our nano-iTLA at the booth.

Another topic was carrier and spatial division multiplexing. Brian Smith from Lumentum gave a Market Focus talk on carrier and spatial division multiplexing (CSDM), which Lumentum believes will define the sixth generation of optical networking.

Highlighting the approaching technological limitation on baud rate scaling, the ‘carrier’ part of CSDM refers to interfaces built from multiple closely-spaced wavelengths. We know that several system vendors have products with interfaces based on two wavelengths, but it was interesting to see this from a component/ module vendor.

We argue that comb lasers come into their own when you go beyond two to four or eight wavelengths and offer significant benefits over independent lasers. So CSDM aligns well with Pilot’s vision and roadmap, and our integrated comb laser assembly (iCLA) will add value to this sixth-generation optical networking.

Speaking of comb lasers, I attended an enjoyable workshop on comb lasers on the Sunday before the meetings got too hectic. The title was ‘Frequency Combs for Optical Communications – Hype or Hope’. It was a lively session featuring a technology push team and a market pull team presenting views from academia and industry.

Eric Bernier offered an important observation from HiSilicon. He pointed to a technology gap between what the market needs and what most comb lasers provide regarding power per wavelength, number of wavelengths, and data rate per lane. Pilot Photonics agrees and spotted the same gap several years ago. Our iCLA bridges it, providing a straightforward upgrade path to scaling to multi-wavelength transceivers but with the added benefits that comb lasers bring over independent lasers.

The workshop closed with an audience participation survey in which attendees were asked: Will frequency combs play a major role in short-reach communications? And will they play a major role in long-reach communications?

Unsurprisingly, given an audience interested in comb lasers, the majority’s response to both questions was yes. However, what surprised me was that the short-reach application had a much larger majority on the yes side: 78% to 22%. For long-reach applications the majority was slim: 54% to 46%.

Having looked at this problem for many years, I believe the technology gap mentioned is easier to bridge and delivers greater benefits for long-reach applications than for short-reach, at least in the near term.

Natarajan Ramachandran, director of product marketing, physical layer products division, Broadcom

Retimed pluggables have repeatedly shown resiliency due to their standards-based approach, offering reliable solutions, manufacturing scale, and balancing metrics around latency, cost and power.

At ECOC this year, multiple module vendors demonstrated 800G DR4 and 1.6T DR8 solutions with 200 gigabit-per-lane optics. As the IEEE works towards ratifying the specs around 200 gigabit per lane, one thing was clear at ECOC: the ecosystem – comprising DSP vendors, driver and transimpedence amplifier (TIA) vendors, and VCSEL/EML/silicon photonics vendors – is ready and can deliver.

Several vendors had module demonstrations using 200 gigabit-per-lane DSPs. What also was apparent at ECOC was that the application space and use cases, be it within traditional data centre networks, AI and machine learning clusters and telcom, continue to grow. Multiple technologies will find the space to co-exist.

How to shepherd a company’s technologies for growth

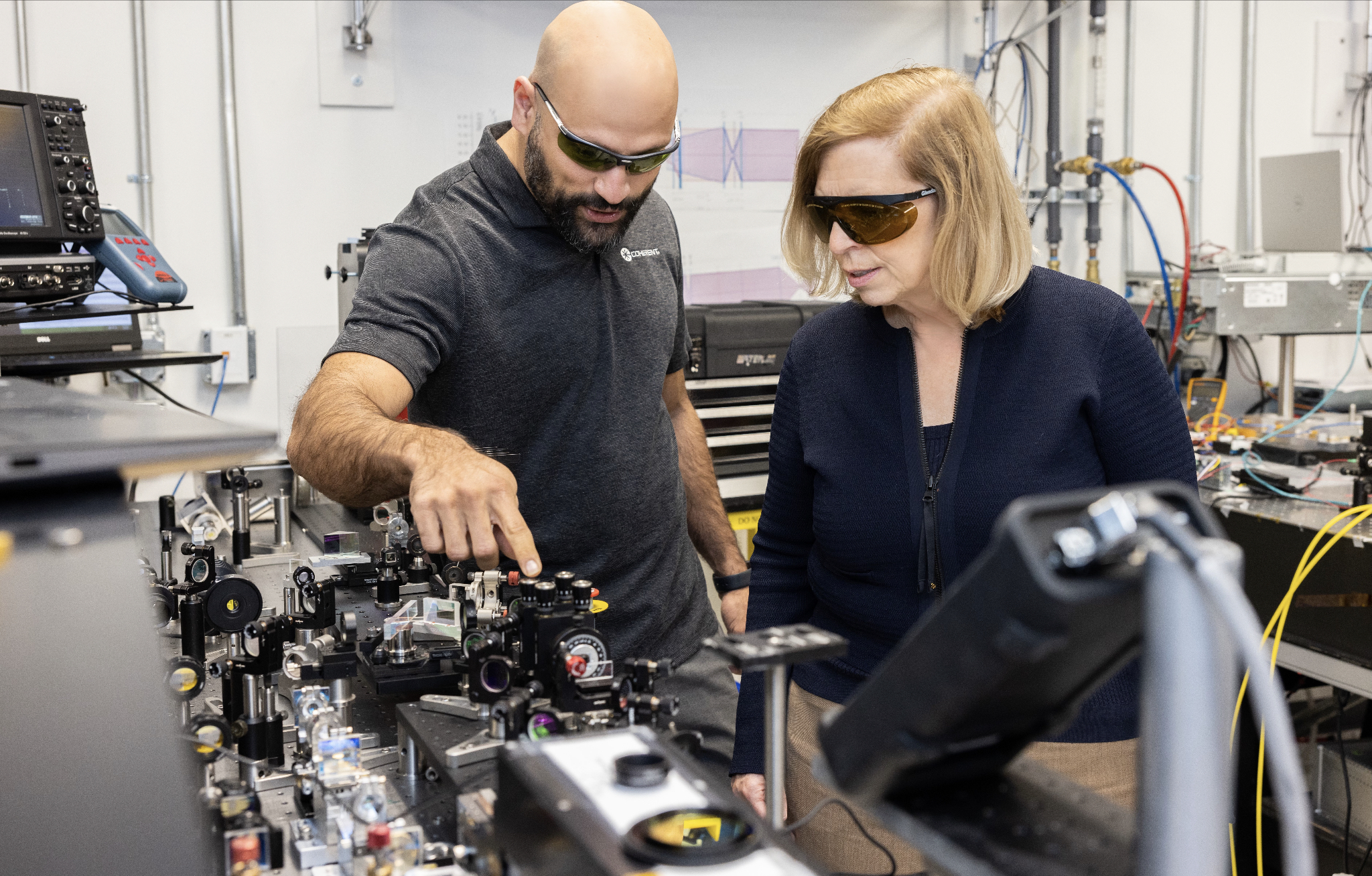

CTO interviews part 3: Dr Julie Eng

- Eng is four months into her new role as CTO of Coherent.

- Previously, she headed Finisar’s transceiver business and then the 3D sensing business, first at Finisar and then at II-VI. II-VI changed its name to Coherent in September 2022

- “CTO is one of these roles that has no universal definition,” says Eng

ulie Eng loved her previous role.

She had been heading II-VI’s (now Coherent’s) 3D sensing unit after being VP of engineering at Finisar’s transceiver business. II-VI bought Finisar in 2019.

She moved across to a new 3D sensing business while still at Finisar. The 3D sensing unit was like a start-up within a large company, she says.

II-VI and Finisar had been competitors in the 3D sensing market. Eng headed the combined units after Finisar’s acquisition.

She enjoyed the role and wasn’t looking to change when the CEO asked her to become Coherent’s CTO.

“To become CTO of the new Coherent – to help define the future of this company which is a five-plus going on six billion dollar company – that is pretty exciting,” says Eng.

The “New” Coherent

Coherent combines a broad portfolio of technologies from II-VI, Finisar, and the firm Coherent which II-VI acquired in 2022.

Just within lasers, Coherent’s portfolio spans from devices 1mm wide that are sold into mobile phones to the former Coherent’s lasers that are meters wide and used for OLED manufacturing.

Being CTO is different from Eng’s line-management roles, which had set, tangible annual goals.

Her role now is to shepherd the company’s technologies and grow the business over the long term.

Eng has been familiarising herself with the company’s technologies. To this aim, Eng is drawing on deep technological expertise across the company’s units.

Luckily, lasers are already covered, she quips.

“One of the things that I always somehow had a knack for is interacting with customers, sensing opportunities, and then figuring out how our technologies can help customers solve their problems,” says Eng.

It is a skill she successfully transferred to the consumer – 3D sensing – business but now it will be needed on a broader scale.

Eng is also making connections across technology units within the company as she seeks to identify new technologies and new market opportunities.

Her CTO role also allows her to engage with every Coherent customer across the company’s many markets.

She admits being CTO is challenging. One issue is grappling with the breadth of technologies the company has. Another is how to assess her works’ impact.

She and the CEO have discussed how best to use her time to benefit the company. Eng has also talked to other companies’ CTOs about the role and what works for them.

“It’s very interesting; CTO is one of these roles that has no universal definition,” says Eng.

Technologies to watch

Eng highlights several developments when asked about noteworthy technologies.

For communications, this is the year when 200 gigabits per lane will likely be achieved.

“The first transceivers I worked on were [SONET/SDH] OC-3 which is 155 megabits per second (Mbps),” she says. “Is wasn’t even a transceiver back then; it was discrete transmitters and receivers.”

That the industry has accelerated technology to achieve multiple lanes of 200 gigabit-per-second (Gbps) in a pluggable module is remarkable, she says.

Eng also notes Coherent’s work on a continuous-wave laser integrated with a Mach-Zehnder modulator – a DMZ – to enable 200 gigabits per lane.

The company is also active in life sciences and health monitoring. Communications, especially during the pandemic, showed its importance in people’s lives. “But life sciences and health-related products have a much more direct impact on people,” says Eng. “That is not something I’ve had direct exposure to.”

Life sciences and health monitoring is a segment where optics and optical devices will play a growing role over time.

Medical devices often originate in research environments such as hospital labs before becoming medical instruments. From the lab, they go to clinical. “What we are talking about here is going from lab to clinical to therapeutics,” she says.

The US Chips Act also heartens Eng: “It was about time for the US to prioritise semiconductors.”

Low-power coherent DSPs

Coherent and ADVA jointly developed a low-power coherent digital signal processor (DSP) and optics design for a 100-gigabit ZR (100ZR) design that fits within a QSFP28 module.

“We have an internal DSP team, and they are developing DSPs for the coherent optics market,” says Eng, adding that having the design team gives Coherent options.

Meanwhile, the debate about direct detection technology versus coherent optics continues.

As optical lane speed increases from 100 gigabits to 200 gigabits, the question remains what reach will direct detection achieve before running out of steam?

With 200 gigabits per lane, 800 gigabit modules can be achieved using four optical lanes, while for 1.6 terabits, eight lanes will be used.

Eng is confident that direct detection will support 10km at these speeds. Beyond 10km, direct detection becomes much more of a challenge, and coherent is an option.

“The real question is will coherent optics meet the size, cost and power consumption expectations of the data centre customers on a timeframe that meets their needs,” says Eng.

Having in-house DSP technology means Coherent can undertake design trade-offs and make the right decisions, she says.

After 1.6 terabits, the design options include increasing the lane rate, using more than eight channels or adopting more advanced modulation schemes.

“We look at the application, the timeline that the product needs to be released, the readiness of the technology, we do measurements – simulations – and we make objective decisions based on the results,” says Eng.

Whatever the prevalent technology is, says Eng, that technology will continue to improve since that is the livelihood of many companies.

“All of us, as an industry, are going to put our all into extending the technologies we currently have,” says Eng. So, when it comes to direct detection versus coherent, everyone will push direct detect technology as far as possible.

“Getting up to 1.6 terabits [using direct detect], that is pretty good,” says Eng. “That is going to last us a pretty long time.”

Materials

Coherent’s toolbox of material systems covers indium phosphide, silicon photonics, and gallium arsenide. It also has silicon carbide, a semiconductor suited for high-power transistors used for power electronics applications.

“We have all the technologies, we use the best technology for the product, and we use good engineering judgement,” says Eng.

Rather than favour indium phosphide or silicon photonics, Eng’s segmentation starts with whether the design is directly modulated or externally modulated.

Until now, up to 50 gigabits per lane has been well served by directly modulated lasers. This has used indium phosphide or, in the case of VCSELs, gallium arsenide.

“In general, directly modulated is the lower cost because the die is tiny, and often it is the lowest power,” says Eng.

But increasing the speed beyond 50Gbps gets more complicated with directly modulated lasers. This is where externally modulated lasers come in.

“Once you are already talking about an externally modulated solution, we start looking at the trade-offs between indium phosphide and silicon photonics,” says Eng.

The laser remains indium phosphide, so the bake-off concerns the modulator and the passive optics.

What indium phosphide brings is better electro-optics performance, while silicon photonics brings the benefits of integration.

“So if there is a high-lane count – lots of passives – or an opportunity to use one laser over multiple modulators, these can be complicated designs, and silicon photonics can help reduce the size,” says Eng.

Pluggables and co-packaged optics

With 200 gigabits per lane becoming available, there is a clear roadmap for 800-gigabits and 1.6-terabit pluggables.

“Customers like pluggables, and I don’t think people should underestimate that,” says Eng, adding that continued innovation will extend their lifetime.

“There are flyover cables between the switch ASIC and the modules, vertical line cards have been proposed, and we have shown board-mounted optical assemblies,” she says.

At some point, co-packaged optics may be the right solution, says Eng. But that will depend on the application’s specification, issues such as bandwidth, size, cost, power consumption and reliability.

“People will only transition to optical input-output when extending pluggables doesn’t make sense anymore,” says Eng. “I think it is probably five-plus years away, but there are probably error bars on that.”

Coherent’s activities include using indium phosphide manufacturing for external laser sources for co-package optics. “And we are working on silicon photonics,” she says.

Coherent is also working on co-packaging VCSELs with high-performance chips. “Not all applications require a 2km reach,” she says.

The coming decade’s opportunities

Eng’s thoughts about the growth opportunities for the coming decade are, not surprisingly, viewed through Coherent’s markets focus.

She highlights four segments: communications, industrial, instrumentation, and electronics.

Fibre-optics communications will continue to grow with bandwidth. The opportunities for innovation include datacom and coherent optics.

She also notes growing interest in free-space optics and satellite communications.

“I see money being spent on that and maybe that is a place where someone like ourselves, with a lot of optics as well as bigger lasers, can play a role,” says Eng.

Precision manufacturing uses lasers in the industrial segment. Eng cites cutting, welding and marking as examples.

“We have elements used for battery manufacturing which is increasing due to electric cars,” she says.

Excimer lasers are also used for OLED and microLED display manufacturing.

“We even have optics in extreme UV steppers [used for advanced process node chip manufacturing],” she says.

For instrumentation, much of the growth is around health life sciences. Coherent makes optics that are used inside PCR testers for COVID-19. It also has engineers working on solid state lasers used for flow cytometry (the sorting of cells). She also cites gene sequencing equipment and medical imaging.

Coherent’s electronics segment refers to the consumer market. Growth here for optics and lasers include AR/VR goggles and the metaverse, wearable health monitoring, and automotive.

For automotive, lasers are used for lidar and in-cabin sensing, such as driver and passenger monitoring.

Silicon carbide is also a growth market, and its uses include the wireless market and power devices for electric vehicles.

“I like the communications market, which we see as growing, but for us, with such a broad portfolio, there are many of these other markets and products that I see as exciting for the remainder of this decade,” says Eng.