Nokia shares its vision for cost-reduced coherent optics

Nokia explains why coherent optics will be key for high-speed short-reach links and shares some of its R&D activities. The latest in a series of articles addressing what next for coherent.

Part 3: Reducing cost, size and power

Coherent optics will play a key role in the network evolution of the telecom and webscale players.

The modules will be used for ever-shorter links to enable future cloud services delivered over 5G and fixed-access networks.

The first uses will be to link data centres and support traffic growth at the network edge.

This will be followed with coherent optics being used within the data centre, once traffic growth requires solutions that 4-level pulse-amplitude modulation (PAM4) direct-detect optics can no longer address.

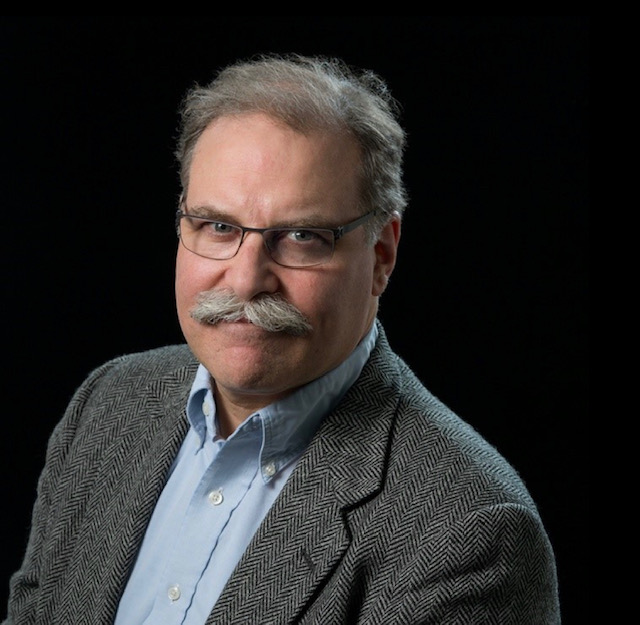

“If you look at PAM4 up to 100 gigabit for long reach and extended reach optics – distances below 80km – it does not scale to higher data rates,” says Marc Bohn, part of product management for Nokia’s optical subsystem group. ”It only scales if you use 100-gigabit in parallel.”

However, to enable short-reach coherent optics, its cost, size and power consumption will need to be reduced significantly. Semiconductor packaging techniques will need to be embraced as will a new generation of coherent digital signal processors (DSPs).

Capacity growth

The adoption of network-edge and on-premise cloud technologies are fueling capacity growth, says Tod Sizer, smart optical fabric & devices research lab leader at Nokia Bell Labs.

Nokia says capacity growth is at 50 per cent per annum and is even faster within the data centre; for every gigabyte entering a data centre, ten gigabytes are transported within the data centre.

“All of this is driving huge amounts of growth in optical capacity at shorter distances,” says Sizer. “To meet that [demand], we need to have coherent solutions to take over where PAM-4 stops.”

Sizer oversees 130 engineers whose research interests include silicon photonics, coherent components and coherent algorithms.

Applications

As well as data centre interconnect, coherent optics will be used for 5G, access and cable networks; markets also highlighted by Infinera and Acacia Communications.

Nokia says the first driver is data centre interconnect.

The large-scale data centre operators triggered the market for 80-120km coherent pluggables with the 400ZR specification for data centre interconnect.

“Right now, with the different architectures in data centres, these guys are saying 80-120km may be an overshoot, maybe we need something for shorter distances to be more efficient,” says Bohn. “Certainly, coherent can tackle that and that is what we are preparing for because there is no alternative, only coherent can cover that space.”

5G is also driving the need for greater bandwidth.

“Traditionally a whole load of processing has been done at the remote ratio head but increasingly, for cost and performance reasons, people are looking at pulling the processing back into the data centre,” says Sizer.

Another traffic driver is how each cellular antenna has three sectors and can use multiple frequency bands.

“Some research we are looking at requires 400 gigabits and above,” says Sizer. “If you want to do a full [mobile] front haul for a massive MIMO (multiple input, multiple output) array, for example.”

Challenges

Several challenges need to be overcome before coherent modules are used widely for shorter-reach links.

To reduce coherent module cost, the optics and DSP need to be co-packaged, borrowing techniques developed by the chip industry.

“Optical and electrical should be brought close together,” says Bohn. “[They should be] co-designed and co-packaged, and the ideal candidate for that is to combine silicon photonics and the DSP.”

The aim is to turn complex designs into a system-on-chip. “Both [the DSP and silicon photonics] are CMOS and you can apply 2D and 3D [die] stacking multi-chip module techniques,” says Bohn, who contrasts it with the custom and manual manufacturing techniques used today.

The coherent DSP also needs to be much simpler than the high-end DSPs used for long-distance optical transport.

For example, the dispersion compensation, which accounts for a significant portion of the chip’s circuitry, is less demanding for shorter links. The forward-error-correction scheme used can also be relaxed as can the bit precision of the analogue-to-digital and digital-to-analogue converters.

Nokia can co-design the silicon photonics and the DSP following its acquisition of Elenion. Nokia is also exploiting Elenion’s packaging know-how and the partnerships it has developed.

Inside the data centre

Nokia highlights two reasons why coherent will eventually be used within the data centre.

The first is the growth in capacity needed inside the data centre. “For the same reason we believe coherent will be the right solution for data centre interconnect and access, the same argument can be made within the data centre,” says Sizer.

A campus data centre is distributed across several buildings and linking them is driving a need for 400-gigabit lanes or more.

This requires a ZR-like solution but for 2km or so rather than 80km.

“It is one of the solutions certainly but that will be driven an awful lot by whether we can make cost-effective solutions to meet the cost targets of the data centre,” says Sizer. That said, there are other ways this can be addressed such as adding fibre.

“Having parallel systems is another area of ongoing research,” says Sizer. “We may need to have unique solutions if traffic grows faster inside the data centre than outside such as spatial-division multiplexing as well as coherent.”

The use of coherent interfaces for networking inside the data centre will take longer.

Bohn points out that 51.2-terabit and 102.4-terabit switches will continue to be served using direct-detect optics but after that, it is unclear because direct-detect optics tops out at 100-gigabits or perhaps 200-gigabits per lane.

“With coherent, it is much easier to get to higher data rates especially over shorter distances,” says Bohn.

Another development benefitting the use of coherent is the next Ethernet standard after 400 Gigabit Ethernet (GbE).

“My research team is looking at that and, in particular, 1.6 Terabit Ethernet (TbE) which is fairly out in the future,” says Sizer. “It will demand a coherent solution, as I expect 800GbE will as well.”

Work to define the next Ethernet standard is starting now and will only be completed in 2025 at the earliest.

Infinera buying Coriant will bring welcome consolidation

Infinera is to purchase privately-held Coriant for $430 million. The deal will effectively double Infinera’s revenues, add 100 new customers and expand the systems vendor’s product portfolio.

Infinera's CEO, Tom FallonBut industry analysts, while welcoming the consolidation among optical systems suppliers, highlight the challenges Infinera faces making the Coriant acquisition a success.

Infinera's CEO, Tom FallonBut industry analysts, while welcoming the consolidation among optical systems suppliers, highlight the challenges Infinera faces making the Coriant acquisition a success.

“The low price reflects that this isn't the best asset on the market,” says Sterling Perrin, principal analyst, optical networking and transport at Heavy Reading. “They are buying $1 of revenue for 50 cents; the price reflects the challenges.”

Benefits

According to Perrin, there are still too many vendors facing "brutal price pressures" despite the optical industry being mature. Removing one vendor that has been cutting prices to win business is good news for the rest.

For Infinera, the acquisition of Coriant promises three main benefits, as outlined by its CEO, Tom Fallon, during a briefing addressing the acquisition.

The first is expanding its vertically-integrated business model across a wider portfolio of products. Infinera develops its own optical technology: its indium-phosphide photonic integrated circuits (PICs) and accompanying coherent DSPs that power its platforms. Having its own technology differentiates the optical performance of its platforms and helps it achieve leading gross margins of over 40 percent, said Fallon.

Exploiting the vertical integration model will be a central part of the Coriant acquisition. Indeed, the company mentioned vertical integration 21 times in as many minutes during its briefing outlining the deal. Infinera expects to deliver industry-leading growth and operating margins once it exploits the benefits of vertical integration across an expanded portfolio of platforms, said Fallon.

Having a seat at the table with the largest global service providers to strategise about where their business is going will be invaluable

Buying Coriant also gives Infinera much-needed scale. Not only will Infinera double its revenues - Coriant’s revenues were about $750 million in 2017 while Infinera’s were $741 million for the same period - but it will expand its customer base including key tier-one service providers and webscale players. According to Fallon, the newly combined company will include nine of the top 10 global tier-one service providers and the six leading global internet content providers.

Infinera admits it has struggled to break into the tier-one operators and points out that trying to enter is an expensive and time-consuming process, estimated at between $10 million to $20 million each time. “[Now, with Coriant,] having a seat at the table with the largest global service providers to strategise about where their business is going will be invaluable,” said Fallon.

Sterling Perrin of Heavy Reading The third benefit Infinera gains is an expanded product portfolio. Coriant has expertise in layer 3 networking, in the metro core with its mTera universal transport platform as well as SDN orchestration and white box technologies. Heavy Reading’s Perrin says Coriant has started development of a layer-3 router white box for edge applications.

Sterling Perrin of Heavy Reading The third benefit Infinera gains is an expanded product portfolio. Coriant has expertise in layer 3 networking, in the metro core with its mTera universal transport platform as well as SDN orchestration and white box technologies. Heavy Reading’s Perrin says Coriant has started development of a layer-3 router white box for edge applications.

Combining the two companies also results in a leading player in data centre interconnect.

“Coriant expands our portfolio, particularly in packet and automation where significant network investment is expected over the next decade,” said Fallon. The deal is happening at the right time, he said, as operators ramp spending as they undertake network transformation.

Infinera will pay $230 million in cash - $150 million up front and the rest in increments - and a further $200 million in shares for Coriant. The company expects to achieve cost savings of $250 million between 2019 and 2021 by combining the two firms, $100 million in 2019 alone. The deal is expected to close in the third quarter of 2018.

If a company is going to put that integrated product into their network, it’s a full-blown RFP process which Infinera may or may not win

Challenges

Industry analysts, while seeing positives for Infinera, have concerns regarding the deal.

A much-needed consolidation of weaker vendors is how George Notter, an analyst at the investment bank, Jefferies, describes the deal. For Infinera, however, continuing as before was not an option. Heavy Reading’s Perrin agrees: ”Infinera has been under a lot of pressure; their core business of long-haul has slowed.”

The deal brings benefits to Infinera: scale, complementary product sets, and the promise of being able to invest more in R&D to benefit its PIC technology, says Notter in a research note.

Gaining customers is also a key positive. “Infinera is really excited about getting the new set of customers and that is what they are paying for,” says Vladimir Kozlov, CEO of LightCounting Market Research. “However, these customers were gained by pricing products at steep discounts.”

What is vital for Infinera is that it delivers its upcoming 2.4-terabit Infinite Capacity Engine 5 (ICE5) optical engine on time. The ICE5 is expected to ship in early 2019. In parallel, Infinera is developing its ICE6 due two years later. Infinera is developing two generations of ICE designs in parallel after being late to market with its current 1.2-terabit optical engine.

Infinera is really excited about getting the new set of customers and that is what they are paying for

But even if the ICE5 is delivered on time, upgrading Coriant's platforms will be a major undertaking. “It sounds like they are going to fit their optical engines in all of Coriant’s gear; I don’t see how that is going to happen anytime quickly,” says Perrin.

Customers bought Coriant's equipment for a reason. Once upgraded with Infinera’s PICs, these will be new products that have to undergo extensive lab testing and full evaluations.

Perrin questions how moving customers off legacy platforms to the new will not result in the service providers triggering a new request-for-proposal (RFP). “If a company is going to put that integrated product into their network, it’s a full-blown RFP process which Infinera may or may not win,” says Perrin. “Infinera talked a lot about the benefits of vertical integration but they didn’t really address the challenges and the specific steps they would take to make that work.”

LightCounting's Vladimir KozlovLightCounting’s Kozlov also questions how this will work.

LightCounting's Vladimir KozlovLightCounting’s Kozlov also questions how this will work.

“The story about vertical integration and scaling up PIC production is compelling, but how will they support Coriant products with the PIC?” he says. “Will they start making pluggable modules internally? Will Coriant’s customers be willing to move away from the pluggables and get locked into Infinera’s PICs? Do they know something that we don’t?”

While Infinera is a top five optical platform supplier globally it hasn’t dominated the market with its PIC technologies, says Perrin. “Even if they technically pull off the vertical integration with the Coriant products, how much is that going to win business for them?” he says. “It is one architecture in a mix that has largely gone to pluggables.”

Transmode

Infinera already has experience acquiring a systems vendor when it bought in 2015 metro-access player, Transmode. Strategically, this was a very solid acquisition, says Perrin, but the jury is still out as to its success.

“The integration, making it work, how Transmode has performed within Infinera hasn’t gone as well as they wanted,” says Perrin. “That said, there are some good opportunities going forward for the Transmode group.”

Infinera also had planned to integrate its PIC technology within Transmode’s products but it didn't make economic sense for the metro market. There may also have been pushback from customers that liked the Transmode products, says Perrin: “With Coriant it looks like they really are going to force the vertical integration.”

Infinera acknowledges the challenges ahead and the importance of overcoming them if it is to secure its future.

“Given the comparable sizes of each company’s revenues and workforce, we recognise that integration will be challenging and is vital for our ultimate success,” said Fallon.

Infinera’s ICE flow

Infinera’s newest Infinite Capacity Engine 5 (ICE5) doubles capacity to 2.4 terabits. The ICE, which comprises a coherent DSP and a photonic integrated circuit (PIC), is being demonstrated this week at the OFC show being held in San Diego.

Infinera has also detailed its ICE6, being developed in tandem with the ICE5. The two designs represent a fork in Infinera’s coherent engine roadmap in terms of the end markets they will address.

Geoff BennettThe ICE5 is targeted at data centre interconnect and applications where fibre in being added towards the network edge. The next-generation access network of cable operators is one such example. Another is mobile operators deploying fibre in preparation for 5G.

Geoff BennettThe ICE5 is targeted at data centre interconnect and applications where fibre in being added towards the network edge. The next-generation access network of cable operators is one such example. Another is mobile operators deploying fibre in preparation for 5G.

First platforms using the ICE5 will be unveiled later this year and will ship early next year.

Infinera’s ICE6 is set to appear two years after the ICE5. Like the ICE4, Infinera’s current Infinite Capacity Engine, the ICE6 will be used across all of Infinera’s product portfolio.

Meanwhile, the 1.2 terabit ICE4 will now be extended to work in the L-band of optical wavelengths alongside the existing C-band, effectively doubling a fibre’s capacity available for service providers.

Infinera’s decision to develop two generations of coherent designs follows the delay in bringing the ICE4 to market.

“The fundamental truth about the industry today is that coherent algorithms are really hard,” says Geoff Bennett, director, solutions and technology at Infinera.

By designing two generations in parallel, Infinera seeks to speed up the introduction of its coherent engines. “With ICE5 and ICE6, we have learnt our lesson,” says Bennett. “We recognise that there is an increased cadence demanded by certain parts of the industry, predominately the internet content providers.”

ICE5

The ICE5 uses a four-wavelength indium-phosphide PIC that, combined with the FlexCoherent DSP, supports a maximum symbol rate of 66Gbaud and a modulation rate of up to 64-ary quadrature amplitude modulation (64-QAM).

Infinera says that the FlexCoherent DSP used for ICE5 is a co-development but is not naming its partners.

Using 64-QAM and 66Gbaud enables 600-gigabit wavelengths for a total PIC capacity of 2.4 terabits. Each PIC is also ‘sliceable’, allowing each of the four wavelengths to be sent to a different location.

Infinera is not detailing the ICE5’s rates but says the design will support lower rates, as low as 200 gigabit-per-second (Gbps) or possibly 100Gbps per wavelength.

Bennett highlights 400Gbps as one speed of market interest. Infinera believes its ICE5 design will deliver 400 gigabits over 1,300km. The 600Gbps wavelength implemented using 64-QAM and 66Gbaud will have a relatively short reach of 200-250km.

“A six hundred gigabit wavelength is going to be very short haul but is ideal for data centre interconnect,” says Bennett, who points out that the extended reach of 400-gigabit wavelengths is attractive and will align with the market emergence of 400 Gigabit Ethernet client signals.

Probabilistic shaping squeezes the last bits of capacity-reach out of the spectrum

Hybrid Modulation

The 400-gigabit will be implemented using a hybrid modulation scheme. While Infinera is not detailing the particular scheme, Bennett cites several ways hybrid modulation can be implemented.

One hybrid modulation technique is to use a different modulation scheme on each of the two light polarisations as a way of offsetting non-linearities. The two modulation schemes can be repeatedly switched between the two polarisation arms. “It turns out that the non-linear penalty takes time to build up,” says Bennett.

Another approach is using blocks of symbols, varying the modulation used for each block. “The coherent receiver has to know how many symbols you are going to send with 64-QAM and how many with 32-QAM, for example,” he says

A third hybrid modulation approach is to use sub-carriers. In a traditional coherent system, a carrier is the output of the transmit laser. To generate sub-carriers, the coherent DSP’s digital-to-analogue converter (DAC) applies a signal to the modulator which causes the carrier to split into multiple sub-carriers.

To transmit at 32Gbaud, four sub-carriers can be used, each modulated at 8Gbaud, says Bennett. Nyquist shaping is used to pack the sub-carriers to ensure there is no spectral efficiency penalty.

“You now have four parallel streams and you can deal with them independently,” says Bennett, who points out that 8Gbaud turns out to be an optimal rate in terms of minimising non-linearities made up of cross-phase and self-phase modulation components.

Sub-carriers can be described as a hybrid modulation approach in that each sub-carrier can be operated at a different baud rate and use a different modulation scheme. This is how probabilistic constellation shaping - a technique that improves spectral efficiency and which allows the data rate used on a carrier to be fine-tuned - will be used with the ICE6, says Infinera.

For the ICE5, sub-carriers are not included. “For the applications we will be using ICE5 for, the sub-carrier technology is not as important,” says Bennett. “Where it is really important is in areas such as sub-sea.”

Silicon photonics has a lower carrier mobility. It is going to be harder and harder to build such parts of the optics in silicon.

Probabilistic constellation shaping

Infinera is not detailing the longer-term ICE6 beyond highlights two papers that were presented at the ECOC show last September that involved a working 100Gbaud sub-carrier-driven wavelength and probabilistic shaping applied to a 1024-QAM signal.

The 100Gbaud rate will enable higher capacity transponders while the use of probabilistic shaping will enable greater spectral efficiency. “Probabilistic shaping squeezes the last bits of capacity-reach out of the spectrum,” says Bennett.

“In ICE6 we will be doing different modulation on each sub-carrier,” says Bennett. “That will be part of probabilistic constellation shaping.” And assuming Infinera adheres to 8Gbaud sub-carriers, 16 will be used for a 100Gbaud symbol rate.

Infinera argues that the interface between the optics and the DSP becomes key at such high baud rates and it argues that its ability to develop both components will give it a system design advantage.

The company also argues that its use of indium phosphide for its PICs will be a crucial advantage at such high baud rates when compared to silicon photonics-based solutions. “Silicon photonics has a lower carrier mobility,” says Bennett. “It is going to be harder and harder to build such parts of the optics in silicon.”

ICE4 embraces the L-band

Infinera’s 1.2 terabit six-wavelength ICE4 was the first design to use Nyquist sub-carriers and SD-FEC gain sharing, part of what Infinera calls its advanced coherent toolkit.

At OFC, Infinera announced that the ICE4 will add the L-band in addition to the C-band. It also announced that the ICE4 has now been adopted across Infinera’s platform portfolio.

The first platforms to use the ICE4 were the Cloud Xpress 2, the compact modular platform used for data centre interconnect, and the XT-3300, a 1 rack-unit (1RU) modular platform targeted at long-haul applications.

A variant of the platform tailored for submarine applications, the XTS-3300, achieved a submarine reach of 10,500km in a trial last year. The modulation format used was 8-QAM coupled with SD-FEC gain-sharing and Nyquist sub-carriers. The resulting spectral efficiency achieved was 4.5bits/s/Hz. In comparison, standard 100-gigabit coherent transmission has a spectral efficiency of 2bits/s/Hz. The total capacity supported in the trial was 18.2 terabits.

Since then, the ICE4 has been added the various DTN-X chassis including the XT-3600 2.4 terabit 4RU platform.

Enabling coherent optics down to 2km short-reach links

Interview 5: Chris Doerr

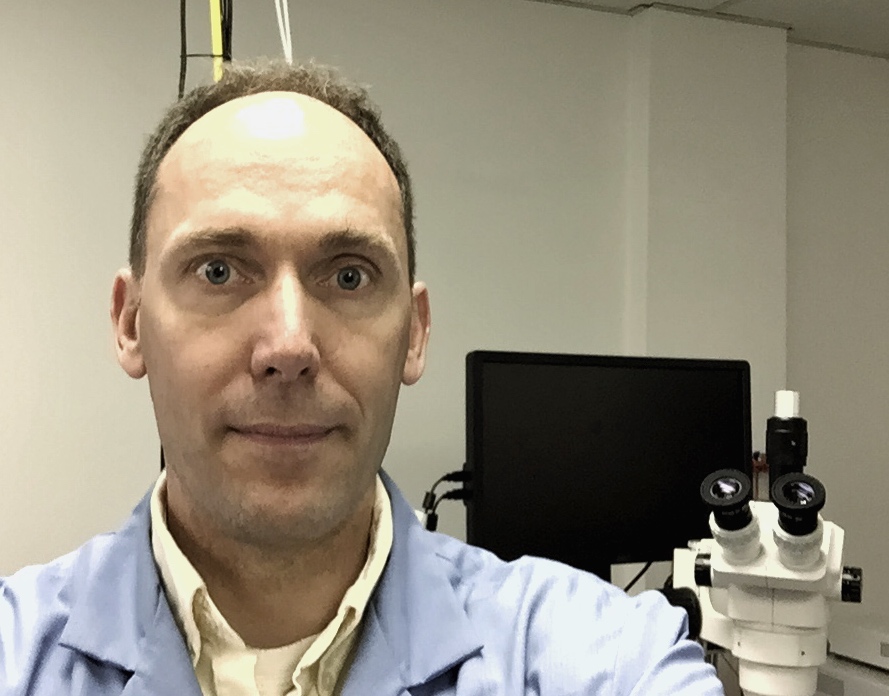

Chris Doerr admits he was a relative latecomer to silicon photonics. But after making his first silicon photonics chip, he was hooked. Nearly a decade later and Doerr is associate vice president of integrated photonics at Acacia Communications. The company uses silicon photonics for its long-distance optical coherent transceivers.

Chris Doerr in the lab

Chris Doerr in the lab

Acacia Communications made headlines in May after completing an initial public offering (IPO), raising approximately $105 million for the company. Technology company IPOs have become a rarity and are not always successful. On its first day of trading, Acacia’s shares opened at $29 per share and closed just under $31.

Although investors may not have understood the subtleties of silicon photonics or coherent DSP-ASICs for that matter, they noted that Acacia has been profitable since 2013. But as becomes clear in talking to Doerr, silicon photonics plays an important role in the company’s coherent transceiver design, and its full potential for coherent has still to be realised.

Bell Labs

Doerr was at Bell Labs for 17 years before joining Acacia in 2011. He spent the majority of his time at Bell Labs making first indium phosphide-based optical devices and then also planar lightwave circuits. One of his bosses at Bell Labs was Y.K. Chen. Chen had arranged a silicon photonics foundry run and asked Doerr if he wanted to submit a design.

What hooked Doerr was silicon photonics’ high yields. He could assume every device was good, whereas when making complex indium phosphide designs, he would have to test maybe five or six devices before finding a working one. And because the yields were high, he could focus more on the design aspects. “Then you could start to make very complex designs - devices with many elements - with confidence,” he says.

Another benefit was that the performance of the silicon photonic circuit matched closely its simulation results. “Indium phosphide is so complex,” he says. “You have to worry about the composition effects and the etching is not that precise.” With silicon, in contrast, the dimensions and the refractive index are known with precision. “You can simulate and design very precisely, which made it [the whole process] richer,” says Doerr.

Silicon photonics is a disruptive technology because of its ability to integrate so many things together and still be high yield and get the raw performance

After that first wafer run, Doerr continued to design both planar lightwave circuits and indium phosphide components at Bell Labs. But soon it was solely silicon photonics ICs.

Doerr views Acacia’s volume production of an integrated coherent transceiver - the transmit and receive optics on the one chip - with a performance that matches discrete optical designs, as one of silicon photonics’ most notable achievements to date.

With a discrete component coherent design, you can use the best of each material, he explains, whereas with an integrated design, compromises are inevitable. “You can’t optimise the layer structure; each component has to share the wafer structure,” he says. Yet with silicon photonics, the design space is so powerful and high-yielding, that these compromises are readily overcome.

Doerr also describes a key moment when he realised the potential of silicon photonics for volume manufacturing.

He was reading an academic paper on grating couplers, a structure used to couple fibres to waveguides. “You can only make that in silicon photonics because you need a high vertical [refractive] index contrast,” he says. Technically, a grating coupler can also be made in indium phosphide but the material has to be cut from under the waveguide; this leaves the waveguide suspended in air.

When he first heard of grating couplers he assumed the coupling efficiency would be of the order of a few percent whereas in practice it is closer to 85 percent. “That is when I realised it is a very powerful concept,” he says.

Integration is key

Doerr pauses before giving measured answers to questions about silicon photonics. Nor does his enthusiasm for silicon photonics blinker him to the challenges it faces. However, his optimism regarding the technology’s future is clear.

“Silicon photonics is a disruptive technology because of its ability to integrate so many things together and still be high yield and get the raw performance,” he says. In the industry, silicon photonics has proven itself for such applications as metro telecommunications but it faces significant competition from established technologies such as indium phosphide. It will require more channels to be integrated for the full potential of silicon photonics as a disruption technology to emerge, says Doerr.

Silicon photonics also has an advantage on indium phosphide in that it can be integrated with electronic ICs using 2.5D and 3D packaging, saving cost, footprint, and power. “If you are in the same material system then such system-in-package is easier,” he says. Also, silicon photonic integrated circuits do not require temperature control, unlike indium phosphide modulators, which saves power.

Areas of focus

One silicon photonics issue is the need for an external laser. For coherent transceivers, it is better to separate the laser from the high-speed optics due to the fact that the coherent DSP-ASIC and the photonic chips are hot and the laser requires temperature control.

For applications such as very short reach links, silicon photonics needs a laser source and while there are many options to integrate the laser to the chip, a clear winning approach has yet to emerge. “Until a really low cost solution is found, it precludes silicon from competing with really low-cost solutions like VCSELs for very short reach applications,” he says.

Silicon photonic chip volumes are still many orders of magnitude fewer than those of electronic ICs. But Acacia says foundries already have silicon photonics lines running, and as these foundries ramp volumes, costs, production times, and node-sizes will continually improve.

Opportunities

The adoption of silicon photonics will increase significantly as more and more functions are integrated onto devices. For coherent designs, Doerr can foresee silicon photonics further reducing the size, cost and power consumption, making them competitive with other optical transceiver technologies for distances as short as 2km.

“You can use high-order formats such as 256-QAM and achieve very high spectral efficiency,” says Doerr. Using such a modulation scheme would require fewer overall lasers to achieve significant transport capacities, improving the cost-per-bit performance for applications such as data centre interconnect. “Fibre is expensive so the more you can squeeze down a fibre, the better,” he says.

Doerr also highlights other opportunities for silicon photonics, beyond communications. Medical applications is one such area. He cites a post-deadline paper at OFC 2016 from Acacia on optical coherent tomography which has similarities with the coherent technology used in telecom.

Longer term, he sees silicon photonics enabling optical input/ output (I/O) between chips. As further evolutionary improvements are achieved, he can see lasers being used externally to the chip to power such I/O. “That could become very high volume,” he says.

However, he expects 3D stacking of chips to take hold first. “That is the easier way,” he says.

The white box concept gets embraced at the optical layer

White boxes have arisen to satisfy the data centre operators’ need for simple building-block functions in large number that they can direct themselves.

“They [data centre operators] started using very simple white boxes - rather simple functionality, much simpler than the large router companies were providing - which they controlled themselves using software-defined networking orchestrators,” says Brandon Collings, CTO of Lumentum.

Such platforms have since evolved to deliver high-performance switching, controlled by third-party SDN orchestrators, and optimised for the simple needs of the data centre, he says. Now this trend is moving to the optical layer where the same flexibility of function is desired. Operators would like to better pair the functionality that they are going to buy with the exact functionality they need for their network, says Collings.

“There is no plan to build networks with different architectures to what is built today,” he says. “It is really about how do we disaggregate conventional platforms to something more flexible to deploy, to control, and which you can integrate with control planes that also manage higher layers of the network, like OTN and the packet layer.”

White box products

Lumentum has a background in integrating optical functions such as reconfigurable optical add/drop multiplexers (ROADMs) and amplifiers onto line cards, known as its TrueFlex products. “That same general element is now the element being demanded by these white box strategies, so we are putting them in pizza boxes,” says Collings.

At OFC, Lumentum announced several white box designs for linking data centres and for metro applications. Such designs are for large-scale data centre operators that use data centre interconnect platforms. But several such operators also have more complex, metro-like optical networking requirements. Traditional telcos such as AT&T are also interested in pursuing the approach.

The first Lumentum white box products include terminal and line amplifiers, a dense WDM multiplexer/ demultiplexer and a ROADM. These hardware boxes come with open interfaces so that they can be controlled by an SDN orchestrator and are being made available to interested parties.

OpenFlow, which is used for electrical switches in the data centre, could be use with such optical white boxes. Other more likely software are the Restconf and Netconf protocols. “They are just protocols that are being defined to interface the orchestrator with a collection of white boxes,” says Collings.

Lumentum’s mux-demux is defined as a white box even though it is passive and has no power or monitoring requirements. That is because the mux-demux is a distinct element that is not part of a platform.

AT&T is exploring the concept of a disaggregated ROADM. Collings says a disaggregated ROADM has two defining characteristics. One is that the hardware isn’t required to come with a full network control management system. “You can buy it and operate it without buying that same vendor’s control system,” he says. The second characteristic is that the ROADM is physically disaggregated - it comes in a pizza box rather than a custom, proprietary chassis.

There remains a large amount of value between encompassing optical hardware in a pizza box to delivering an operating network

Lumentum: a systems vendor?

The optical layer white box ecosystem continues to develop, says Collings, with many players having different approaches and different levels of ‘aggressiveness’ in pursuing the concept. There is also the issue of the orchestrators and who will provide them. Such a network control system could be written by the hyper-scale data centre operators or be developed by the classical network equipment manufacturers, says Collings.

Collings says selling pizza boxes does not make Lumentum a systems vendor. “There is a lot of value-add that has to happen between us delivering a piece of hardware with simple open northbound control interfaces and a complete deployed, qualified, engineered system.”

Control software is needed as is network engineering; value that traditional system vendors have been adding. “That is not our expertise; we are not trying to step into that space,” says Collings. There remains a large amount of value between encompassing optical hardware in a pizza box to delivering an operating network, he says.

This value and how it is going to be provided is also at the core of an ongoing industry debate. “Is it the network provider or the people that are very good at it: the network equipment makers, and how that plays out.”

Lumentum’s white box ROADM was part of an Open Networking Lab proof-of-concept demonstration at OFC.

OFC 2016: a sample of the technical paper highlights

Here is a small sample of the technical paper highlights being presented at the conference.

Doubling core network capacity

Microsoft has conducted a study measuring the performance of its North American core backbone network to determine how the use of bandwidth-variable transceivers (BVTs) could boost capacity.

The highest capacity modulation scheme suited for each link from the choice of polarisation-multiplexed, quadrature phase-shift keying (PM-QPSK), polarisation-multiplexed, 8 quadrature amplitude modulation (PM-8QAM) and PM-16QAM can then be used.

By measuring the signal (Q-factor) for all its PM-QPSK based 100 gigabit links, Microsoft's study found that network capacity could be increased by 70 percent using BVTs. Equally, having the ability to increase capacity in 25-gigabit increments would increase capacity by a further 16 percent while a finer resolution of 1-gigabit would add an extra 13 percent.

Microsoft says such tuning of links need not be done in real time but rather when a link is commissioned or undergoing maintenance.

[paper M2J.2]

Architecting a new metro

How can operators redesign their metro network to enable rapid service innovation? This is the subject of a joint paper from AT&T, the Open Networking Lab and Stanford University. The work is part of a programme dubbed CORD to redesign the central office as a data centre using commodity hardware and open software to enable the rapid scaling of services. In particular, OpenFlow-enabled white boxes, the Open Network Operating System (ONOS) - a software-defined networking (SDN) operating system, and network control and management applications are used.

As part of CORD, three legacy telecom devices - optical line termination (OLT), customer premises equipment (CPE), and broadband network gateways (BNG) - have been virtualised and implemented on servers.

The paper details how a single SDN control plane based on ONOS is used to create a converged packet-optical metro network and how its support for bandwidth on-demand and automatic restoration at the optical level is used for enterprise connectivity and video distribution services.

The paper also discusses how the metro architecture supports 'disaggregated' reconfigurable optical add/ drop multiplexers (ROADMs). By disaggregating a chassis-based ROADM into commodity components, an operator can size its infrastructure as required and grow it with demand, the paper says.

[paper Th1A.7]

400 gigabit single-carrier transmission

Nokia Bell Labs reports work on 400 gigabit-per-second (Gbps) single-carrier optical transmission over submarine distances. The attraction of adopting 400 gigabit single-carrier transmission as that it is the most efficient way to reduce the cost-per-bit of optical transmission systems.

The Bell Labs' paper reviews state-of-the-art 400 gigabit single-channel transmissions over 6,000km and greater distances, and discusses the tradeoffs between such variables as symbol rate, modulation and forward error correction (FEC) schemes.

400Gbps single-carrier submarine transmission is likely in the next few years

PM-16QAM is proposed as a promising modulation scheme to achieve beyond 6,000km distances and a spectral efficiency exceeding 5b/s/Hz. But this requires a symbol rate of greater than 60 gigabaud to accommodate the 20 percent overhead FEC. Pulse-shaping at the transmitter is also used.

Exploring the receiver performance with the varying symbol rate/ FEC overhead, Bell Labs reports that the best tradeoff between coding gain and implementation penalties is 64 gigabaud and 27.3% overhead. It concludes that single-carrier 400Gbps submarine transmission is likely in the next few years.

[paper Th1B.4]

Silicon modulator for CFP2-ACOs

Cisco has developed a compact flip-chip assembly that combines a silicon photonics modulator and a silicon germanium BiCMOS Mach-Zehnder modulator driver. Such an assembly forms the basis for low-cost advanced coherent optical transceivers such as the CFP2-ACO.

Cisco has demonstrated the assembly operating at 128.7Gbps using PM-QPSK and 257.3Gbps using PM-16QAM. Cisco believes this is the first demonstration of transmission at 257.3Gbps using PM-16QAM over 1,200km of standard single-mode fibre using a silicon photonics-based device.

The modulator has also been demonstrated operating at 321.4Gbps using PM-16QAM transmission and a 20 percent FEC overhead, the highest bit rate yet achieved using a silicon-photonics based transmitter, claims Cisco.

Cisco is already using CFP2-ACO modules as part of its NCS 1002 data centre interconnect platform that implement PM-16QAM and deliver 250 gigabit due to the use of a higher baud rate than the 32 gigabaud used for existing 100-gigabit coherent systems.

[paper Th1F.2]

Flexible Ethernet to exploit line-side efficiencies

Given how the optical network network is starting to use adaptive-rate interfaces, a paper from Google asks how the client side can benefit from such line-side flexibility.

The paper points out that traditional DWDM transport equipment typically multiplexes lower-rate client ports but that this doesn't apply to network operators that manage their own data centres. Here, traffic is exclusively packet-based from IP routers and typically matches the line rate. This is why data centre interconnect platforms have become popular as they require limited grooming capability.

Google highlights how Flexible Ethernet (FlexE), for which the Optical Internetworking Forum has just defined an Implementation Agreement for, combined with data centre interconnect equipment is an extremely effective combination.

FlexE supports Ethernet MAC rates independent of the Ethernet physical layer rate being used. Google shows examples of how using FlexE, sub client rates can match the line-side rate as well as how multiple client ports can support a higher speed router logical port.

The paper concludes that combining FlexE with data centre interconnect results in a low cost, low power, compact design that will enable Internet content providers to scale their networks.

[paper W4G.4]

MultiPhy readies 100 Gigabit serial direct-detection chip

MultiPhy is developing a chip that will support serial 100 Gigabit-per-second (Gbps) transmission using 25 Gig optical components. The device will enable short reach links within the data centre and up to 80km point-to-point links for data centre interconnect. The fabless chip company expects to have first samples of the chip, dubbed FlexPhy, by year-end.

Figure 1: A block diagram of the 100 Gig serial FlexPhy. The transmitter output is an electrical signal that is fed to the optics. Equally, the input to the receive path is an electrical signal generated by the receiver optics. Source: Gazettabyte

Figure 1: A block diagram of the 100 Gig serial FlexPhy. The transmitter output is an electrical signal that is fed to the optics. Equally, the input to the receive path is an electrical signal generated by the receiver optics. Source: Gazettabyte

The FlexPhy IC comprises multiplexing and demultiplexing functions as well as a receiver digital signal processor (DSP). The IC's transmitter path has a CAUI-4 (4x28 Gig) interface, a 4:1 multiplexer and four-level pulse amplitude modulation (PAM-4) that encodes two bits per symbol. The resulting chip output is a 50 Gbaud signal used to drive a laser to produce the 100 Gbps output stream.

"The input/output doesn't toggle at 100 Gig, it toggles at 50 Gig," says Neal Neslusan, vice president of sales and marketing at MultiPhy. "But 50 Gig PAM-4 is actually 100 Gigabit-per-second."

The IC's receiver portion will use digital signal processing to recover and decode the PAM-4 signals, and demultiplex the data into four 28 Gbps electrical streams. The FlexPhy IC will fit within a QSFP28 pluggable module.

As with MultiPhy's first-generation chipset, the optics are overdriven. With the MP1101Q 4x28 Gig multiplexer and MP1100Q four-channel receiver, 10 Gig optics are used to achieve four 28 Gig lanes, while with the FlexPhy, a 25 Gig laser is used. "Using a 25 GigaHertz laser and double-driving it to 50 GigaHertz induces some noise but the receiver DSP cleans it up," says Neslusan.

The use of PAM-4 incurs an optical signal-to-noise ratio (OSNR) penalty compared to non-return-to-zero (NRZ) signalling used for MultiPhy's first-generation direct-detection chipset. But PAM-4 has a greater spectral density; the 100 Gbps signal fits within a 50 GHz channel, resulting in 80 wavelengths in the C-band. This equates to 8 terabits of capacity to connect data centres up to 80 km apart.

Within the data centre, MultiPhy’s physical layer IC will enable 100 Gbps serial interfaces. The design could also enable 400 Gig links over distances of 500 m, 2 km and 10 km, by using four FlexPhys, four transmitter optical sub-assemblies (TOSAs) and four receiver optical sub-assemblies (ROSAs).

Meanwhile, MultiPhy's existing direct-detection chipset has been adopted by multiple customers. These include two optical module makers – Oplink and a Chinese vendor – and a major Chinese telecom system vendor that is using the chipset for a product coming to market now.

Cyan's stackable optical rack for data centre interconnent

"The drivers for these [data centre] guys every day of the week is lowest cost-per-gigabit"

Joe Cumello

The amount of traffic moved between data centres can be huge. According to ACG Research, certain cloud-based applications shared between data centres can require between 40 to 500 terabits of capacity. This could be to link adjacent data centre buildings to appear as one large logical one, or connect data centres across a metro, 20 km to 200 km apart. For data centres separated across greater distances, traditional long-haul links are typically sufficient.

Cyan says it developed the N-series platform following conversations conducted with internet content providers over the last two years. "We realised that the white box movement would make its way into the data centre interconnect space," says Cumello.

White box servers and white box switches, manufactured by original design manufacturers (ODMs), are already being used in the data centre due to their lower cost. Cyan is using a similar approach for its N-Series, using commercial-off-the-shelf hardware and open software.

"The drivers for these [data centre] guys every day of the week is lowest cost-per-gigabit," says Cumello.

N-Series platform

Cyan's N-Series N11 is a 1-rack-unit (1RU) box that has a total capacity of 800 Gigabit-per-second (Gbps). The 1RU shelf comprises two units, each using two client-side 100Gbps QSFP28s and a line-side interface that supports 100 Gbps coherent transmission using PM-QPSK, or 200 Gbps coherent using PM-16QAM. The transmission capacity can be traded with reach: using 100 Gbps, optical transmission up to 2,000 km is possible, while capacity can be doubled using 200 Gbps lightpaths for links up to 600 km. Cyan is using Clariphy's CL20010 coherent transceiver/ framer chip. Stacking 42 of the 1RUs within a chassis results in an overall capacity - client side and line side - of 33.6 terabit.

There is a whole ecosystem of companies competing to drive better capacity and scale

The N-Series N11 uses a custom line-side design but Cyan says that by adopting commercial-off-the-shelf design, it will benefit from the pluggable line-side optical module roadmap. The roadmap includes 200 Gbps and 400 Gbps coherent MSA modules, pluggable CFP2 and CFP4 analogue coherent optics, and the CFP2 digital coherent optics that also integrates the DSP-ASIC.

"There is a whole ecosystem of companies competing to drive better capacity and scale," says Cumello. "By using commercial-off-the-shelf technology, we are going to get to better scale, better density, better energy efficiency and better capacity."

To support these various options, Cyan has designed the chassis to support 1RU shelves with several front plate options including a single full-width unit, two half-width ones as used for the N11, or four quarter-width units.

Open software

For software, the N-series platform uses a Linux networking operating system. Using Linux enables third-party applications to run on the N-series, and enables IT staff to use open source tools they already know. "The data centre guys use Linux and know how to run servers and switches so we have provided that kind of software through Cyan's Linux," says Cumello. Cyan has also developed its own networking applications for configuration management, protocol handling and statistics management that run on the Linux operating system.

The open software architecture of the N-Series. Also shown are the two units that make up a rack. Source: Cyan.

The open software architecture of the N-Series. Also shown are the two units that make up a rack. Source: Cyan.

"We have essentially disaggregated the software from the hardware," says Cumello. Should a data centre operator chooses a future, cheaper white box interconnect product, he says, Cyan's applications and Linux networking operating system will still run on that platform.

The N-series will be available for customer trials in the second quarter and will be available commercially from the third quarter of 2015.

North American operators in an optical spending rethink

Optical transport spending by the North American operators dropped 13 percent year-on-year in the third quarter of 2014, according to market research firm Dell'Oro Group.

Operators are rethinking the optical vendors they buy equipment from as they consider their future networks. "Software-defined networking (SDN) and Network Functions Virtualisation (NFV) - all the futuristic next network developments, operators are considering what that entails," says Jimmy Yu, vice president of optical transport research at Dell’Oro. "Those decisions have pushed out spending."

NFV will not impact optical transport directly, says Yu, and could even benefit it with the greater signalling to central locations that it will generate. But software-defined networks will require Transport SDN. "You [as an operator] have to decide which vendors are going to commit to it [Transport SDN]," says Yu.

SDN and NFV - all the futuristic next network developments, operators are considering what that entails. Those decisions have pushed out spending

The result is that the North American tier-one operators reduced their spending in the third quarter 2014. Yu highlights AT&T which during 2013 through to mid 2014 undertook robust spending. "What we saw growing [in that period] was WDM metro equipment, and it is that spending that has dropped off in the third quarter," says Yu. For equipment vendors Ciena and Fujitsu that are part of AT&T's Domain 2.0 supplier programme, the Q3 reduced spending is unwelcome news. But Yu expects North American optical transport spending in 2015 to exceed 2014's. This, despite AT&T announcing that its capital expenditure in 2015 will dip to US $18 billion from $21 billion in 2014 now that its Project VIP network investment has peaked.

But Yu says AT&T has other developments that will require spending. "Even though AT&T may reduce spending on Project VIP, it is purchasing DirecTV and the Mexican mobile carrier, lusacell," he says. "That type of stuff needs network integration." AT&T has also committed to passing two million homes with fibre once it acquires DirecTV.

Verizon is another potential reason for 2015 optical transport growth in North America. It has a request-for-proposal for metro DWDM equipment and the only issue is when the operator will start awarding contracts. Meanwhile, each year the large internet content providers grow their optical transport spending.

Dell'Oro expects 2014 global optical transport spending to be flat, with 2015 forecast to experience three percent growth

Asia Pacific remains one of the brighter regions for optical transport in 2014. "Partly this is because China is buying a lot of DWDM long-haul equipment, with China Mobile being one of the biggest buyers of 100 Gig," says Yu. EMEA continues to under-perform and Yu expects optical transport spending to decline in 2014. "But there seems to be a lot of activity and it's just a question of when that activity turns into revenue," he says.

Dell'Oro expects 2014 global optical transport spending to be flat compared to 2013, with 2015 forecast to experience three percent growth. "That growth is dependent on Europe starting to improve," says Yu.

One area driving optical transport growth that Yu highlights is interconnected data centres. "Whether enterprises or large companies interconnecting their data centres, internet content providers distributing their networks as they add more data centres, or telecom operators wanting to jump on the bandwagon and build their own data centres to offer services; that is one of the more interesting developments," he says.

Global optical networking market set for solid growth

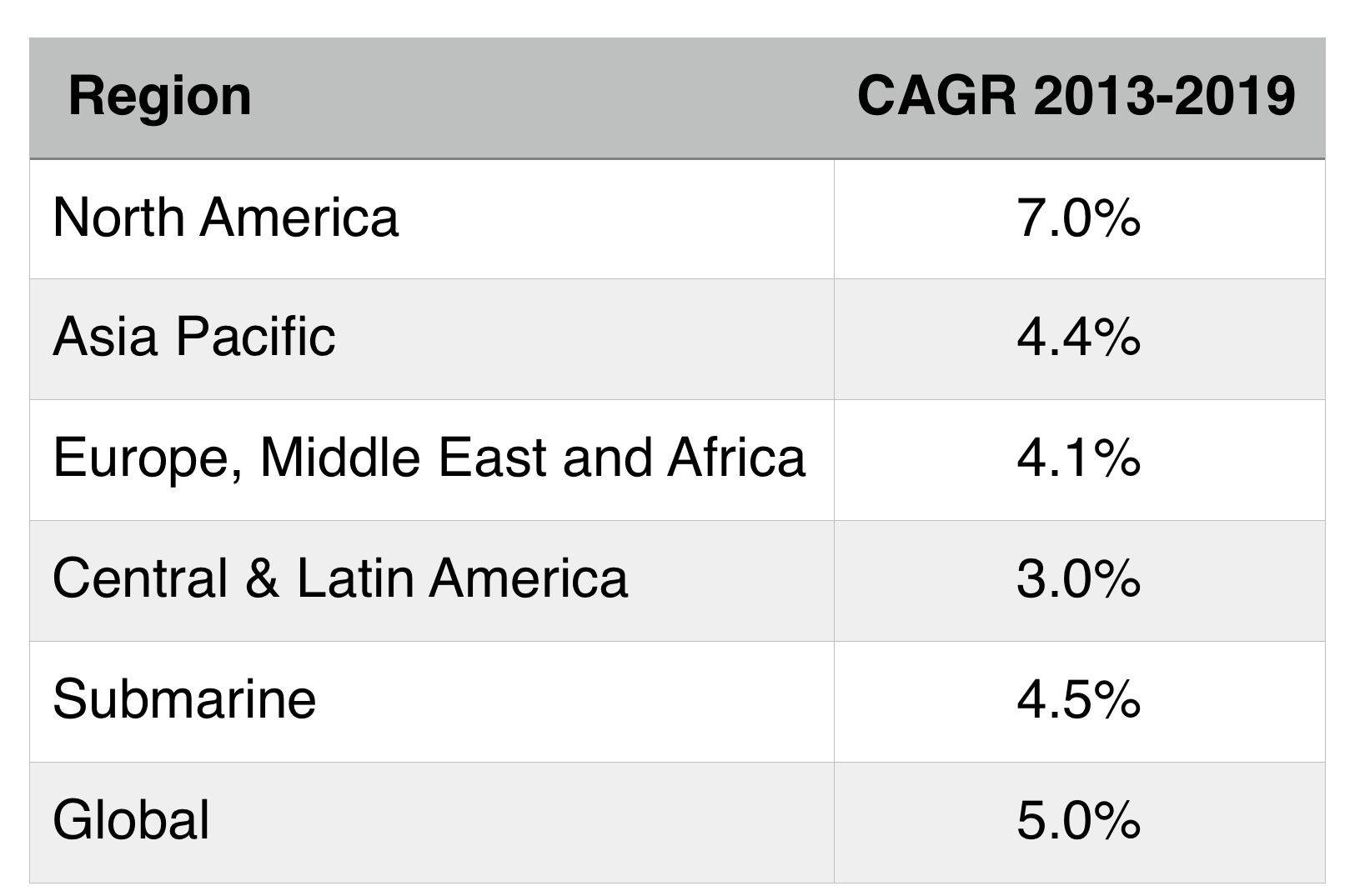

Source: Ovum

Source: Ovum

The global optical networking market will grow at a year-over-year rate of 5 percent through 2019. So claims market research firm, Ovum, in its optical networking forecast for 2013 to 2019. North America will lead the market growth, with data centre deployments and demand for 100 Gigabit being the main drivers.

The building of data centres drives demand for optical interconnect. "It [data centre operators] is almost a new category of buyer," says Ian Redpath, principal analyst, network infrastructure at Ovum. The segment is growing faster than telco spending on fixed and mobile networks.

"This whole phenomenon of the large data centre operators is more pronounced in North America, and we think that will continue throughout the forecast period," says Redpath.

Demand for 100 Gigabit is coming from several segments: large incumbent operators, cable operators and internet content service providers. "All these entities are buying a technology [100 Gig] that is prime time," says Redpath.

Asia Pacific will be the region with the second largest growth for the forecast period, at 4.4 percent compound annual growth rate (CAGR).

The deployment of optical equipment in China and Japan was down in 2013: China dipped 6 percent while Japan was down a huge 23 percent compared to 2012 market demand.

The underlying trend in China is one of growth, with the optical market valued at US $3 billion. "They just had to have a pause," says Redpath, who points out that the Chinese market has tripled in a relatively short period. "They are now retooling for the next big thing: LTE; it it just a matter of time," he says. The deployment of 100 Gig, by the large three domestic operators, may start by the year end or spill into 2015.

Optics is the foundation of an industry that is growing

Japan's sharp decline in 2013 follows massive growth in 2012, the result of replacing networks lost following the 2011 earthquake and tsunami. "That was a one-time bump followed by a one-time reset, with the market now back to normal," says Redpath.

Meanwhile, the EMEA optical networking market will growth at 4.1 percent. "This is a pretty modest growth rate, with more upside coming in the latter period," says Redpath. "The operators have been neglecting their core for so long, they are going to have to come back and reinvest."

Ovum says the weakness of the European market will run its course during the forecast period and expects Europe's northern countries - the UK and Germany - to lead the recovery, followed by the likes of Spain, Italy and Greece.

The market research firm singles out the UK market as being particularly dynamic, and an economy that will lead Europe out of recession. "It is probably closer to the North America market than any other country in terms of competitors and non-carrier spending," says Redpath. "The UK is also one of the leading data centre markets in the world."

Ovum remains upbeat about the long-term prospects of the global optical networking market. "Optics is the foundation of an industry that is growing," says Redpath.

He also points to recent developments in the net neutrality debate, and cites how over-the-top TV and film player, Netflix, has signed agreements with telecom and cable operators. "If over-the-top players realise that they can't keep free-riding on these networks, and to get performance they give a little money to the telcos, then that is a good thing for the ultimate food chain," says Redpath.

Further reading:

Global market soft in 1Q14; North America bucks trend, click here