Colt's network transformation

Colt's technology and architecture specialist, Mirko Voltolini, talks to Gazettabyte about how the service provider has transformed its network from one based on custom platforms to an open, modular design.

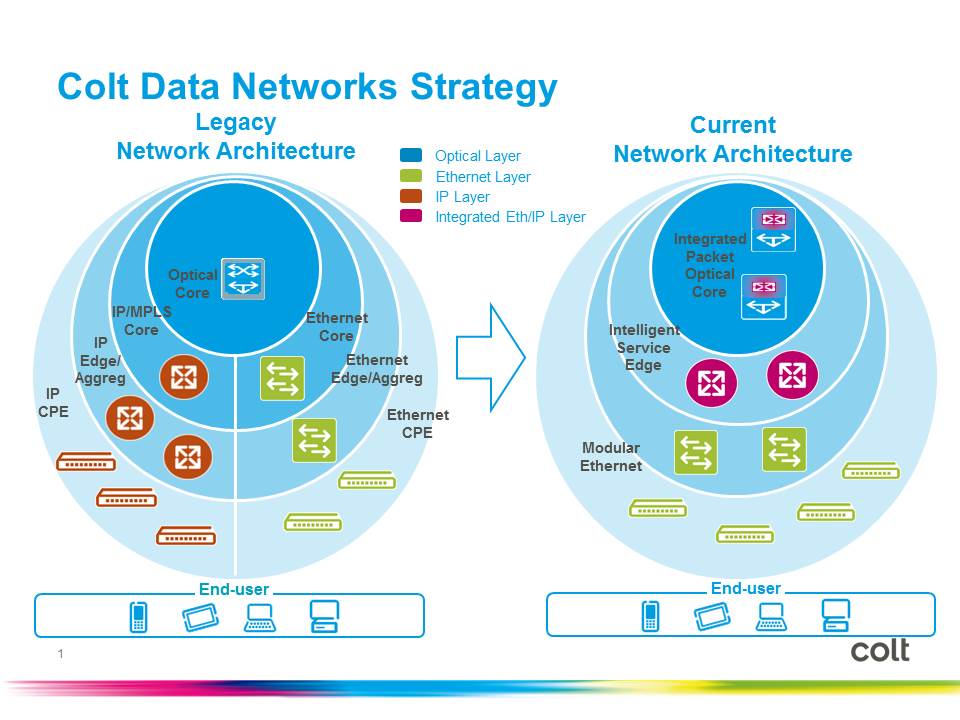

It was obvious to Colt that something had to change. Its network architecture based on proprietary platforms running custom software was not sustainable; the highly customised network was cumbersome, resistant to change and expensive to run. The network also required a platform to be replaced - or at least a new platform added alongside an existing one - every five to seven years.

Mirko Voltolini

Mirko Voltolini

"The cost of this approach is enormous," says Mirko Voltolini, vice president technology and architecture at Colt Technology Services. "Not just in money but the time it takes to roll out a new platform."

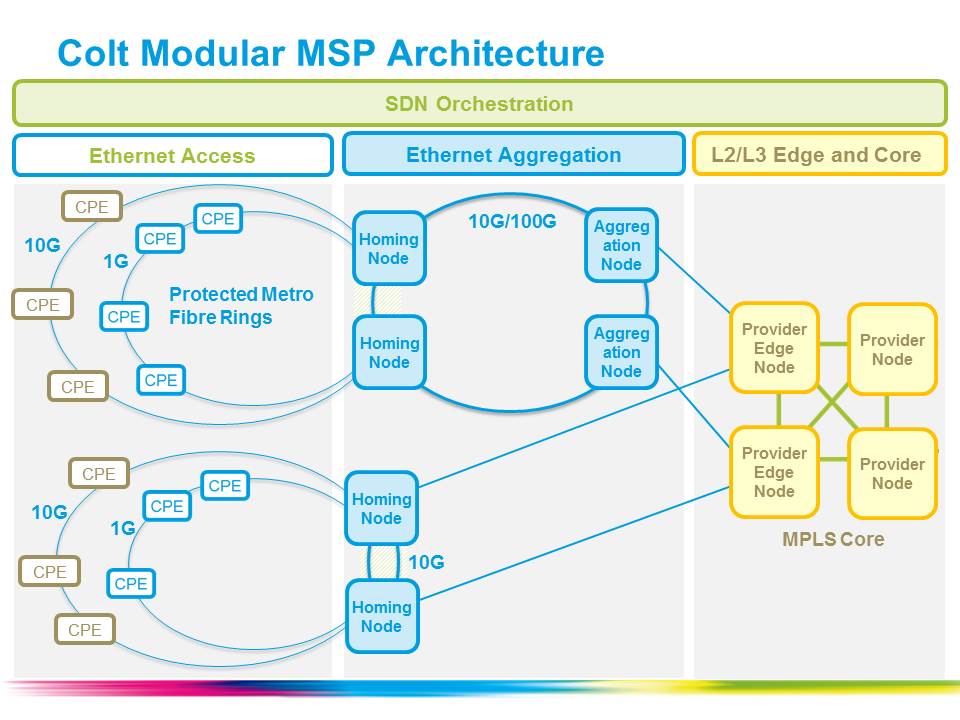

Instead, the service provider has sought a modular approach to network design using standardised platforms that are separated from each other. That way, a new platform with a better feature set or improved economics can be slotted in without impacted the other platforms. Colt calls its resulting network a modular multi-service platform (MSP).

The MSP now delivers the majority of Colt's data networking and all-IP services. These includes Carrier Ethernet point-to-point, hub-and-spoke and private networks services, as well as internet access, IP VPNs and VoIP IP-based services.

The vendors chosen for the MSP include Cyan with its Z-Series packet-optical transport system (P-OTS) and Blue Planet software-defined networking (SDN) platform and Accedian Networks' customer premise equipment (CPE). Cyan's Z-Series does not support IP, so Colt uses Juniper Networks' and Alcatel-Lucent's IP edge platforms. Colt also has a legacy 20-year-old SDH network but despite using a P-OTS platform, it has decided to leave the SDH platform alone, with the modular MSP running alongside it.

Colt chose its vendors based on certain design goals. "The key was openness," says Voltolini. "We didn't want to have a closed system." It was Cyan's management system, the Blue Planet platform, that led Colt to choose Cyan.

Associated with Blue Planet is an ecosystem that allows the management software to control other vendors' platforms. Cyan uses 'element adapters' that mediate between its SDN interface software and the proprietary interfaces of its vendor partners. Cyan says that its Z-Series P-OTS appears as a third-party piece of equipment to its Blue Planet software in the same way as the other vendors' equipment are; a view confirmed by Colt. "Because of its openness, we have been able to integrate other vendors to use the same management system as if they were Cyan components," says Voltolini.

"Cyan was probably the best option available and we decided to go with it," says Voltolini. The company was looking at what was available two years ago and Voltolini points out that the market has evolved significantly since then. "In the end, if you want to move ahead, you need to make decisions," he says. "We are quite happy with what we have picked and we continue to improve it."

Colt says that as well as SDN, network functions virtualisation (NFV) is also important. "With the same modular platform we have created a virtual component which is a layer-3 CPE," says Voltolini. The company is issuing a request-for-information (RFI) regarding other CPE functions like firewalls, load-balancers and other networking components.

Benefits and lessons learned

Adopting the MSP has speeded up Colt's service delivery. Before the modular network, it would take between 30 and 45 days for Colt to fulfil a customer's request for a three-month-long Ethernet link upgrade, from 100 Megabit to 200 Megabit. Now, such a request can be fulfilled in seconds. "We didn't need any more layer-3 CPE and we can upgrade remotely the bandwidth," says Voltolini.

Colt also estimates that it will halve its operational costs once the new network is fully deployed; the network went live in November 2013 and has not been deployed in all locations. The operational expense improvement and the greater service flexibility both benefit Colt's bottom line, says Voltolini.

A key lesson learned from the network transformation is the importance of leading staff through change rather than any technological issues. "The technology has been a challenge but in the end, with the suppliers, you can design anything you want if you have the right level of collaboration," says Voltolini. "But when you completely transform the way you deliver services, you are touching everything that is part of the engine of the company."

Colt cites aspects such as engineering solutions, service delivery, service operations, systems and processes, and the sales process. "You need to lead the transition is such a way that everybody is going to follow you," says Voltolini.

Colt encountered obstacles created because of the staff's natural resistance to change. "Certain things took longer," says Voltolini. "We had to overcome obstacles that weren't really obstacles, just people's fear of change."

Optical networking market in rude health

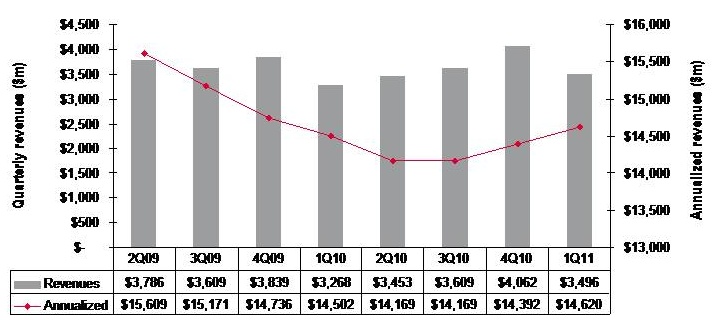

Quarterly market revenues, global optical networking (1Q 2011). Source: Ovum

Quarterly market revenues, global optical networking (1Q 2011). Source: Ovum

Despite recent falls in optical equipment makers’ stock, the optical networking market remains in good health with analysts predicting 6-7% growth in 2011.

For Andrew Schmitt, directing analyst for optical at Infonetics Research, unfulfilled expectations are nothing new. Optical networking is a market of single-digit yearly growth yet in the last year certain market segments have grown above average: spending on ROADM-based wavelength division multiplexing (WDM) optical network equipment, for example, has grown 20% since the first quarter of 2010.

“Every few years people get this expectation that there is going to be this hockey stick [growth] and it is not,” says Schmitt. “There has been a lot of Wall Street money moving into this sector in the latter part of 2010 and first part of this year and they have just had their expectations reset, but operationally the industry is very healthy.”

“Nothing in this business changes quickly but the pace of change is starting to accelerate”

Andrew Schmitt, Infonetics Research

But Schmitt acknowledges that there is industry concern about the market outlook. “There have been lots of client calls in the first half of the year wanting to talk numbers,” says Schmitt. “When the market is growing rapidly there is no need for such calls but when it is uncertain, customers put more time into understanding what is going on.”

Both Infonetics and market research firm Ovum say the optical networking market grew 7% globally in the last year (2Q10 to 1Q11).

Ovum says the market reached US $3.5bn in the first quarter of 2011 and it expects 6% growth this year. “Most of the growth will come from North America—general recovery, stimulus-related spending, and LTE (Long Term Evolution)-inspired spending; and from South and Central America mostly mobile and fixed broadband-related,” says Dana Cooperson, network infrastructure practice leader at Ovum.

Ovum also notes that optical networking annualised spending for the last four quarters (2Q10-1Q11) finally went into the black with 1% growth, to reach $14.6bn. Annualised share figures are a strong indicator of longer-term market trends, says Ovum.

Market growth

Factors accounting for the growth include optical equipment demand for mobile and broadband backhaul. Carriers are also embarking on a multi-year optical upgrade to 40 and 100 Gigabit transmission over Optical Transport Network (OTN) and ROADM-based networks. Infonetics notes that ROADM spending in particular set a new high in the first quarter, rising 4% sequentially.

Ovum expects overall growth to come from metro and backbone WDM markets and from LTE. “For metro it is a combination of new builds, as DWDM continues to take over the metro core from SONET/SDH, and expansions of ROADM and 40 Gigabit,” says Cooperson. “For backbone it is a combination of retrofits for 40 and 100 Gigabit and overbuilds with 40 and 100 Gigabit coherent-optimised systems.”

Many operators are also looking at OTN switching and how it can help with network efficiency and manageability, she says, while mobile backhaul continues to be a hot spot as well at the access end of the network.

The Americas are the regions accounting for market growth whereas in Asia-Pacific and Europe, Middle East and Africa the spending remains flat.

“We’re not as bullish on Europe as I’ve heard some others are,” says Cooperson. “We expected China to slow down as capital intensities in the 34-35% seen in 2008 and 2009 were unsustainable. We saw the cooling down a bit earlier in 2010 than we had expected, but it did cool down and will continue to.”

Ovum expects Asia-Pacific as a whole to be moribund. But at least the pullbacks in China will be countered by slow growth in Japan and a big upsurge in India after a huge decline last year due to delayed 3G-related builds among other issues.

Outlook

Ovum is optimistic about the optical networking market due to continued competitive pressures and traffic growth. “We don’t think traffic growth can just continue without attention to the underlying issues related to revenue pressure, regardless of competitive pressures,” says Cooperson. “But newer optical and packet systems offer significant improvements over the old in terms of power efficiency, manageability, and of course 40 and 100 Gigabit coherent and ROADM features.”

“Most of the growth will come from North America"

Dana Cooperson, Ovum.

Many networks worldwide are also due for a core infrastructure update to benefit capacity and efficiency while many other operators are upgrading their access networks for mobile backhaul and enterprise Ethernet services.

Schmitt stresses that while it is right to talk about a 'core reboot', there are all sorts of operators that make up the market: the established carriers, those focussed on Layer 2 and Layer 3 transport, dark fibre companies and cable companies.

“Everyone has a different business so there is not a whole lot of group-think in this industry,” says Schmitt. “So when you talk about a transition to 40 and 100 Gigabit, some carriers will make that transition earlier than others because the nature of their business demands it.”

However, there are developments in equipment costs that are leading to change. “Once you get out to 2013-14, 100 Gigabit [transport] looks really good relative to 40 Gigabit and tunable XFPs at 10 Gigabit look really, really good,” says Schmitt, who believes these are going to be two dominating technologies. “People are going to use 100 Gigabit and when they can afford to throw more 10 Gigabit at the [capacity] problem, in shorter metro and regional spans, they will use tunable XFPs,” he says. “That is a whole new level in terms of driving down cost at 10 Gigabit that people haven’t factored in yet.”

Pacier change

The move to 100 Gigabit will not lead to increased spending, stresses Schmitt. Rather its significance is as a ‘mix shift’: The adoption of 100 Gigabit will shift spending from older systems to newer ones so that the technology is interesting in terms of market share shift rather than by growing overall revenues.

That said, there are areas of optical spending where capital expenditure (capex) is growing faster than the single-digit trend. These include certain competitive telco providers and dark fibre providers like AboveNet, TimeWarner Telecom and Colt. “You look at their capex year-over-year and it is increasing in some cases more over 20% a year,” says Schmitt.

He also notes that while the likes of Google, Yahoo, Microsoft and Apple do not spend on optical equipment as much as established operators such as Verizon or AT&T, their growth rate is higher. “There are sectors of the market that are growing quickly, and competition that are positioned to service those sectors successfully are going to see above-trend growth,” says Schmitt.

He highlights three areas of innovations - ‘big vectors’- that are going to change the business.

One is optical transport's move away from simple on-off keying signalling that opens up all kinds of innovation. Another is the shift in the players buying optical equipment. “A lot more of the R&D is driven by the AboveNets, Time Warners, Comcasts and the Googles and less by the old time PTTs,” says Schmitt. “That is going to change the way R&D is done.”

The third is photonic integration which Schmitt equates to the very early state of the electronics business. While Infinera has done some interesting things with integration, its latest 500 Gigabit PIC (photonic integrated circuit) is a big leap in density, he says: “It will be interesting if that sort of technology crosses over into other applications such as short- and intermediate-reach applications.”

“Nothing in this business changes quickly but the pace of change is starting to accelerate,” says Schmitt. “These three things, when you throw them together in a pot, are going to result in some unpredictable outcomes.”