DSL: Will phantom channels become real deployments?

Alcatel-Lucent is promoting its DSL Phantom Mode technology as a complement to fibre-to-the-x (FTTx) technology. Operators can use the technology to continue to extend services offerings to existing DSL subscribers as they roll out FTTx over the next decade or more.

But one analyst believes the technology could take years to commercialise and questions whether the announcement is not sending a wrong message to the industry by providing an alternative to fibre.

“The investment required to upgrade DSL is quite small”

Stefaan Vanhastel, Alcatel-Lucent

What has been achieved?

The 300Mbps data rate is achieved using two copper wire pairs between the access equipment and a DSL modem although three DSL ports are required at each end. The rate drops to 100Mbps when the reach is extended to 1km. In comparison very high speed Digital Subscriber Line 2’s (VDSL2) data rate over a single line ranges from 20 to 40Mbps over 1km.

None of the three techniques that Alcatel-Lucent uses – bonding, vectoring and the phantom mode that creates an extra virtual channel alongside the two bonded pairs - is new. What the company claims is that it is the first to combine all three for DSL.

In March Ericsson announced it had achieved 500Mbps over 500m but it used six bonded pairs and vectoring only.

Why is the Phantom Mode important?

The significance of the announcement, according to Alcatel-Lucent, is that operators can continue to offer existing DSL customers new bandwidth-intensive services as they roll out FTTx.

“Rolling out FTTx will take a significant amount of time,” says Stefaan Vanhastel, director of product marketing, wireline networks at Alcatel-Lucent. “Operators are looking to reuse their copper infrastructure in the short-to-medium term - the next 5 to 10 years.”

An operator must have a central office or cabinet equipment 1km or less from the user’s residence as well as having two wire pairs per building or residence. “In many countries two pairs are available,” says Vanhastel.

However, one analyst questions the development and promotion of such copper-enhancing technology.

“I think Alcatel is being disingenuous when they say "fiber will take long to implement, this is an intermediary solution’,” says the analyst, who asked not to be named. “They know full well that customers would see this as a way to hold back on deploying fibre.

“Ultimately to me this is schizophrenia at work. Alcatel-Lucent wants to be all things to all service providers and may be sending the wrong message to the market that they need not invest to sustain the bandwidth demand growth, which is suicidal both for service providers and for Alcatel-Lucent in the long run.”

Alcatel-Lucent does believe operators will invest in DSL alongside FTTx.

“The investment required to upgrade DSL is quite small,” says Vanhastel. “Even with two ports it is a bargain; you get the investment back in one or two months.”

Even operators more advanced in their FTTx deployments will want to offer new higher bandwidth services such as high-definition TV to all their customers.

“What are you going to do? Offer your services to just 50% of your customers?” says Vanhastel “They [the remaining customers] will go elsewhere.”

Method used

The Bell Labs research arm of Alcatel-Lucent has used three techniques to enhance DSL’s speed and reach performance.

- Bonding: The combination of copper line pairs to boost the number of channels – in this case two are bonded - and hence the data rate between access equipment and the DSL modem.

- Vectoring: Noise cancellation techniques using digital signal processing to improve the overall signal-to-noise performance. “It involves measuring the noise on all the lines and generating anti-phase – the inverse signal – such that the two cancel out,” says Vanhastel.

- Phantom mode: The phantom mode technology uses two physical wires to create a third virtual one. The technology was first proposed in the 1880s as a way to add an extra virtual telephone line.

Two physical pairs and the third phantom one. Source: Alcatel-Lucent

Two physical pairs and the third phantom one. Source: Alcatel-Lucent

Using the phantom mode, only two wire pairs are needed to connect the end equipment. The information on the third “virtual” line is shared over the two physical channels. Using analogue electronics, the data on the third channel is processed and recovered. “We add and subtract through the use of a bunch of transformers,” says Vanhastel. Where the circuitry is placed, whether in the DSLAM access equipment or elsewhere, is to be decided.

To create the virtual wire, a modem supporting three-pair bonding is required. In addition the chipset in the DSL modem must have sufficient processing performance to execute vectoring on three channels. That's because adding the phantom mode degrades the performance of all the channels due to crosstalk. The crosstalk is removed between the channels using vectoring.

What next?

The technology needs to be brought to market. “At the earliest it will be 2012,” says Vanhastel.

But the analyst points out that the technology is lab tested: “Between test labs and implementation, count a significant number of years.”

The concept could even be extended using more wire pairs. The relationship is (N-1) phantom channels for N wire pairs i.e. 1 virtual channel with two pairs, 2 with 3 pairs etc.

Alcatel-Lucent says it has already completed two VDSL2 bonding trials in Asia Pacific, while three operators are undertaking VDSL2 vectoring tests in their labs and will move to testing in the field using a single line this year.

“Bonding is here today, vectoring will be 2011 and the phantom mode will be after that,” says Vanhastel.

EPON becomes long reach

“Rural [PON deployment] is a tough proposition”

Barry Gray

Moreover, the TK3401 supports up to four such EPONs. The chip does not require changes to EPON’s optical transceivers although wavelength division multiplexing (WDM) transceivers are needed for the greater reach.

The TK3401 sits within what Barry Gray, director of marketing for Teknovus, calls the Intelligent PON Node (IPN). The IPN resides 20km from the subscriber’s optical network unit (ONU), where the PON’s optical line terminal (OLT) normally resides.

On one side of the IPN platform are sockets for up to four EPON OLT transceivers that support the PONs. On the other side are four SFP WDM transceivers that communicate with the central office up to 80km away and where the OLT platform is located. The OLT line card instead of using OLT optics uses WDM transceivers also in the SFP form factor. As such the line card does not require any redesign (see diagram).

Up to four point-to-point fibres can be used to connect the PONs’ traffic to the OLT, or a single fibre and up to 8 lambdas with coarse WDM (CWDM) technology to multiplex four PONs onto a single trunk fibre.

The 256 subscribers are achieved using a PX20+ specified optical transceiver. “It has a 28dB link budget such that going through 8 splitter stages is still sufficient for 2km distances [from the ONUs],” says Gray. “This is ideal for multi-dwelling unit deployments.”

Besides the pluggable optics, the IPN design includes the TK3401, a field programmable gate array (FPGA), and a flash memory.

The TK3401 comprises an EPON ONU media access controller (MAC), microprocessor and on-chip memory. The MAC registers the IPN with the central office OLT to set up remote IPN management and configuration communication links. The on-chip memory holds the firmware that configures the FPGA on start-up. The FPGA implements a crossbar switch to connect traffic from any of the EPONs to any of the WDM ports.

The IPN approach offers other advantages besides the 100km reach and increased subscriber count. It has a power consumption of 20W which means it can be powered from such locations as a telegraph pole. As the PONs are first populated, all four PONs’ traffic can also be aggregated into a single WDM link OLT port, with OLT ports added only when needed. In turn a fibre link can be used for protection with a sub-100ms restoration time.

However, unlike long reach PON or WDM-PON which also offer a 100km reach, the Teknovus scheme still requires the intermediate network node. The node is also active as it must be powered.

Teknovus claims it has strong interest from its IPN-based EPON architecture from operators in Japan and South Korea, while interest in China is for rural PON deployments. “Rural [PON deployment] is a tough proposition for service providers,” says Gray. “There is not the subscriber density and it is more expensive; the same is also true for mobile backhaul.”

The company is demonstrating the IPN to customers.

Click here for Teknovus' IPN presentation and White Paper

WDM-PON: Can it save operators over €10bn in total cost of ownership?

Source: ADVA Optical Networking

Source: ADVA Optical Networking

“The focus of operators to squeeze the last dollar out of the system and optical component vendors is really nonsense.”

Klaus Grobe, ADVA Optical Networking.

Key findings

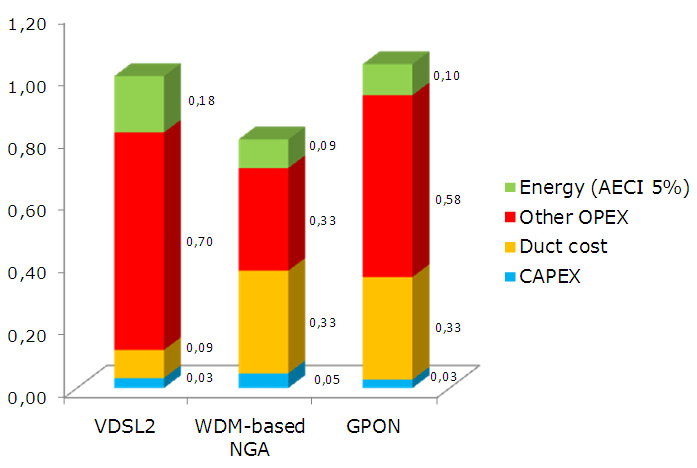

The total cost of ownership (TCO) of a widely deployed WDM-PON network is at least 20 percent cheaper than the broadband alternatives of VDSL and GPON. Given that the cost of deploying a wide-scale access network in a large western European country is €60bn, a 20 percent cost saving is huge, even if spread over 25 years.

What was modelled?

ADVA Optical Networking wanted to quantify the TCO of three access schemes: wavelength-division-multiplexing passive optical networking (WDM-PON), gigabit PON (GPON) - the PON scheme favoured by European incumbents, and copper-based VDSL (very high bit-rate digital subscriber line).

The company modelled a deployment serving 1 million residences and 10,000 enterprises. “We took seriously the idea of broadband roll out especially when operators talk about it being a strategic goal,” says Klaus Grobe, principal engineer at ADVA Optical Networking. “We wanted a single number that says it all.”

Assumptions

ADVA Optical Networking splits the TCO into four categories:

- Duct cost

- Other operational expense (OpEx)

- Energy consumption

- Capital expenditure (CapEx)

For ducting, it is assumed that VDSL already has fibre to the cabinet and the copper linking the user, whereas for optical access - WDM-PON and GPON - the feeder fibre is present but distribution fibre must be added to connect each home and enterprise. “There is also a certain upgrade of the feeder fibre required but it is 5 percent of the distribution fibre costs,” says Grobe. Hence the ducting costs of GPON and WDM-PON are similar and higher than VDSL.

A 25-year lifetime was also used for the TCO analysis during which three generations of upgrades are envisaged. For the end device like a PON optical network unit (ONU) the cost is the same for each generation, even if performance is significant improved each time.

The ‘other OpEx’ includes all the elements of OpEx except energy costs. The category includes planning and provisioning; operations, administration and maintenance (OA&M); and general overhead.

Planning and provisioning, as the name implies, covers the planning and provisioning of system links and bandwidth, says Grobe. Also the WDM-PON network serves both residential and enterprises whereas duplicate networks are required for GPON and VDSL, adding cost.

The ‘general overheads’ category includes an operator’s sales department. Grobe admits there is huge variation here depending on the operator and thus a common figure for all three cases was used.

Energy consumption is clearly important here. Three annual energy cost increase (AECI) rates were explored – 2, 5 and 10 percent (shown in the chart is the 5% case), with a cost of 80 €/MWh assumed for the first year.

The energy cost savings for WDM-PON come not from the individual equipment but from the reduced number of sites deploying the access technology allows. The power consumed of a WDM-PON ONU is 1W, greater than VDSL, says Grobe, but a lot more local exchanges and cabinets are used for VDSL than for WDM-PON.

And this is where the biggest savings arise: the difference in OA&M due to there being fewer sites for WDM-PON than for GPON and VDSL. That’s because WDM-PON has a larger, up to 100km, reach from the central office to the end user. And, as mentioned, a WDM-PON network caters for enterprise and residential users whereas GPON and VDSL require two distinct networks. This explains the large differences between VDSL, GPON and WDM-PON in the ‘other OpEX’ category.

Grobe says it is difficult to estimate the site reduction deploying WDM-PON will deliver. Operators are less forthcoming with such figures. However, the model and assumptions have been presented to operators and no objections were raised. Equally, the model is robust – varying wildly any one parameter does not change the main findings of the model.

Lastly, for CapEx, WDM-PON equipment is, as expected, the most expensive. CapEx for all three cases, however, is by far the smallest contributor to TCO.

Mass roll outs on the way?

So will operators now deploy WDM-PON on a huge scale? Sadly no, says Grobe. Up-front costs are paramount in operators’ thinking despite the vast cost saving if the lifetime of the network is considered.

But the analysis highlights something else for Grobe that will resonate with the optical community. “The focus of operators to squeeze the last dollar out of system and optical component vendors is really nonsense,” he says.

See ADVA Optical Networking's White Paper

See an associated presentation

Next-Gen PON: An interview with BT

Peter Bell, Access Platform Director, BT Innovate & Design

Peter Bell, Access Platform Director, BT Innovate & Design

Q: The status of 10 Gigabit PON – 10G EPON and 10G GPON (XG-PON): Applications, where it will be likely be used, and why is it needed?

PB: IEEE 10G EPON: BT not directly involved but we have been tracking it and believe the standard is close to completion (gazettabyte: The standard was ratified in September 2009.)

ITU-T 10Gbps PON: This has been worked on in the Full Service Access Network group (FSAN) where it became known as XG-PON. The first version XG-PON1 is 10Gbps downstream and 2.5Gbps upstream and work has started on this in ITU-T with a view to completion in the 2010 timeframe. The second version XG-PON2 is 10Gbps symmetrical and would follow later.

Not specific to BT’s plans but an operator may use 10Gbps PON where its higher capacity justified the extra cost. For example: business customers, feeding multi-dwelling units (MDUs) or VDSL street cabinets

Q: BT's interest in WDM-PON and how would it use it?

PB: BT is actively researching WDM-PON. In a paper presented at ECOC '09 conference in Vienna (24th September 2009) we reported the operation of a compact DWDM comb source on an integrated platform in a 32-channel, 50km WDM-PON system using 1.25Gbps reflective modulation.

We see WDM-PON as a longer term solution providing significantly higher capacity than GPON. As such we are interested in the 1Gbps per wavelength variants of WDM-PON and not the 100Mbps per wavelength variants.

Q: FSAN has two areas of research regarding NG PON: What is the status of this work?

PB: NG-PON1 work is focussed on 10 Gbps PON (known as XG-PON) and has advanced quite quickly into standardisation in ITU-T.

NG-PON2 work is longer term and progressing in parallel to NG-PON1

Q: BT's activities in next gen PON – 10G PON and WDM-PON?

PB: It is fair to say BT has led research on 10Gbps PONs. For example an early 10Gbps PON paper by Nesset et al from ECOC 2005 we documented the first, error-free physical layer transmission at 10Gbps, over a 100km reach PON architecture for up and downstream.

We then partnered with vendors to achieve early proof-of-concepts via two EU funded collaborations.

Firstly in MUSE we collaborated with NSN et al to essentially do first proof-of-concept of what has become known as XG-PON1 (see attached long reach PON paper).

Secondly, our work with NSN, Alcatel-Lucent et al on 10Gbps symmetrical hybrid WDM/TDMA PONs in EU project PIEMAN has very recently been completed.

Q: What are the technical challenges associated with 10G PON and especially WDM-PON?

For 10Gbps PONs in general the technical challenges are:

- Achieving the same loss budgets - reach - as GPON despite operating at higher bitrate and without pushing up the cost.

- Coexistence on same fibres as GPON to aid migration.

- For the specific case of 10Gbps symmetrical (XG-PON2) the 10 Gbps burst mode receiver to use in the headend is especially challenging. This has been a major achievement of our work in PIEMAN.

For WDM-PONs the technical challenges are:

- Reducing the cost and footprint of the headend equipment (requires optical component innovation)

- Standardisation to increase volumes of WDM-PON specific optical components thereby reducing costs.

- Upgrade from live GPON/EPON network to WDM-PON (e.g. changing splitter technology)

Q: There are several ways in which WDM-PON can be implemented, does BT favour one and why, or is it less fussed about the implementation and more meeting its cost points?

PB: We are only interested in WDM-PONs giving 1Gbps per wavelength or more and not the 100Mbps per wavelength variants. In terms of detailed implementation we would support the variant giving lowest cost, footprint and power consumption.

Q: What has been happening with BT's Long Reach PON work

PB: We have done lots of work on the long reach PON concept which is summarised in a review published paper from IEEE JLT and includes details of our work to prototype a next-generation PON capable of 10Gbps, 100km reach and 512-way split. This includes EU collaborations MUSE and PIEMAN

From a technical perspective, Class B+ and C+ GPON (G.984.2) could reach a high percentage of UK customers from a significantly reduced number of BT exchanges. Longer reach PONs would then increase the coverage further.

Following our widely published work in amplified GPON, extended reach GPON has now been standardised (G.984.6) to have 60 km reach and 128-way split, and some vendors have early products. And 10Gbps PON standards are expected to have same reach as GPON.

BroadLight awarded a dynamic bandwidth allocation patent

Passive optical networking (PON) chip company, Broadlight, has been awarded a patent by the US Patent Office entitled: ‘Method and grant scheduler for cyclically allocating time slots to optical network units’.

Why is this important?

Dynamic bandwidth allocation (DBA) performs a key role in point-to-multipoint PON networks. A PON comprises an optical line terminal (OLT) at an operator’s central office connected to several optical network units (ONUs) via fibre. An ONU typically resides in the building basement or in a home.

The OLT broadcasts data downstream to the ONUs. In a gigabit PON (GPON), the downstream data rate is 2.5Gbps. Each ONU identifying the data meant for it using a unique packet header. In the upstream path – for GPON it is 1.25Gbps - only one ONU broadcasts at a time.

DBA is needed to make efficient use of the uplink capacity by assigning slots when each ONU can transmit its data. DBA must also take into account quality of service (QoS) requirements associated with the various traffic types (video, voice and data). “DBA increases revenue for the network provider by ensuring that bandwidth is not wasted,” says Eli Elmoalem, a system architect at Broadlight.

Method used:

Broadlight’s patent implements two approaches to DBA. The first, dubbed status reporting DBA, involves periodically polling the ONUs to determine their latest traffic needs. The second approach - traffic monitoring DBA – requires the OLT to run an algorithm that predicts the ONUs’ bandwidth needs based on their traffic bandwidth usage history.

Broadlight’s patented technique for GPON runs either or both approaches to determine how much bandwidth to allocate to each ONU. The patent also details how best to partition the tasks between the OLT silicon and software executed on the chip.

This is Broadlight’s second DBA patent award. The first, entitled “Method of providing QoS and bandwidth allocation in a point to multi-point network” is a generic DBA approach, says Eli Weitz, Broadlight’s CTO, applicable to any point-to-multipoint network whether it is cable, Broadband PON (BPON), GPON or Ethernet PON (EPON).

What next?

Developing DBA for 10G GPON. The development work for 10G PON is being undertaken by Full Service Access Network (FSAN) and will be standardised by the ITU-T.

DBA for 10G GPON will be more demanding: the split ratio - the number of ONUs served by one OLT – is higher with as many as 512 ONUs per PON, as is the upstream bandwidth. For 10G GPON, two upstream rates are being proposed: 2.5Gbps and 10Gbps.

References:

[1] “Predictive DBA: The ‘Right’ Method for Dynamic Bandwidth Allocation in Point-to-MultiPoint FTTH Networks”, a white paper by Broadlight

[2] “The Importance of Dynamic Bandwidth Allocation in GPON Networks,” a white paper by PMC-Sierra.

[3] “A Comparison of Dynamic Bandwidth Allocation for EPON, GPON and Next Generation TDM PON.” IEEE Communications Magazine, March 2009

OneChip solution for Fibre-To-The-Home

Jim Hjartarson, CEO of OneChip PhotonicsAn interview with Jim Hjartarson, CEO of OneChip Photonics

Jim Hjartarson, CEO of OneChip PhotonicsAn interview with Jim Hjartarson, CEO of OneChip Photonics

Q. In March 2009, OneChip raised $19.5m. How difficult is it nowadays for an optical component firm to receive venture capital funding?

A. Clearly, the venture capital community, given the current macroeconomic environment, is being selective about the new investments it makes in the technology market in general, and photonics in particular. However, if you can demonstrate that you have a unique approach to a problem that has not yet been solved, and that there is a large, untapped market opportunity, VCs will be interested in your value proposition.

Q. What is it about your company's business plan that secured the investment?

A. We believe OneChip Photonics has three fundamental advantages that resulted in our securing our initial two rounds of funding, which totaled $19.5 million:

- A truly breakthrough approach and technology that will remove the cost and performance barriers that have been impeding the ubiquitous deployment of Fiber-to-the-Home (FTTH) and enable new business and consumer broadband applications.

- A large, untapped market opportunity. Ovum estimates that the FTTx optical transceiver market will grow from $387 million by the end of 2009 to $594 million by the end of 2013. OneChip also is poised to introduce photonics integration into other high-volume business and consumer markets, where our breakthrough photonic integrated circuit (PIC) technology can reduce costs and improve performance. These markets could be orders of magnitude larger than the FTTx optical transceiver market.

- A seasoned and successful management team. OneChip has attracted top talent – from industry leading companies such as MetroPhotonics, Bookham, Catena Networks, Fiberxon, Nortel and Teknovus – who have successful track records of designing, manufacturing, marketing and selling transceivers, PICs and mass-market broadband access solutions.

Q. The passive optical networking (PON) transceiver market faces considerable pricing pressures. Companies use TO cans and manual labour or more sophisticated hybrid integration where the laser and photodetectors are dropped onto a common platform to meet various PON transceiver specifications. Why is OneChip pursuing indium phosphide-based monolithic integration and why will such an approach be cheaper than a hybrid platform that can address several PON standards?

A. Most current FTTH transceiver providers base their transceivers on either discrete optics or planar lightwave circuit (PLC) designs. These designs offer low levels of integration and require assembly from multiple parts. There is little technical differentiation among them. Rather, vendors must compete on the basis of who can assemble the parts in a slightly cheaper fashion. And there is little opportunity to further reduce such costs.

While more integrated than fully discrete optics-based designs, PLC designs still require discrete active components and the assembly of as many as 10 parts. Great care must be taken, during the manufacturing process, to align all parts of the transceiver correctly. And while packaging can be non-hermetic, these parts can fall out of alignment through thermal or mechanical stress. PLC designs also have proven to be an expensive alternative. For all of these reasons, the PON system vendors with which OneChip has engaged have indicated that they are not interested in deploying PLC-based designs.

OneChip Photonics is taking a new approach with its breakthrough PIC technology. OneChip is monolithically integrating all the functions required for an optical transceiver onto a single, indium phosphide (InP)-based chip. All active AND passive components of the chip – including the distributed-feedback (DFB) laser, optically pre-amplified detector (OPAD), wavelength splitter (WS), spot-size converter (SSC), and various elements of passive waveguide circuitry – are, uniquely, integrated in one epitaxial growth step, without re-growth or post-growth modification of the epitaxial material.

With respect to transmit performance, OneChip’s single-frequency DFB lasers will offer a superior performance – much more suitable for longer-reach and higher bit-rate applications – than competing Fabry-Perot (FP) lasers. With respect to receive performance, OneChip’s optically pre-amplified detectordesign is a higher gain-bandwidth solution than competing avalanche photodiode (APD) solutions. It also is a lower-cost solution, as it does not require a high-voltage power source.

OneChip’smonolithic photonic integrated circuits (PICs) have the smallest footprint on the market, the optical parts are aligned for life, and the parts are highly robust (resistant to vibration and other outside elements). Further, OneChip’s PICs are designed for automated mounting on a silicon optical bench, without requiring active alignment, using industry-standard, automated assembly processes – resulting in high yields of good devices.

Utilizing automated production processes, OneChip can maintain the highest production scalability (easily ramping up and down) in the industry and respond rapidly to customer needs. Standard production processes also mean reliable supplies to customers, at the lowest prices on the market.

Q. Several companies have explored integrated PON solutions and have either dismissed the idea or have come to market with impressive integrated designs only to ultimately fail (e.g. Xponent Photonics).Why are you confident OneChip will fare better?

As noted earlier, PLC designs developed by vendors such as Xponent are not fully integrated. PLC designs still require discrete active components and the assembly of as many as 10 parts, using a glass substrate. This results in poor yields and high costs.

OneChip is taking a fundamentally different approach. We are the only company in the optical access market that is monolithically integrating all the active and passive functions required for an optical transceiver onto a single, indium phosphide (InP)-based chip. This enables us to achieve low cost, high performance, high yields and high quality.

OneChip is one of only a few companies with new core intellectual property and advanced technology in the optical transceiver business that can sustain a competitive advantage over other optical component providers, which rely on conventional technology and assembly processes. Carriers and system providers recognize that an approach, which would eliminate assembly from multiple parts, is needed to lower the cost and improve the performance of transceivers, Optical Network Terminals (ONTs) and Optical Line Terminals (OLTs) in optical access networks. We believe OneChip’s fully integrated technology can help unleash the potential of FTTH and other mass-market optical communications applications.

Q. If integrated PON is a good idea why, in OneChip’s opinion, have silicon photonics startups so far ignored this market?

A. “Silicon photonics” designs face the inherent limitation that a laser cannot be implemented in silicon. Therefore, separate optical and electrical devices must be grown with different processes and then assembled together. With as many as 10 parts having to be interconnected on a ceramic substrate, the alignment, tuning and reliability issues can significantly add costs and reduce yields.

In addition, system providers and service providers need to be cognizant of the inherent performance limitations with transceivers built from discrete parts. While short-reach EPON transceivers already have been optimized down to below a U.S. $15 price, these implementations can only meet low-end performance requirements. Networks would require a switch to more costly transceivers to support longer-range EPON, 2.5G EPON, GPON or 10G PON. Because most service providers are looking to reap the payback benefits of their investments in fiber installations/retrofits over the shortest possible timeframes, it doesn’t make sense to risk adding the high cost of a forklift changeover of transceiver technology at some point during the payback period.

Q. PON with its high volumes has always been viewed as the first likely market for photonic integrated circuits (PICs). What will be the second?

A. OneChip recognizes that optical communications is becoming economically and technologically mandatory in areas outside of traditional telecommunications, such as optical interconnections in data centers and other short to ultra-short reach broadband optical networks. OneChip is poised to introduce photonics integration into these and other high-volume business and consumer markets, where our PIC technology can reduce costs and improve performance.

[End]

Click here tomore details on OneChip Photonics