How to shepherd a company’s technologies for growth

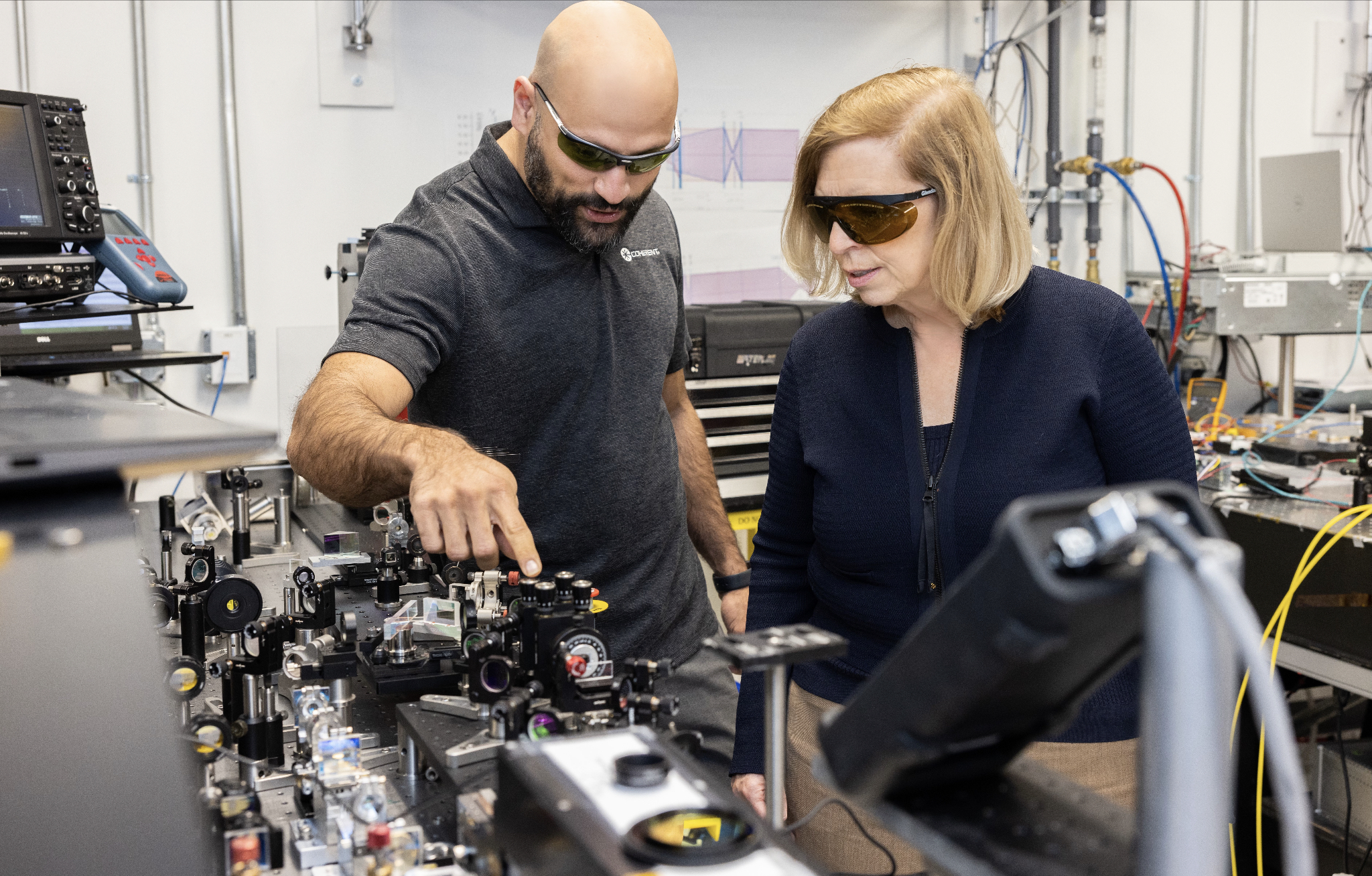

CTO interviews part 3: Dr Julie Eng

- Eng is four months into her new role as CTO of Coherent.

- Previously, she headed Finisar’s transceiver business and then the 3D sensing business, first at Finisar and then at II-VI. II-VI changed its name to Coherent in September 2022

- “CTO is one of these roles that has no universal definition,” says Eng

ulie Eng loved her previous role.

She had been heading II-VI’s (now Coherent’s) 3D sensing unit after being VP of engineering at Finisar’s transceiver business. II-VI bought Finisar in 2019.

She moved across to a new 3D sensing business while still at Finisar. The 3D sensing unit was like a start-up within a large company, she says.

II-VI and Finisar had been competitors in the 3D sensing market. Eng headed the combined units after Finisar’s acquisition.

She enjoyed the role and wasn’t looking to change when the CEO asked her to become Coherent’s CTO.

“To become CTO of the new Coherent – to help define the future of this company which is a five-plus going on six billion dollar company – that is pretty exciting,” says Eng.

The “New” Coherent

Coherent combines a broad portfolio of technologies from II-VI, Finisar, and the firm Coherent which II-VI acquired in 2022.

Just within lasers, Coherent’s portfolio spans from devices 1mm wide that are sold into mobile phones to the former Coherent’s lasers that are meters wide and used for OLED manufacturing.

Being CTO is different from Eng’s line-management roles, which had set, tangible annual goals.

Her role now is to shepherd the company’s technologies and grow the business over the long term.

Eng has been familiarising herself with the company’s technologies. To this aim, Eng is drawing on deep technological expertise across the company’s units.

Luckily, lasers are already covered, she quips.

“One of the things that I always somehow had a knack for is interacting with customers, sensing opportunities, and then figuring out how our technologies can help customers solve their problems,” says Eng.

It is a skill she successfully transferred to the consumer – 3D sensing – business but now it will be needed on a broader scale.

Eng is also making connections across technology units within the company as she seeks to identify new technologies and new market opportunities.

Her CTO role also allows her to engage with every Coherent customer across the company’s many markets.

She admits being CTO is challenging. One issue is grappling with the breadth of technologies the company has. Another is how to assess her works’ impact.

She and the CEO have discussed how best to use her time to benefit the company. Eng has also talked to other companies’ CTOs about the role and what works for them.

“It’s very interesting; CTO is one of these roles that has no universal definition,” says Eng.

Technologies to watch

Eng highlights several developments when asked about noteworthy technologies.

For communications, this is the year when 200 gigabits per lane will likely be achieved.

“The first transceivers I worked on were [SONET/SDH] OC-3 which is 155 megabits per second (Mbps),” she says. “Is wasn’t even a transceiver back then; it was discrete transmitters and receivers.”

That the industry has accelerated technology to achieve multiple lanes of 200 gigabit-per-second (Gbps) in a pluggable module is remarkable, she says.

Eng also notes Coherent’s work on a continuous-wave laser integrated with a Mach-Zehnder modulator – a DMZ – to enable 200 gigabits per lane.

The company is also active in life sciences and health monitoring. Communications, especially during the pandemic, showed its importance in people’s lives. “But life sciences and health-related products have a much more direct impact on people,” says Eng. “That is not something I’ve had direct exposure to.”

Life sciences and health monitoring is a segment where optics and optical devices will play a growing role over time.

Medical devices often originate in research environments such as hospital labs before becoming medical instruments. From the lab, they go to clinical. “What we are talking about here is going from lab to clinical to therapeutics,” she says.

The US Chips Act also heartens Eng: “It was about time for the US to prioritise semiconductors.”

Low-power coherent DSPs

Coherent and ADVA jointly developed a low-power coherent digital signal processor (DSP) and optics design for a 100-gigabit ZR (100ZR) design that fits within a QSFP28 module.

“We have an internal DSP team, and they are developing DSPs for the coherent optics market,” says Eng, adding that having the design team gives Coherent options.

Meanwhile, the debate about direct detection technology versus coherent optics continues.

As optical lane speed increases from 100 gigabits to 200 gigabits, the question remains what reach will direct detection achieve before running out of steam?

With 200 gigabits per lane, 800 gigabit modules can be achieved using four optical lanes, while for 1.6 terabits, eight lanes will be used.

Eng is confident that direct detection will support 10km at these speeds. Beyond 10km, direct detection becomes much more of a challenge, and coherent is an option.

“The real question is will coherent optics meet the size, cost and power consumption expectations of the data centre customers on a timeframe that meets their needs,” says Eng.

Having in-house DSP technology means Coherent can undertake design trade-offs and make the right decisions, she says.

After 1.6 terabits, the design options include increasing the lane rate, using more than eight channels or adopting more advanced modulation schemes.

“We look at the application, the timeline that the product needs to be released, the readiness of the technology, we do measurements – simulations – and we make objective decisions based on the results,” says Eng.

Whatever the prevalent technology is, says Eng, that technology will continue to improve since that is the livelihood of many companies.

“All of us, as an industry, are going to put our all into extending the technologies we currently have,” says Eng. So, when it comes to direct detection versus coherent, everyone will push direct detect technology as far as possible.

“Getting up to 1.6 terabits [using direct detect], that is pretty good,” says Eng. “That is going to last us a pretty long time.”

Materials

Coherent’s toolbox of material systems covers indium phosphide, silicon photonics, and gallium arsenide. It also has silicon carbide, a semiconductor suited for high-power transistors used for power electronics applications.

“We have all the technologies, we use the best technology for the product, and we use good engineering judgement,” says Eng.

Rather than favour indium phosphide or silicon photonics, Eng’s segmentation starts with whether the design is directly modulated or externally modulated.

Until now, up to 50 gigabits per lane has been well served by directly modulated lasers. This has used indium phosphide or, in the case of VCSELs, gallium arsenide.

“In general, directly modulated is the lower cost because the die is tiny, and often it is the lowest power,” says Eng.

But increasing the speed beyond 50Gbps gets more complicated with directly modulated lasers. This is where externally modulated lasers come in.

“Once you are already talking about an externally modulated solution, we start looking at the trade-offs between indium phosphide and silicon photonics,” says Eng.

The laser remains indium phosphide, so the bake-off concerns the modulator and the passive optics.

What indium phosphide brings is better electro-optics performance, while silicon photonics brings the benefits of integration.

“So if there is a high-lane count – lots of passives – or an opportunity to use one laser over multiple modulators, these can be complicated designs, and silicon photonics can help reduce the size,” says Eng.

Pluggables and co-packaged optics

With 200 gigabits per lane becoming available, there is a clear roadmap for 800-gigabits and 1.6-terabit pluggables.

“Customers like pluggables, and I don’t think people should underestimate that,” says Eng, adding that continued innovation will extend their lifetime.

“There are flyover cables between the switch ASIC and the modules, vertical line cards have been proposed, and we have shown board-mounted optical assemblies,” she says.

At some point, co-packaged optics may be the right solution, says Eng. But that will depend on the application’s specification, issues such as bandwidth, size, cost, power consumption and reliability.

“People will only transition to optical input-output when extending pluggables doesn’t make sense anymore,” says Eng. “I think it is probably five-plus years away, but there are probably error bars on that.”

Coherent’s activities include using indium phosphide manufacturing for external laser sources for co-package optics. “And we are working on silicon photonics,” she says.

Coherent is also working on co-packaging VCSELs with high-performance chips. “Not all applications require a 2km reach,” she says.

The coming decade’s opportunities

Eng’s thoughts about the growth opportunities for the coming decade are, not surprisingly, viewed through Coherent’s markets focus.

She highlights four segments: communications, industrial, instrumentation, and electronics.

Fibre-optics communications will continue to grow with bandwidth. The opportunities for innovation include datacom and coherent optics.

She also notes growing interest in free-space optics and satellite communications.

“I see money being spent on that and maybe that is a place where someone like ourselves, with a lot of optics as well as bigger lasers, can play a role,” says Eng.

Precision manufacturing uses lasers in the industrial segment. Eng cites cutting, welding and marking as examples.

“We have elements used for battery manufacturing which is increasing due to electric cars,” she says.

Excimer lasers are also used for OLED and microLED display manufacturing.

“We even have optics in extreme UV steppers [used for advanced process node chip manufacturing],” she says.

For instrumentation, much of the growth is around health life sciences. Coherent makes optics that are used inside PCR testers for COVID-19. It also has engineers working on solid state lasers used for flow cytometry (the sorting of cells). She also cites gene sequencing equipment and medical imaging.

Coherent’s electronics segment refers to the consumer market. Growth here for optics and lasers include AR/VR goggles and the metaverse, wearable health monitoring, and automotive.

For automotive, lasers are used for lidar and in-cabin sensing, such as driver and passenger monitoring.

Silicon carbide is also a growth market, and its uses include the wireless market and power devices for electric vehicles.

“I like the communications market, which we see as growing, but for us, with such a broad portfolio, there are many of these other markets and products that I see as exciting for the remainder of this decade,” says Eng.

Interview: Finisar’s CEO reflects on a notable year

Michael Hurlston has had an eventful 2018.

The year started with him replacing Finisar’s veteran CEO, Jerry Rawls, and it is now ending with Finisar being acquired by the firm II-VI for $3.2 billion.

Finisar is Hurlston’s first experience in the optical component industry, having spent his career in semiconductors. One year in and he already has strong views about the industry and its direction.

Michael Hurlston

“We have seen in the semiconductor industry a period of massive consolidation in the last three to four years,” says Hurlston, in his first interview sinced the deal was announced. “I think it is not that different in optics: scales matters.”

Hurlston says that, right from the start, he recognised the need to drive industry consolidation. “We had started thinking about that fairly deeply at the time the Lumentum-Oclaro acquisition was announced and that gave us more impetus to look at this,” says Hurlston. The result was revealed in November with the announced acquisition of Finisar by II-VI.

“Finisar considered so many deals in the past but could not converge on a solution,” says Vladimir Kozlov, CEO and founder of market research firm, LightCounting. "It needed a new CEO to bring a different perspective. The new II-VI will look more like many diversified semiconductor vendors, addressing multiple markets: automotive, industrial and communications."

“We really have two complementary companies for the most part,” says Hurlston, who highlights VCSELs and reconfigurable optical add-drop multiplexers (ROADMs) as the only product segments where there is overlap. Merging II-VI and Finisar with disparate portfolios further benefits scale, he says.

Chip background

Hurlston’s semiconductor experience was gained at Broadcom and involved Wi-Fi devices. The key lessons he learned there is the importance of offering differentiated products to customers and the need to expand into new application areas.

“Wi-Fi is a standard, a technology, that has rules as you have to interoperate between different chipsets and different producers,” says Hurlston. “But we did find ways to differentiate under a standards umbrella.”

>

“It turns out co-packaging is a great top-line opportunity for optics companies because eventually we will be tasked with pulling together that sub-system”

What he has found, to his surprise, is that it is harder to differentiate in the optical components industry. “What we are trying to do is find spots where we can offer differentiation,” says Hurlston.

Optical components usage needs to also expand into new segments, he says, just as Wi-Fi evolved from a PC-centric technology to home networking and ultimately mobile handsets.

Hurlston cites as an example in the optical components industry how VCSELs are now being used for 3D sensing in handsets. There are also emerging opportunities in automotive and the data centre.

For the automative market, applications include in-cabin sensing to assist drivers and LIDAR (laser detection and ranging) to help vehicles build up an image of their surroundings in real-time. “LIDAR is further out but it is a significant opportunity,” says Hurlston.

For data centres, a key opportunity silicon co-packaging: bringing optics closer to switch silicon.

Currently, switch platform use pluggable optical modules on the faceplate to send and receive data. But with switch silicon capacity doubling every two years, the speed and density of the input-output means optics will have to get closer to the switch silicon.

On-board optics - as promoted by the Consortium for On-Board Optics (COBO) - is one option. Another is co-packaged optics, where the optics and silicon are placed in the same package.

“It turns out co-packaging is a great top-line opportunity for optics companies because eventually we will be tasked with pulling together that sub-system,” says Hurlston. “The integration of the switch chip and optics is something that will be technically difficult and necessitate differentiation.”

Challenges

As well as the issue of acquisitions, another area Hurlston has tackled in his short tenure is Finisar’s manufacturing model and how it can be improved.

“Finisar is a technology company at heart but the life-blood of the company is manufacturing,” he says.

Manufacturing is also one area where there is a notable difference between chips and optics. “There are manufacturing complexities with semiconductors and semiconductor process but optics takes it to a whole different level,” he says.

This is due to the manufacturing complexity of optical transceiver which Finisar’s CEO likens to manufacturing a mobile phone. There are chips that need a printed circuit board onto which are also added optical subassemblies housing such components as lasers and photo-detectors.

“Part of it [the complexity] is the human labour - the human touch - that is involved in the manufacturing and assembling of these transceivers ” he says. Finisar says its laser fab employs several hundred people whereas its optical transceiver factories employ thousands: 5,000 staff in Malaysia and some 5,500 in China.

“Our manufacturing model has been where I’ve spent a lot of time,” says Hurston. Some efficiencies have been gained but not nearly as much as he initially hoped.

Consolidation

One of the issues that has hindered greater industry consolidation has been the need for synergy between companies. A semiconductor company will only acquire or merge with another semiconductor company, and the same with a laser company looking for another laser player, he says. “What I admire about II-VI is that they are pretty bold,” says Hurlston. “What II-VI did is go after something that is not overlapping.”

He believes the creation of such broad-based suppliers is something the optics industry will have to do more of: “The transceiver guys are going to have to go after different areas of the value chain.”

In most mature industries, three large diversified companies typically dominate the marketplace. Given Lumentum’s acquisition of Oclaro has just closed and II-VI’s acquisition of Finisar is due to be completed in mid-2019, will there be another large deal?

“This is a big industry and the opportunity today and going forward is big,” says Hurlston. But there are so many players in different parts of the supply chain such that he is unsure whether these niche companies will survive in the long run.

“Whether there will be three, four or five large players, I don’t know,” he says. “But we are definitely going to see fewer; this [II-VI - Finisar deal] isn't the last transaction that drives industry consolidation.”

>

“Whether there will be three, four or five large players, I don’t know but we are definitely going to see fewer”

How will Finisar make optical transceivers in such a competitive marketplace, that includes an increasing number of Chinese entrants, while delivering gross margins that meet Wall Street expectations?

Finisar does have certain advantages, he says, such as making its own lasers. “We also make our own semiconductors, a lot of the semiconductor solutions the Chinese guys have are sourced,” he says. “That gives us an inherent advantage.”

Having its own manufacturing facilities in the Far East means that Chinese players have no inherent manufacturing advantage there. However, he admits that the gross margin expected of Finisar is higher that its Chinese competitors.

This is why Finisar’s CEO stresses the need to pursue pockets of differentiation and why the company has to be first to market in important productareas that all players will target. “We historically have not been first to market,” he says. “We have made adjustments in the last year in our time-to-market and our ability to get to big products transitions that will be hyper-competitive first.”

Hurston expresses some satisfaction in the improved revenues and gross margins as reported in Finisar’s last two quarters’ results, albeit these quarters coming after what he calls ‘a low base’.

“We have also made significant progress in 3D sensing that has been a big challenge for us,” he says.

What next?

Hurlston says he hopes to have a role in the new company once the deal closes.

“But If I don’t, I’ve really enjoyed working with the [Finisar] team and in this space,” he says. “It’s been a bit of a learning curve but I’ve learnt a couple of tricks. Hopefully there will be another opportunity to apply some of that learning to a job elsewhere.”

Lumentum jolts the industry with Oclaro acquisition

Lumentum announced on Monday its plan to acquire Oclaro in a deal worth $1.8 billion.

The prospect of consolidation among optical component players has long been mooted yet the announcement provided the first big news jolt at the OFC show, being held in San Diego this week.

Alan Lowe“Combined, we will be an industry leader in telecom transmission and transport as well as 3D sensing,” said Alan Lowe, president and CEO of Lumentum, on an analyst call discussing the deal.

Alan Lowe“Combined, we will be an industry leader in telecom transmission and transport as well as 3D sensing,” said Alan Lowe, president and CEO of Lumentum, on an analyst call discussing the deal.

Lumentum says their joint revenues totalled $1.7 billion with a 39% gross margin over the last year. And $60 million in synergies are forecast in the second year after the deal closes, which is expected to happen later this year.

The $1.8 billion acquisition will comprise 56 percent cash and 44 percent Lumentum stock. Lumentum will also raise $550 million to help finance the deal.

“This is a big deal as it consolidates the telecom part of the component market,” says Daryl Inniss, business development manager at OFS Fitel and former market research analyst.

Background

Lowe said that ever since Lumentum became a standalone company three years ago, the firm concentrated on addressing the increase in optical communications demand that started in late 2015 and then last year on ramping the production of its 3D sensing components. “Execution on major M&As had to wait,” he said.

The company investigated potential acquisitions and evaluated several key technologies including silicon photonics and indium phosphide. This led to it alighting on Oclaro with its indium phosphide and photonic integrated circuit (PIC) expertise.

Lowe also highlighted Oclaro’s strategy of the last five years of first trimming its business lines and then successfully executing on delivering optical transmission products.

Oclaro’s CEO, Greg Dougherty, CEO of Oclaro, described how his company has focussed on delivering differentiated photonic chip products to various growing end markets. “This is a very good combination for both companies and for the industry,” said Dougherty.

There is no overabundance in [optical] chip designers worldwide and together we have the strongest chip designer team in the world

Business plans

Lumentum’s business includes telecom transport components, modules and sub-systems. Its products include reconfigurable optical add/drop multiplexers (ROADMs), pump lasers, optical amplifiers and submarine products. In the second half of 2017, Lumentum’s telecom revenue mix was split three quarters telecom transport with transmission products accounted for the remaining quarter. Other Lumentum businesses include industrial lasers and 3D sensing.

In contrast, Oclaro’s focus in solely transmission components and modules, with the revenue mix in its most recent quarter being 53 percent telecom line side and 47 percent datacom client-side products.

The combined R&D resources of the merged company will allow it to do a much better job at supporting datacom products using the new QSFP-DD and OSFP form factors. “Right now I’m guessing that Alan is spread thin and I know the Oclaro datacom team has been spread thin,” says Dougherty.

The acquisition will also pool the two companies’ fabrication facilities.

Lumentum has already moved its lithium niobate manufacturing to its main gallium arsenide and indium phosphide fab in San Jose, California. San Jose also hosts a separate planar lightwave circuit fab.

Oclaro, which is headquartered in San Jose, has three photonic chip fabrication sites: an indium phosphide laser fab for datacom in Japan that makes directly modulated lasers (DMLs) and electro-absorption modulated lasers (EMLs), an indium phosphide fab in the UK that manufactures coherent optical components and sub-assemblies, and a lithium niobate fab in Italy.

The acquisition will also bolster the company’s chip design resources. “There is no overabundance in [optical] chip designers worldwide and together we have the strongest chip designer team in the world,” says Dougherty.

Lumentum plans to assign some of the chip designers to tackle a burgeoning pipeline of 3D sensing product designs.

In 2017 Lumentum reported three customers that accounted for nearly half of its revenues, while Oclaro had four customers, each accounted for 10 percent or more of its sales, in 4Q 2017. Oclaro selected customers include the webscale players, Amazon, Google and Microsoft, as well as leading systems vendors such as Ciena, Cisco, Coriant, Huawei, Juniper, Nokia and ZTE.

Both Oclaro and Lumentum, along with Neophotonics, signed an agreement with Ciena a year ago to use its WaveLogic Ai DSP in their coherent module designs.

Lumentum plans to provide more deal details closer to its closure. Meanwhile, the two CEOs will continue to run their companies with Oclaro’s Dougherty remaining at least during the transition period.

Further information:

For the link to the acquisition presentation, click here.