Silicon Photonics: Fueling the Next Information Revolution

New book to be published in December 2016

Silicon Photonics: Fueling the Next Information Revolution is the title of the book Daryl Inniss and I have just completed.

We started writing the book at the end of 2014. We felt the timing was right for a silicon photonics synthesis book that assesses the significant changes taking place in the datacom, telecom, and semiconductor industries, and explains the market opportunities that will result and the role silicon photonics will play.

Silicon photonics is coming to market at a time of momentous change. Internet content providers are driving new requirements as they scale their data centres. The chip industry is grappling with the end of Moore’s law. And the telecom community faces its own challenges as the bandwidth-carrying capacity of fibre starts to be approached.

Silicon photonics will be a key technology for a post–Moore’s law era, and it will be the chip industry, not the photonics industry, that will drive optics

Each of these changes – the data center, the end of Moore’s law, and a looming capacity crunch – is significant in its own right. But collectively they signify a need for new thinking regarding chips, optics, and systems. Such requirements will also give rise to new business opportunities and industry change. Silicon photonics is arriving at an opportune time.

Despite this, the optical industry still questions the significance of silicon photonics while, for the chip industry, optics remains a science peripheral to their daily concerns. This too will change.

The book discusses how silicon photonics is set to influence both industries. For the optical industry, the technology will allow designs to be tackled in new ways. For the chip industry, silicon photonics may be a peripheral if interesting technology, but it will impact chip design.

The focus of the book is the telecom and datacom industries; these are and will remain the primary markets for silicon photonics for the next decade at least. But we also note other developments where silicon photonics can play an important role.

Silicon photonics will be a key technology for a post–Moore’s law era, and it will be the chip industry, not the photonics industry, that will drive optics.

The book is being published by Elsevier’s Morgan Kaufman and will be available from mid-December. To see the contents of the book, click here.

Daryl Inniss reflects on a career in market research

Daryl Inniss

Daryl Inniss

Rocky beginnings

I jumped ship in 2001 joining RHK, a market research firm, knowing nothing about the craft. I had been a technical manager and loved research and development, but work was 500 miles from my family and the weekly commute was gruelling.

Back then, the telecom market was crashing and I believed my job was at risk. Moving to a small market research firm could hardly be described as good planning, but it turned out to be a godsend.

I had no idea what I was getting into and my first months did not help. My mother passed away within a month of joining and I was absent for half of my first 40 days. But my boss was very supportive. Meanwhile, work consisted of unintelligible, endless conference calls. And while in this daze, September 11th occurred.

The first report - getting the job done

Completing my first market research report helped ground me in the art. I wrote about optical dispersion compensators. After interviewing many companies, I wrote a long and complicated piece, an exercise that I found difficult. I also struggled with who would read the report and what would be done with the data.

The report aimed to explain technical issues simply and included a market forecast. Completing it proved hard because there was always more information to include, a better explanation, and better forecast data to be gathered.

I felt unsatisfied but the report received kudos. Internally I was told that I was the second or third analyst to tackle that topic and the first to complete the work. And an optical company complimented me on the report. But I felt dissatisfied and wished I had done better. I wanted to understand the subject more, wished I could provide clearer, simpler explanations and also provide a better forecast.

Nonetheless, I learned the importance of completing assignments as they can go on forever.

A market researcher's role

An analyst tries to identify market opportunities and winning strategies. Looking at new products, for example, the goal is to explain what they are, why they are being introduced, who will use them, their value, and the competitive landscape. The issues must be explained to novices and experts alike. The technical novice may get a glimpse of what the technology means and how it works, while a technical expert may understand the ecosystem more deeply.

An analyst must strive to prepare simple messages that are steeped in facts. You need to have a story—say why something is happening and explain it in the context of the bigger picture.

Forecasts, market share, rankings, prices and volumes are all important. Everyone loves numbers. But the story underpinning the numbers is far more important and most people do not take the time to determine the causes behind the numbers.

Where is the industry going?

I have spent the last 15 years analysing the optical components market. Sustainable profitability is the biggest topic, and consolidation is viewed as providing the best approach. Notwithstanding the mergers and acquisitions, the market is fragmented, margins remain low, and there is still no evidence of true consolidation.

Independent of all the change, optical component suppliers post gross margins below 40 percent and most are below 30 percent while semiconductor companies are routinely above 50 percent. There is a force keeping the industry stuck at this level, in part because there is little product differentiation.

Forecasts, market share, rankings, prices and volumes are all important. Everyone loves numbers. But the story underpinning the numbers is far more important

Avago Technologies’ divestiture of its optical module business to Foxxconn Interconnect Technology Group points to one high-margin path. Discrete components—particularly lasers and modulators, and to a lesser extent photodiodes and receivers - command higher margins. Vendors can offer differentiated products at this level. Total revenues are lower so the challenge is to win enough business to fill the factory because these are fixed-cost, intensive businesses.

Subsystems offer another high-margin path, particularly for vertically-integrated companies. Here vendors are challenged with a long time-to-market, requiring a strong design team to support customer requests. Also business can be lumpy because solutions are customer-specific.

Acacia Communications' coherent 100 gigabit transponders is an example solution that has the basis to win broad-based business and high margins. The products offer a one-stop-shop solution including optics, electronics, and software. Acacia is developing silicon photonics so it controls most of the bill of materials, keeping down product cost. And its solution is differentiated in that it helps customers get their products to market while achieving a high level of performance.

Market research: even more important now

The communications industry is going through extensive change making market research more important than ever. The Web 2.0 companies are the new optical communication mindshare leaders, driving technology and business practices.

Simultaneously China is the biggest consumer of optical gear, both for long-haul and access networks. Optical component suppliers need to understand how to compete in this new environment. What are the new rules? How are they evolving? How can companies best position themselves to win more business?

Just like when I started, I ask how can a market researcher help component companies navigate this new world. No doubt, this is a challenge, but market researchers provide the collective market voice. They are the market mirror that shows the beauty spots and the warts. They are given license to say what everyone is thinking. They can raise market consciousness so participants may act fearlessly.

But market researchers need to understand the story from top to bottom—end customer to suppliers. They must communicate well which includes not only delivering the story but also being humble, admitting mistakes, keeping sources and information confidential, and taking corrective actions.

This is indeed a challenge and I feel honoured to have had the opportunity to participate. I could not have done the job without the help of wonderful people from all over the world. Their generosity, warmth, and kindness made all the difference. At bottom, it is these relationships that mattered as we tried to help each other navigate.

Biography

Dr. Daryl Inniss is Director, New Business Development at OFS Fitel, the designer, manufacturer and provider of optical fibre, fibre optic cable, connectivity, fibre-to-the-subscriber and specialty photonics products.

He was formerly Components Practice Leader at market research firm Ovum and RHK. Daryl was Technical Manager at JDSU and Lucent Technologies, Bell Laboratories, and started his career as a Member of the Technical Staff, AT&T Bell Labs.

Silicon photonics book scheduled for early 2016

The work will provide an assessment of silicon photonics and its market impact over the next decade. The title will explore key trends and challenges facing the telecom and datacom industries, provide a history of silicon photonics, and detail its importance. The title will also pinpoint those applications that will benefit most from the technology.

Optical industry restructuring: The analysts' view

The view that the optical industry is due a shake-up has been aired periodically over the last decade. Yet the industry's structure has remained intact. Now, with the depressed state of the telecom industry, the spectre of impending restructuring is again being raised.

In Part 2, Gazettabyte asked several market research analysts - Heavy Reading's Sterling Perrin, Ovum's Daryl Inniss and Dell'Oro's Jimmy Yu - for their views.

Part II: The analysts' view

"It is just a very slow, grinding process of adjustment; I am not sure that the next five years will be any different to what we've seen"

Sterling Perrin, Heavy Reading

Larry Schwerin, CEO of ROADM subsystem player Capella Intelligent Subsystems, believes optical industry restructuring is inevitable. Optical networking analysts largely agree with Schwerin's analysis. Where they differ is that the analysts say change is already evident and that restructuring will be gradual.

"The industry has not been in good shape for many years," says Sterling Perrin, senior analyst at Heavy Reading. "The operators are the ones with the power [in the supply chain] and they seem to be doing decently but it is not a good situation for the systems players and especially for the component vendors."

Daryl Inniss, practice leader for components at Ovum, highlights the changes taking place at the optical component layer. "There is no one dominate [optical component] supplier driving the industry that you would say: This is undeniably the industry leader," says Inniss.

A typical rule of thumb for an industry in that you need the top three [firms] to own between two thirds and 80 percent of the market, says Inniss: "These are real market leaders that drive the industry; everyone else is a specialist with a niche focus."

But the absence of such dominant players should not be equated with a lack of change or that component companies don't recognise the need to adapt.

"Finisar looks more like an industry leader than we have had before, and its behaviour is that of market leader," says Inniss. Finisar is building an integrated company to become a one-stop-shop supplier, he says, as is the newly merged Oclaro-Opnext which is taking similar steps to be a vertically integrated company. Finisar acquired Israeli optical amplifier specialist RED-C Optical Networks in July 2012.

Capella's Schwerin also wonders about the long term prospects of some of the smaller system vendors. Chinese vendors Huawei and ZTE now account for 30 percent of the market, while Alcatel-Lucent is the only other major vendor with double-digit share.

The rest of the market is split among numerous optical vendors. "If you think about that, if you have 5 percent or less [optical networking] market share, that really is not a sustainable business given the [companies'] overhead expenses," says Schwerin.

However Jimmy Yu, vice president of optical transport research at Dell’Oro Group, believes there is a role for generalist and specialist systems suppliers, and that market share is not the only indicator of a company's economic health. “You have a few vendors that are healthy and have a good share of the market,” he says. “That said, when I look at some of these [smaller] vendors, I say they are better off.”

Yu cites the likes of ADVA Optical Networking and Transmode, both small players with less than 3 percent market share but they are some of the most profitable system companies with gross margins typically above 40 percent. “Do I think they are going to be around? Yes. They are both healthy and investing as needed.”

Innovation

Equipment makers are also acquiring specialist component players. Cisco Systems acquired coherent receiver specialist CoreOptics in 2010 and more recently silicon photonics player, Lightwire. Meanwhile Huawei acquired photonic integration specialist, CIP Technologies in January 2012. "This is to acquire strategic technologies, not for revenues but to differentiate and reduce the cost of their products," says Perrin.

"There is a problem with the rate of innovation coming from the component vendors," adds Inniss. This is not a failing of the component vendors as innovation has to come from the system vendors: a device will only be embraced by equipment vendors if it is needed and available in time.

Inniss also highlights the changing nature of the market where optical networking and the carriers are just one part. This includes enterprises, cloud computing and the growing importance of content service providers such as Google, Facebook and Amazon who buy components and gear. "It is a much bigger picture than just looking at optical networking," says Inniss.

"There is no one dominate [optical component] supplier driving the industry that you would say: This is undeniably the industry leader"

"There is no one dominate [optical component] supplier driving the industry that you would say: This is undeniably the industry leader"

Daryl Inniss, Ovum

Huawei is one system vendor targeting these broader markets, from components to switches, from consumer to the data centre core. Huawei has transformed itself from a follower to a leader in certain areas, while fellow Chinese vendor ZTE is also getting stronger and gaining market share.

Moreover, a consequence of these leading system vendors is that it will fuel the emergence of Chinese optical component players. At present the Chinese optical component players are followers but Inniss expects this to change over the next 3-5 years, as it has at the system level.

Perrin also notes Huawei's huge emphasis on the enterprise and IT markets but highlights several challenges.

The content service providers may be a market but it is not as big an opportunity as traditional telecom. "It is also tricky for the systems providers to navigate as you really can't build all your product line to fit Google's specs and still expect to sell to a BT or an AT&T," says Perrin. That said, systems companies have to go after every opportunity they can because telecom has slowed globally so significantly, he says.

Inniss expects the big optical component players to start to distance themselves, although this does not mean their figures will improve significantly.

"This market is what it is - they [component players] will continue to have 35 percent gross margins and that is the ceiling," says Inniss. But if players want to improve their margins, they will have to invest and grow their presence in markets outside of telecom.

"I like the idea of a Cisco or a Huawei acquiring technology to use internally as a way to differentiate and innovate, and we are going to see more of that," says Perrin.

Thus the supply chain is changing, say the analysts, albeit in a gradual way; not the radical change that Capella's Schwerin suggests is coming.

"It is just a very slow, grinding process of adjustment; I am not sure that the next five years will be any different to what we've seen," says Perrin. "I just don't see why there is some catalyst that suggests it is going to be different to the past two years."

This is based on an article that appears in the Optical Connections magazine for ECOC 2012

Optical components: The six billion dollar industry

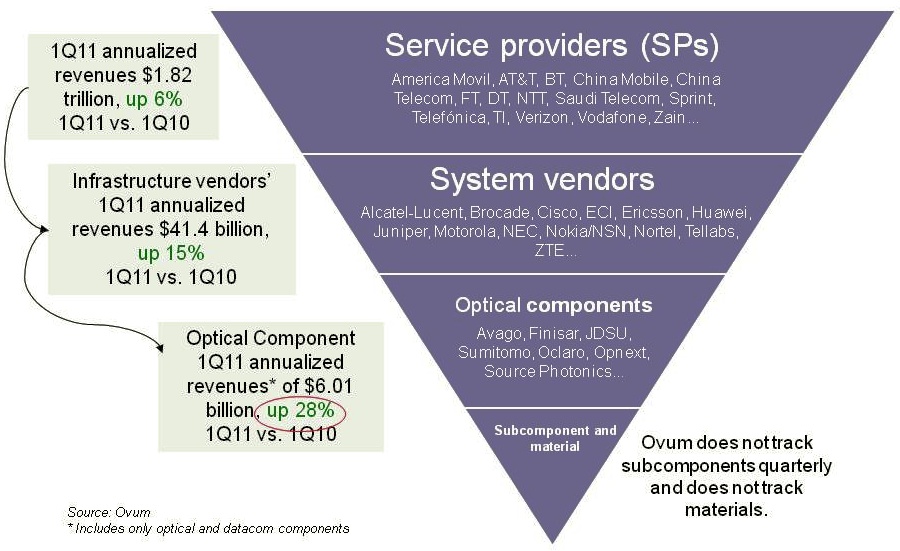

The service provider industry, including wireless and wireline players, is up 6% year-on-year (2Q10 to 1Q11) to reach US $1.82 trillion, according to Ovum. The equipment market, mainly telecom vendors but also the likes of Brocade, has also shown strong growth - up 15% - to reach revenues of over $41.4 billion. But the most striking growth has occurred in the optical components market, up 28%, to achieve revenues of over $6 billion, says the market research firm.

Source: Ovum

Source: Ovum

“This is the first time optical components has exceeded six billion since 2001,” says Daryl Inniss, practice leader, Ovum Components. Moreover, the optical component industry growth has continued over six consecutive quarters with the growth being more than 25% for the past four quarters. “None of the other [two] segments have performed in this way,” says Inniss.

Ovum cites three factors accounting for the growth. Fibre-to-the-x (FTTx) is experiencing strong growth while revenues have entered the market from datacom players from the start of 2010. “The [optical] component recovery was led by datacom,” says Inniss. “We speculate that some of that money came from the Googles, Facebooks and Yahoos!.” A third factor accounting for growth has been optical equipment vendors ordering more long lead-time items than needed – such as ROADMs – to secure supply.

Source: Ovum

Source: Ovum

The second chart above shows the different market segments normalised since the start of 1999. Shown are the capex spending for optical networking, optical networking equipment revenues, optical components and FTTx equipment spending.

Optical networking spending is some 3.5x that of the components. FTTx equipment revenues are lower than the optical component industry’s and is therefore multiplied by 2.25, while capex is 9.2x that of optical equipment. The peak revenue in 2001 is the optical component revenues during the optical boom.

Several points can be drawn from the normalised chart:

- The strong recent growth in FTTx is the result of the booming Chinese market.

- From 2003 to 2008, the overall market showed steady growth, as illustrated by the best-fit line.

- From 2003 to 2008, capex and optical networking revenues were in line, while two thirds of the optical component revenues were due to this telecom spending.

- From 2010 onwards, components deviated from these two other segments due to the datacom spending from new players and the strong growth in FTTx.

- Once the market crashed in early 2009, optical components, networking and capex all fell. FTTx recovered after only one quarter and was followed by optical components. Optical networking and capex, meanwhile, have still not fully recovered when compared with the underlying growth line.