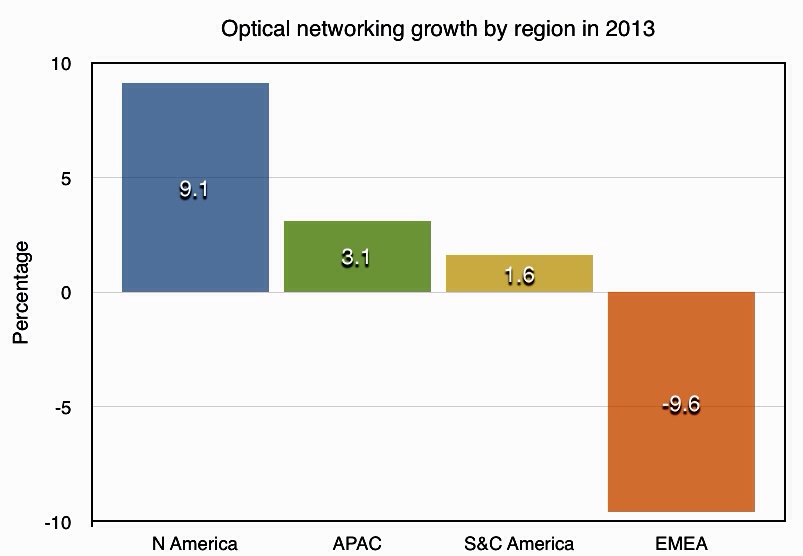

Optical networking spending up in all regions except Europe

Source data: Ovum

Source data: Ovum

Ovum forecasts that the global optical networking market will grow to US $17.5 billion by 2018, a compound annual growth rate of 3.1 percent.

Optical networking spending in North America will be up 9.1 percent in 2013 after two flat years. North American tier-1 service providers and cable operators are investing in the core network to support all traffic types, and 100 Gigabit is being deployed in volume.

In contrast, optical networking sales in EMEA will contract by nearly 10 percent in 2013. “Non-spending in Europe is the major factor in the overall EMEA decline,” says Ian Redpath, principal analyst, network infrastructure at Ovum.

The major technology trend for this forecast is the ascendancy of 100 Gig, whose sales exceeded 40 Gig revenues in 2Q13

EMEA optical networking spending has been down in four out of the past five years, and the lack of investment is becoming acute, says Ovum. Given that service providers are stretching their existing networks, spending will have to take place eventually to make up for the prolonged period of inactivity.

This year has seen 100 Gigabit become the wavelength of choice for large WDM systems, with sales surging. Spending on 100 Gigabit has now overtaken spending on 40 Gigabit which declined in the first half of the year.

"The major technology trend for this forecast is the ascendancy of 100 Gig, whose sales exceeded 40 Gig revenues in 2Q13," says Redpath.

Further reading:

Ovum: Optical networks forecast: top line steady, 100G surging, click here

60-second interview with .... Dell'Oro's Jimmy Yu

"For the year, it is going to be a fivefold growth rate [for 100 Gig transport]."

Jimmy Yu, Dell'Oro

Q: That fact that the market is down 5 percent on a year ago. Why is this?

A: There are a few factors. First, the macro-economy in Europe continues to get worse; that causes a slowdown.

A second factor is that in North America there was a decline in the second quarter, which is pretty unusual. Part of it, we think, might be that operators have caught up with a lot of the spending to increase broadband, after adding [to the network] for a couple of good years.

The third issue is that the China market has had a really slow start. And while there has been talk about the Chinese market softening, it seems that the CapEx [capital expenditure] is there for a strong second half.

What categories does Dell'Oro include when it talks about optical transport?

There are two main pieces: WDM [wavelength division multiplexing], both metro and long haul, and the multi-service multiplexer used for aggregation. The third piece, which is really small, is optical switching - optical cross-connect used in the core and lately more so in the metro.

According to Dell'Oro, wavelength division multiplexing was up 5 percent in the first half of 2012 compared to the same period a year ago, due to demand for 40 Gig and 100 Gig. What is happening in these two markets?

At 100 Gig we are at an inflection point where demand growth rates are really high. We've got a doubling in demand and shipments quarter-on-quarter [in the second quarter]. For the year, it is going to be a fivefold growth rate.

Also the 40 Gig is still growing. It has been around for a few years so its growth rate is not as strong [as 100 Gig transport] but it is still a significant part of the market.

Has the market settled on particular modulation scheme, especially at 40 Gig?

For 100 Gig the majority [deployed] is coherent. There is one company at least, ADVA Optical Networking, which is coming out with its direct-detection scheme for 100 Gig. This has now been shipping for one quarter. There is a market for the price point and the lower-span link of direct-detection.

For 40 Gig there is still a mix of modulations. Vendors coming out with 100 Gig coherent are also coming out with 40 Gig coherent options. So coherent at 40 Gig is now approaching half of the total market and is happening pretty quickly.

As for [40 Gig] DQPSK [differential quadrature phase-shift keying] modulation, it is probably a little bit more than DPSK [differential phase-shift keying].

You also report a rise in the adoption of optical packet products and that it contributed close to one-third of the optical market revenues in the first half 2012. Why is that?

The optical packet platform is a wider definition than just packet optical transport systems (P-OTS).

One reason why optical packet is growing is that with traditional P-OTS, you have cross-connect and switching capabilities in a WDM system so as you go to higher 40 and 100 Gig wavelengths you want some bandwidth management in that system.

Another thing is that people are trying to make the aggregation layer - the traditional SONET/SDH - more Ethernet friendly and MPLS-TP [multiprotocol label switching, transport profile] is gaining traction.

Combined, we are seeing this optical packet market has grown 12 percent year-on-year in the second quarter whereas the overall market has declined.

Dell'Oro said Huawei has 20 percent market share, which other vendors have double-digit market share?

Besides Huawei, the other vendors with double-digit percentage for the quarter - in order - are ZTE, Alcatel-Lucent and Ciena.

Did you see anything in this latest study that was surprising?

There was nothing in this quarter but I saw it last quarter. The legacy equipment – traditional SONET/SDH – is declining. Most of the market decline for optical is in legacy.

SONET/SDH sales in the second quarter of 2012 declined by 20 percent year-on-year. It is finally happening: the market is shifting away from SONET/SDH.