OFC/NFOEC 2013 product round-up - Part 1

Part 1: Client-side transceivers

- First CFP2 single-mode and multi-mode transceiver announcements

- Cisco Systems unveils its CPAK module

- 100 Gigabit QSFPs from Kotura and Luxtera

- CFP2 and 40km CFP 10x10 MSA modules

- Infiniband FDR and 'LR4 superset' QSFPs

The recent OFC/NFOEC exhibition and conference held in Anaheim, California, saw a slew of optical transceiver announcements. The first CFP2 client-side products for single-mode and multi-mode fibre were unveiled by several companies, as was Cisco Systems' in-house CPAK transceiver.

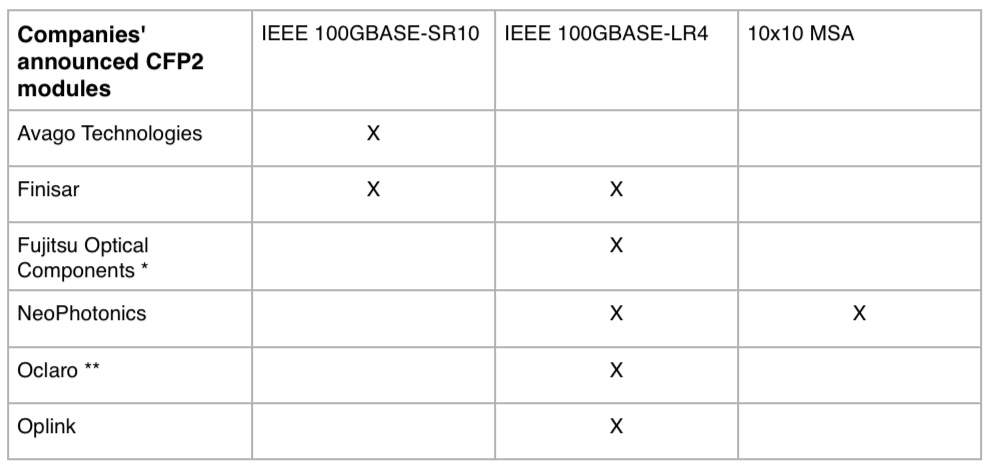

The CFP2 is the pluggable form factor that follows the first generation CFP. The CFP MSA announced the completion of the CFP2 specification at the show, while several vendors including Avago Technologies, Finisar, Fujitsu Optical Components, NeoPhotonics, Oclaro and Oplink Communications detailed their first CFP2 products.

The 40 and 100 Gigabit CFP2 is half the size of the CFP, enabling at least a doubling of the CFP2 transceivers on a faceplate compared to four CFPs (see table below). The CFP2 is also future-proofed to support 200 and 400Gbps (See first comment at bottom of CFP2 story).

Another difference between the CFP and the CFP2 is that the CFP2 uses a 4x25Gbps electrical interface. Accordingly, the CFP2 does not need the 'gearbox' IC that translates between ten, 10 Gigabit-per-second (Gbps) lanes to four, 25Gbps electrical lanes that interface to the 4x25/28Gbps optics. Removing the gearbox IC saves space and reduces the power consumption by several watts.

The industry has long settled on the SFP+ at 10Gbps while the QSFP has become the 40Gbps form factor of choice. With 100Gbps still in its infancy, transceiver vendors are pursuing several client-side interfaces. Much work will be needed to reduce the size, power consumption and cost of 100Gbps interfaces before the industry settles on a single pluggable form factor for the single-mode and multi-mode standards.

CFP2 announcements

Finisar demonstrated two CFP2 modules, one implementing the IEEE 100GBASE-LR4 10km standard and the other, the IEEE 100GBASE-SR10 100m multi-mode standard. The company is using directly-modulated, distributed feedback (DFB) lasers for its CFP2 LR4. In contrast, the CFP module uses more expensive, electro-absorption modulator lasers (EMLs). Finisar demonstrated interoperability between the two LR4 modules, an EML-based CFP and a DFB-based CFP2, at the show.

* An ER4 CFP2 is under development

** Oclaro disclosed indium phosphide components for a future CFP2 line side pluggable

Using directly modulated lasers also reduces the power consumption, says Finisar. Overall, the CFP2 LR4 consumes 7W compared to a 24W first-generation CFP-based LR4.

"We can migrate these [directly modulated laser] designs to a single quad 28 Gig photonic integrated circuit TOSA," says Rafik Ward, Finisar's vice president of marketing. "Likewise on the receive [path], there will be a quad 28 Gig ROSA." The TOSA refers to a transmitter optical sub-assembly while the ROSA is the receiver equivalent. Ward says the CFP2s will be in production this year.

Several module and chip makers took part in the Optical Internetworking Forum's (OIF) multi-vendor demonstration of its 4x25 Gigabit chip-to-module electrical interface, the CEI-28G-VSR. The demonstration included CFP2 LR4s from Finisar and from Oclaro as well as Luxtera's 100Gbps shorter reach module in a QSFP28. Oclaro's CFP2 is expected to be in production in the third quarter of 2013.

Another standard implemented in the CFP2 is the 100GBASE-SR10 multi-mode standard. Avago Technologies and Finisar both detailed CFP2 SR10 modules. The SR10 uses 10 VCSELs, each operating at 10Gbps. The SR10 can be used as a 100Gbps interface or as 10 independent 10Gbps channels.

The CFP2 SR10 can be interfaced to 10 Gigabit Ethernet (GbE) SFP+ modules or combinations of 10GbE SFP+ and 40GbE QSFPs. "What people are looking for using the CFP2 multi-mode module is not only for the 100 Gig Ethernet application but interoperability with 40 Gig Ethernet as well as 10 Gig Ethernet modules," says I Hsing Tan, Ethernet segment marketing manager in the fibre optics product division at Avago.

The SR10 electrical interface specification supports retiming and non-retiming options. The Avago CFP2 module includes clock data recovery ICs that can be used for retiming if needed or bypassed. The result is that Avago's CFP2 SR10 consumes 4-6W, depending on whether the clock data recovery chips are bypassed or used.

Meanwhile, NeoPhotonics became the first company to announce the 10x10 MSA in a CFP2.

NeoPhotonics has not detailed the power consumption but says the 10x10Gbps CFP2 is lower than the CFP since all of the chips - photonic and electrical - are a newer generation and much work has gone into reducing the power consumption.

"Demand is quite strong for the 10x10 solution," says Ferris Lipscomb, vice president of marketing at NeoPhotonics. "The CFP2 version is being developed, and we expect strong demand there as well."

The key advantage of the 10x10-based solution over a 4x25Gbps design is cost, according to NeoPhotonics. "10x10 enjoys the volume and maturity of 10 Gig, and thus the cost advantage," says Lipscomb. "We believe the 10x10 CFP2 will follow the trend of the 10x10 MSA CFP and will offer a significant cost advantage over CFP2 LR4-based solutions."

Cisco's CPAK

Cisco finally showed its in-house silicon photonics-based CPAK transceiver at OFC/NFOEC. The CPAK is the first product to be announced following Cisco's acquisition of silicon photonics player, LightWire.

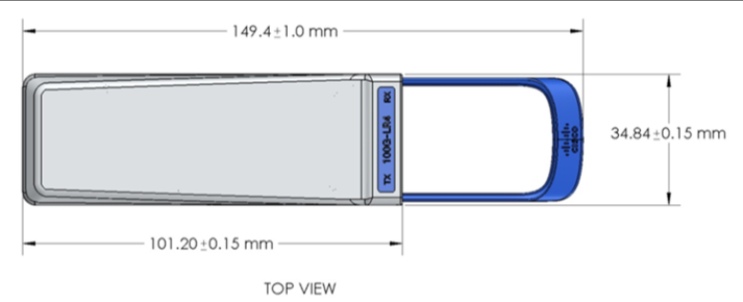

Cisco says the CPAK is more compact than the CFP2 transceiver with the company claiming that 12 or more transceivers will fit on a faceplate. "While the industry is leapfrogging the CFP with the CFP2, our CPAK leapfrogs the CFP2 because it is much more efficient from a size and power consumption perspective," says Sultan Dawood, a marketing manager at Cisco.

Vendors backing the CFP2 stress that the CPAK is only slighter smaller than the MSA module. "The CFP2 and the CPAK are both interim form factors pending when the CFP4 becomes available." says Avago's Tan. "Any product [like the CFP2] governed by an MSA is going to see strong market adoption."

Cisco's CPAK transceiver Source: Cisco

Cisco's CPAK transceiver Source: Cisco

The CFP4 specification is still being worked on but 16 CFP4s will fit on a faceplate and the transceiver is scheduled for the second half of 2014.

At OFC, Cisco demonstrated the CPAK implementing the 100GBASE-LR4 and -SR10 standards. The CPAK transceiver will be generally available in the summer of 2013, says Cisco.

CFP

Oplink Communication and hybrid integration specialist, Kaiam, showed a 100Gbps 10x10 MSA CFP implementing a 40km extended reach.

The 10x10 40km CFP is for connecting data centres and for broadband backhaul applications. The CFP electro-absorption modulator lasers coupled to a wavelength multiplexer make up the TOSA while the ROSA comprises avalanche photodiode receivers and a demultiplexer. Samples will be available in the second quarter of 2013, with production starting in the third quarter.

Source Photonics announced a second-generation 100GBASE-LR4 CFP with a power consumption of 12-14W.

Meanwhile, Effdon Networks detailed its first 100Gbps product, a CFP with a reach of 80km. Until now 100Gbps CFPs have been limited largely to 10km LR4 while the first 100Gbps CFPs with a reach of 80km or greater being 4x25Gbps direct-detection designs that can include specialist ICs.

100 Gig QSFP

Luxtera and Kotura, both detailed 100 Gigabit QSFPs that use their respective silicon photonics technology. The Kotura design uses two chips, has a reach of 2km and is a four-channel wavelength-division multiplexing (WDM) design while the Luxtera design is a four-channel integrated transceiver that uses a single laser and is tailored for 500m although Luxtera says it can achieve a 2km reach.

40 Gigabit Ethernet and Infiniband FDR

Avago Technologies announced that its eSR4 40 Gigabit Ethernet (GbE) QSFP+ has a reach of up to 550m, beyond the reach specified by the IEEE 40GBASE-SR4 standard. The eSR4 supports 40GbE or four independent 10GbE channels. When used as a multi-channel 10GbE interface, the QSFP+ interfaces to various 10GbE form factors such as X2, XFP and SFP+, It can also interface to a 100GbE CFP2, as mentioned.

Avago first announced the eSR4 QSFP+ with a reach of 300m over OM3 multi-mode fibre and 400m over OM4 fibre. The eSR4 now extends the reach to a guaranteed 550m when used with specific OM4 fibre from fibre makers Corning, Commscope and Panduit.

The extended reach is needed to address larger data centres now being build, as well as support flatter switch architectures that use two rather than three tiers of switches, and that have greater traffic flowing between switches on the same tier.

Avago says data centre managers are moving to deploy OM4 fibre. "The end user is going to move from OM3 to OM4 fibre for future-proofing purposes," says Tan. "The next-generation 32 Gig Fibre Channel and 100 Gigabit Ethernet are focussing on OM4 fibre."

Meanwhile, ColorChip showed its 56Gbps QSFP+ implementing the FDR (Fourteen Data Rate) 4x Infiniband standard as part of a Mellanox MetroX long-haul system demonstration at the show.

Finisar also demonstrated a 40Gbps QSFP using four 1310nm VCSELs. The result is a QSFP with a 10km reach that supports a 40Gbps link or four, 10Gbps links when used in a 'breakout' mode. The existing 40GBASE-LR4 standard supports a 40Gbps link only. Finisar's non-standard implementation adds a point-to-multipoint configuration.

"A single form factor port can be used not only for 40 Gig but also can enable higher density 10 Gig applications than what you can do with SFP+," says Ward.

Kaiam detailed a 40Gbps QSFP+ ER4 transceiver having a 40km reach. The QSFP+ transceiver has the equivalent functionality of four DML-based SFP+s fixed on a coarse WDM grid, and includes a wavelength multiplexer and de-multiplexer.

For OFC/NFOEC 2013 - Part 2, click here

Further reading

LightCounting: OFC/NFOEC review: news from the show floor, click here

Ovum: Cisco hits both show hot buttons with silicon photonics for 100G, click here

OFC/NFOEC 2013 to highlight a period of change

Next week's OFC/NFOEC conference and exhibition, to be held in Anaheim, California, provides an opportunity to assess developments in the network and the data centre and get an update on emerging, potentially disruptive technologies.

Source: Gazettabyte

Source: Gazettabyte

Several networking developments suggest a period of change and opportunity for the industry. Yet the impact on optical component players will be subtle, with players being spared the full effects of any disruption. Meanwhile, industry players must contend with the ongoing challenges of fierce competition and price erosion while also funding much needed innovation.

The last year has seen the rise of software-defined networking (SDN), the operator-backed Network Functions Virtualization (NFV) initiative and growing interest in silicon photonics.

SDN has already being deployed in the data centre. Large data centre adopters are using an open standard implementation of SDN, OpenFlow, to control and tackle changing traffic flow requirements and workloads.

Telcos are also interested in SDN. They view the emerging technology as providing a more fundamental way to optimise their all-IP networks in terms of processing, storage and transport.

Carrier requirements are broader than those of data centre operators; unsurprising given their more complex networks. It is also unclear how open and interoperable SDN will be, given that established vendors are less keen to enable their switches and IP routers to be externally controlled. But the consensus is that the telcos and large content service providers backing SDN are too important to ignore. If traditional switching and routers hamper the initiative with proprietary add-ons, newer players will willing fulfill requirements.

Optical component players must assess how SDN will impact the optical layer and perhaps even components, a topic the OIF is already investigating, while keeping an eye on whether SDN causes market share shifts among switch and router vendors.

The ETSI Network Functions Virtualization (NFV) is an operator-backed initiative that has received far less media attention than SDN. With NFV, telcos want to embrace IT server technology to replace the many specialist hardware boxes that take up valuable space, consume power, add to their already complex operations support systems (OSS) while requiring specialist staff. By moving functions such as firewalls, gateways, and deep packet inspection onto cheap servers scaled using Ethernet switches, operators want lower cost systems running virtualised implementations of these functions.

The two-year NFV initiative could prove disruptive for many specialist vendors albeit ones whose equipment operate at higher layers of the network, removed from the optical layer. But the takeaway for optical component players is how pervasive virtualisation technology is becoming and the continual rise of the data centre.

Silicon photonics is one technology set to impact the data centre. The technology is already being used in active optical cables and optical engines to connect data centre equipment, and soon will appear in optical transceivers such as Cisco Systems' own 100Gbps CPAK module.

Silicon photonics promises to enable designs that disrupt existing equipment. Start-up Compass-EOS has announced a compact IP core router that is already running live operator traffic. The router makes use of a scalable chip coupled to huge-bandwidth optical interfaces based on 168, 8 Gigabit-per-second (Gbps) vertical-cavity surface-emitting lasers (VCSELs) and photodetectors. The Terabit-plus bandwidth enables all the router chips to be connected in a mesh, doing away with the need for the router's midplane and switching fabric.

The integrated silicon-optics design is not strictly silicon photonics - silicon used as a medium for light - but it shows how optics is starting to be used for short distance links to enable disruptive system designs.

Some financial analysts are beating the drum of silicon photonics. But integrated designs using VCSELs, traditional photonic integration and silicon photonics will all co-exist for years to come and even though silicon photonics is expected to make a big impact in the data centre, the Compass-EOS router highlights how disruptive designs can occur in telecoms.

Market status

The optical component industry continues to contend with more immediate challenges after experiencing sharp price declines in 2012.

The good news is that market research companies do not expect a repeat of the harsh price declines anytime soon. They also forecast better market prospects: The Dell'Oro Group expects optical transport to grow through 2017 at a compound annual growth rate (CAGR) of 10 percent, while LightCounting expects the optical transceiver market to grow 50 percent, to US $5.1bn in 2017. Meanwhile Ovum estimates the optical component market will grow by a mid-single-digit percent in 2013 after a contraction in 2012.

In the last year it has become clear how high-speed optical transport will evolve. The equipment makers' latest generation coherent ASICs use advanced modulation techniques, add flexibility by trading transport speed with reach, and use super-channels to support 400 Gigabit and 1 Terabit transmissions. Vendors are also looking longer term to techniques such as spatial-division multiplexing as fibre spectrum usage starts to approach the theoretical limit.

Yet the emphasis on 400 Gigabit and even 1 Terabit is somewhat surprising given how 100 Gigabit deployment is still in its infancy. And if the high-speed optical transmission roadmap is now clear, issues remain.

OFC/NFOEC 2013 will highlight the progress in 100 Gigabit transponder form factors that follow the 5x7-inch MSA, 100 Gigabit pluggable coherent modules, and the uptake of 100 Gigabit direct-detection modules for shorter reach links - tens or hundreds of kilometers - to connect data centres, for example.

There is also an industry consensus regarding wavelength-selective switches (WSSes) - the key building block of ROADMs - with the industry choosing a route-and-select architecture, although that was already the case a year ago.

There will also be announcements at OFC/NFOEC regarding client-side 40 and 100 Gigabit Ethernet developments based on the CFP2 and CFP4 that promise denser interfaces and Terabit capacity blades. Oclaro has already detailed its 100GBASE-LR4 10km CFP2 while Avago Technologies has announced its 100GBASE-SR10 parallel fibre CFP2 with a reach of 150m over OM4 fibre.

The CFP2 and QSFP+ make use of integrated photonic designs. Progress in optical integration, as always, is one topic to watch for at the show.

PON and WDM-PON remain areas of interest. Not so much developments in state-of-the-art transceivers such as for 10 Gigabit EPON and XG-PON1, though clearly of interest, but rather enhancements of existing technologies that benefit the economics of deployment.

The article is based on a news analysis published by the organisers before this year's OFC/NFOEC event.

CyOptics gets $50m worth of new investors and funding

“Volume production scale is very important to having a successful business”

Ed Coringrato, CyOptics

The $50m investment in CyOptics has two elements: the amount paid by new investors in CyOptics to replace existing ones and funding for the company.

“This is different from the years-ago, traditional funding round but not all that different from what is more and more taking place,” says Ed Coringrato, CEO of CyOptics. “Fifty million is a big number but it is a ‘primary/ secondary’: the secondary is tendering out current investors that are choosing to exit, while the primary is what people think of as a traditional investment.” CyOptics has not detailed how the $50m is split between the two.

The funding is needed to bolster the company’s working capital, says Coringrato, despite CyOptics achieving over $100m in revenues in 2010. The money is required because of growth, he says: inventories the company holds are growing, there is more cash outstanding and the company’s payments are also rising.

There is also a need to invest in the company. “For the first time in a long time we are starting to make significant capital investments in our business,” says Coringrato. “We are ramping the fab, the packaging capability, and the assembly and test.”

The company is investing in R&D. At the moment 11 percent of its revenue is invested in R&D and the company wants to approach 13 percent. “That is a challenge in our industry – the investment in R&D is pretty significant,” says Coringrato. “If we are to continue to be significant and have leading-edge products, we must continue to make that investment.”

Manufacturing

CyOptics acquired Triquint Semiconductor’s optoelectronics operations in 2005, and before that Triquint had bought the optoelectronics operations of Agere Systems. This resulted in CyOptics inheriting automated manufacturing facilities and as a result it never felt the need to move manufacturing to the Far East to achieve cost benefits. CyOptics does use some contract manufacturing but its high-end products are made in-house.

“We have been focussed on automated production, cycle-time reduction and yield improvement,” says Coringrato. “The capital investment is to replicate what we have, adding more machines to get more output.”

Markets

CyOptics supplies fibre-to-the-x (FTTx) components to transmit optical subassembly (TOSA) and receive optical subassembly (ROSA) makers, optical transceiver players and board manufacturers. FTTx is an important market for CyOptics as it is a volume driver. “Volume production scale is very important to having a successful business,” says Coringrato.

The company also supplies 2.5 and 10 Gigabit-per-second (Gbps) TOSAs and ROSAs for XFP and SFP pluggable modules for the metro. “We want to play at the higher end as well as that is the where the growth opportunities are and the healthier margins,” says Coringrato.

CyOptics is also active in what it calls high-end product areas.

One area is as a supplier of components for the US defence industry. CyOptics entered the defence market in 2005. “These are custom products designed for specific applications,” says Stefan Rochus, vice president of marketing and business development. These include custom chip fabrication and packaging undertaking for defence contractors that supply the US Department of Defense. “When you look around there are not many companies that can do that,” says Rochus. One example CyOptics cites is a 1480nm pump-laser, part of a fibre-optic gyroscope for use in a satellite.

“We are shipping 40Gbps and 100Gbps coherent receivers into the PM-QPSK market”

Stefan Rochus, CyOptics

The defence market may require long development cycles but CyOptics believes that in the next few years several of its products could lead to reasonable volumes and a better average selling price than telecom components.

Another high-end product segment CyOptics is pursuing is photonic integrated circuits (PICs) using the company's indium-phosphide and planar lightwave circuit expertise.

Rochus says the company has several PIC developments including 10x10Gbps TOSAs and ROSAs as well as emerging 40GBASE-LR4 and coherent detection designs. “We are shipping 40Gbps and 100Gbps coherent receivers into the PM-QPSK market,” says Rochus.

CyOptics’ product portfolio is a good balance between high-volume and high average selling price components, says Rochus.

10x10 MSA

CyOptics is part of the recent 10X10 MSA, the 100Gbps multi-source agreement that includes Google and Brocade. “There is a follow-up high density 10x10Gbps MSA and we will be a member of this as well,” says Rochus. “This [10x10G design] is for short reach, up to 2km, but we are also shipping product for DWDM for an Nx10Gbps TOSA/ROSA solution.”

Why is CyOptics supporting the Google-backed 10x10Gbps MSA?

“The IEEE has only standardised the 100GBASE-SR10 which is 100m and the 100GBASE-LR4 which is 10km, there is a gap in the middle for [a] 2km [interface] which the MSA tries to solve,” says Rochus. “This is particularly important for the larger data centres.”

Rochus claims the 10x10Gbps design is the cheapest solution and that the volumes that will result from growth in the 10 Gigabit PON market will further reduce the component costs used for the interface. Furthermore the interface will be lower power.

That said, CyOptics is backing both interface styles, selling TOSAs and ROSAs for the 10x10Gbps interface and lasers for the 4x25Gbps-styled 100 Gigabit interfaces.

What next?

“The bigger we can get in terms of volume and revenue, the better our financials,” says Coringrato. “Potentially CyOptics is not only attractive for our preferred path, which is an IPO offering at the right time, but also I think it won't discourage others from being interested in us.”

Further reading

Google and the optical component industry

According to a report by Pauline Rigby, Google wants something in between two existing IEEE interface standards. The 100GBase-SR10, which has 10 parallel channels and a 125m span, has too short a reach for Google.

“What is good for an 800-pound gorilla is not necessarily good for the industry. It [Google] should have been at the table when the IEEE was working on the standard."

“What is good for an 800-pound gorilla is not necessarily good for the industry. It [Google] should have been at the table when the IEEE was working on the standard."

Daryl Inniss, practice leader, components, Ovum

The second interface, the 100GBase-LR4, uses four channels that are multiplexed onto a single fibre and has a 10km reach. The issue here is that Google doesn’t need a 10km reach and while a single fibre is better than the multi-mode fibre based SR10, the interface is costly with its “gearbox” IC that translates between 10 lanes of 10Gbps and four lanes each at 25Gbps. Both IEEE interfaces are also implemented using a CFP form factor which is bulky.

What Google wants

Google wants optical component vendors to develop a new 100 Gigabit Ethernet multi-source agreement (MSA) that is based on a single-mode interface with a 2km reach, reports Rigby. Such a design would use a ten-channel laser array whose output is multiplexed onto a fibre, a similar laser array-multiplexer arrangement that has already been developed by Santur. Using such a part, the new interface could be developed quickly and cheaply, says Google.

The proposed interface clearly has merits and Google, an important force with an appetite for optics, makes some valid points. But the industry is developing 4x25Gbps interfaces and while such interfaces may be challenging, no-one doubts they will come.

Google’s next moves

Google has a history of being contrarian if it believes it best serves its business. The way the internet giant designs data centres is one example, using massive numbers of cheap servers arranged in a fault-tolerant architecture.

But there is only so much it can do in-house and developing a new optical interface will require help from optical component players.

Google has the financial muscle to hire an optical component firm to engineer and manufacture a custom interface. A recent example of such a partnership is IBM's work with Avago Technologies to develop board-level optics – or an optical engine – for use within IBM’s POWER7 supercomputer systems.

According to Karen Liu, vice president, components and video technologies at market research firm Ovum, once such an interface is developed, Google could allow others to buy it to help reduce its price. “Remember the Lucent form factor which became a de facto standard but wasn’t originally intended to be?” says Liu. “This approach could work.”

Taking a longer term view, Google could also invest in optical component start-ups. The return may take years and as the experience of the last decade has shown, optical components is a risky business. But Google could encourage a supply of novel, leading-edge technologies over the next decade.

The optical component industry is right to push back with regard Google’s request for a new 100 Gigabit Ethernet MSA, as Finisar has done. While Google may be an important player that can drive interface requirements, many players have helped frame the IEEE 100Gbps Ethernet standards work. In the last decade the optical industry has also seen other giant firms try to drive the industry only to eventually exit.

“The industry needs to move on,” says Daryl Inniss, practice leader, components at Ovum. “What is good for an 800-pound gorilla is not necessarily good for the industry.” Inniss also suggests a simple and effective way Google could have influenced the 100 Gigabit Ethernet MSA work: “It [Google] should have been at the table when the IEEE was working on the standard."